The USDA’s Risk Management Agency announced the long-awaited launch of the Dairy-Revenue Protection (Dairy-RP) milk revenue insurance program. Developed by the American Farm Bureau Federation (AFBF), American Farm Bureau Insurance Services and other collaborators, the program is now in the hands of authorized crop insurance agents, who are attending workshops and preparing spreadsheets and actuarial tables for the start of the application period, Oct. 9. Here’s what we think we know so far. Watch Progressive Dairyman for additional information.

What is Dairy-Revenue Protection (Dairy-RP)?

Dairy-RP is a federally subsidized insurance program for dairy farmers, covering milk revenue. The program is administered through the USDA’s Risk Management Agency and offered through authorized crop insurance agencies. Sign-up for the new product begins Oct. 9, 2018, with the first available coverage starting the first quarter of 2019.

What does Dairy-RP do?

Dairy-RP is designed to insure against unexpected declines in the quarterly income from milk sales. The value of milk used in the policy can be fully customized by the dairy farmer. Income declines may be due to lower milk production, lower milk or lower component prices. The income declines are indexed at the state level, so they do not insure farm-level milk production declines.

Dairy-RP will provide indemnity payments based on the difference between the expected revenue (called the “guaranteed” revenue) at the time the coverage is purchased and the state-indexed actual revenue announced at the end of each quarter. The expected revenue is based on futures prices for milk and dairy commodities, and the amount of milk production elected for coverage by the dairy farmer.

Dairy-RP does not insure against death of dairy cattle, other loss or destruction of dairy cattle, or any other loss or damage of any kind whatsoever.

Getting started, what decisions do I have to make?

Under Dairy-RP, a farmer has five decisions to make:

1. The method to value milk in the policy (class or component pricing)

2. The amount of milk production to cover

3. The level of coverage (from 70 percent to 95 percent) of the revenue guarantee

4. Which quarterly contracts you plan to purchase

5. What level (if any) to set the optional protection factor

Where do I buy it?

You can fill out an application form with an authorized crop insurance agent anytime on or after Oct. 9, 2018. A list of authorized crop insurance agents is available at all USDA service centers and on the RMA website. Participation in Dairy-RP does not require sign-up at a local USDA office.

Application with an insurance agent does not initiate coverage. Coverage does not begin until you actually purchase a quarterly insurance endorsement.

When can I purchase coverage?

With a few exceptions (see below), you can purchase coverage on a daily basis, after coverage prices and rates are published on the USDA Risk Management Agency website at 4 p.m. (Central). The coverage prices and rates are valid from 4 p.m. that day until 9 a.m. the next business day (both times Central).

Exceptions include days when prices and rates are not posted on the RMA website by 4 p.m. Also, due to the potential of creating wide swings in milk or commodity futures markets, Dairy-RP will also not be sold on days when USDA releases monthly Milk Production, Dairy Products or Cold Storage reports, or when RMA suspends sales due to unusual milk or commodity price relationships.

What are my Dairy-RP revenue pricing options?

Dairy-RP offers two revenue pricing options:

• The Class Pricing Option uses a combination of Class III and Class IV milk prices as a basis for determining coverage and indemnities.

• The Component Pricing Option uses the component milk prices for butterfat, protein and other solids as a basis for determining coverage and indemnities. Under this option you may select the butterfat test percentage and protein test percentage to establish your insured milk price.

How do I know which option is right for me?

The authorized crop insurance agent should be able to help answer this question. They will be developing spreadsheets to perform calculations. Part of the answer lies in your individual herd and milk marketings. A Jersey herd with high components will likely benefit from the Component Pricing Option.

What time period can I cover?

You can purchase coverage in quarterly (three-month) increments, starting on the next available quarter. Quarters are January-March, April-June, July-September and October-December. Sales for a quarter will stop approximately 15 days before the beginning of the quarter.

You may purchase coverage for a maximum of five of the quarterly insurance periods. For example, if purchasing coverage on Jan. 10, 2019, coverage could be purchased for April-June 2019, July-September 2019, October-December 2019, January-March 2020 and April-June 2020. There is no obligation to buy more than one quarter at a time, and one quarter can be purchased several times to diversify risk management.

After the original application, this is a continuous policy, remaining in effect for each crop year following the acceptance of the original application, unless canceled by the farmer or the insurance agency. Again, coverage only applies to the quarters in which you purchase an endorsement.

Does it matter where my dairy operation is?

Dairy-RP is approved for sale in all counties in all 50 states. However, Dairy-RP is an area-based insurance product. Depending on where the dairy is located, it is indexed to state-level milk production data provided by the USDA.

Yield adjustment factors will be calculated for each of the major 23 dairy states in which USDA announces monthly milk production data. Farmers in states outside the major 23 will be grouped into pooled production regions.

How are my insurance premiums calculated?

No two dairy operation premium payments are guaranteed to be the same. The cost of the policy is based on actuarial tables and will vary daily, based on different coverage options and on the expected prices and risk in the market. Expected milk and component prices are based on the Chicago Mercantile Exchange futures prices. In general, higher levels of liability and more deferred policies will be more expensive to purchase. You may cover 70 percent to 95 percent of your expected quarterly revenue, in 5 percent increments.

How are premium subsidies determined?

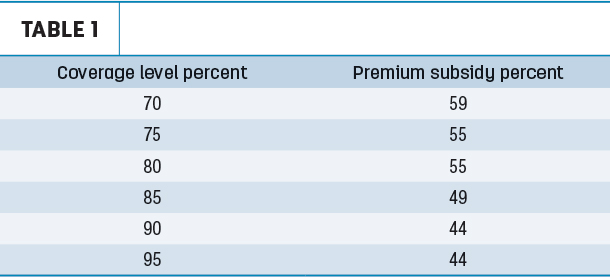

The federal government provides premium subsidies based on the coverage level selected (Table 1):

As you can see from the table above, the discount decreases as the farmer’s elected deductible decreases; i.e., 70 percent coverage has a higher premium discount than 95 percent coverage. For example, if the total Dairy-RP policy premium for 95 percent coverage were 20 cents per hundredweight, the farmer would receive a discount of 9 cents, paying 11 cents per cwt for the policy.

To be eligible for a USDA premium subsidy, the dairy operation must comply with provisions of USDA conservation programs. If you qualify as a beginning farmer, your premium subsidy will be 10 percent greater than the subsidy listed above.

What’s an optional 'Protection Factor?'

Because local conditions and on-farm factors make farm-level milk production more variable than state-averaged values, Dairy-RP includes an optional protection factor. Selected by the farmer, the factor provides greater flexibility in matching farm-level production risk.

How does the optional Protection Factor affect my premium and/or indemnity?

The higher the protection factor, the higher the liability, so premiums will be higher. In the event of an indemnity, the amount paid to a dairy farmer is scaled higher by the protection factor. For example, a farmer with a 1.5 protection factor and an indemnity of $10,000 would receive a $15,000 payment under Dairy-RP. Premium cost versus the potential indemnity benefit will be a key factor. Approximate costs will be determined in the coming weeks, once insurance agents have developed quoting software.

How are my indemnity payments calculated?

Just like premiums, no two dairy operations' indemnity payments are guaranteed to be the same. Depending on which option you selected (Class Pricing Option or Component Pricing Option), the actual value of milk is based on final USDA-published prices for Class III milk, Class IV milk, butterfat, protein and other solids, using a three-month average of these values. Your covered milk production and yield adjustment factor are included in the indemnity calculations. The indemnity, importantly, will be a result of when you purchased your Dairy-RP policy as expected prices and revenues change daily.

When are my indemnity payments calculated?

The insurance agent will send you a notice of probable loss approximately 10 days after all Dairy-RP data applicable for the quarterly insurance period are released by USDA.

In order to receive an indemnity, you must submit a claim form and include all required documents, including a milk production worksheet, within 60 days following the notice of probable loss issue date.

The insurance agent will settle your claim by subtracting the actual milk revenue from the level of revenue you insured. If the result is greater than zero, an indemnity will be paid to you in this amount. If applicable, the optional protection factor will also be used to determine the indemnity payment.

If I qualify for an indemnity payment, when will I receive payment?

The indemnity payment will be made within 30 days after the insurance agent receives a properly executed claim form.

What kind of paperwork/records will I have to keep?

A report submitted by you on the form must show monthly milk marketings and, if applicable, the butterfat test and protein test during the quarter insured. In most cases, the records needed are already available on your dairy operation and include your monthly milk check showing total pounds and component levels.

Can I cancel a policy?

Once a quarterly endorsement is initiated, it cannot be cancelled. You simply stop buying coverage for subsequent quarters to end participation.

If I buy Dairy-RP coverage, can I participate in other federal dairy income margin protection programs?

Dairy farmers participating in Dairy-RP can enroll in the USDA’s Margin Protection Program (or a program by another name approved in the 2018 Farm Bill). They can also use Dairy-RP and Livestock Gross Margin for Dairy (LGM-Dairy) margin insurance during the reinsurance year, but not in the same month.

Sources and resources

USDA Risk Management Agency website

Dairy-RP definition and descriptions

John Newton, director of Market Intelligence with the American Farm Bureau Federation, and Ron Mortensen, Dairy Gross Margin LLC, contributed to this article.

Brian Rice and Ryan Yonkman, with Rice Dairy, conducted a video question/answer session with AFBF’s John Newton, providing additional details on Dairy-RP. That session is available on YouTube. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke