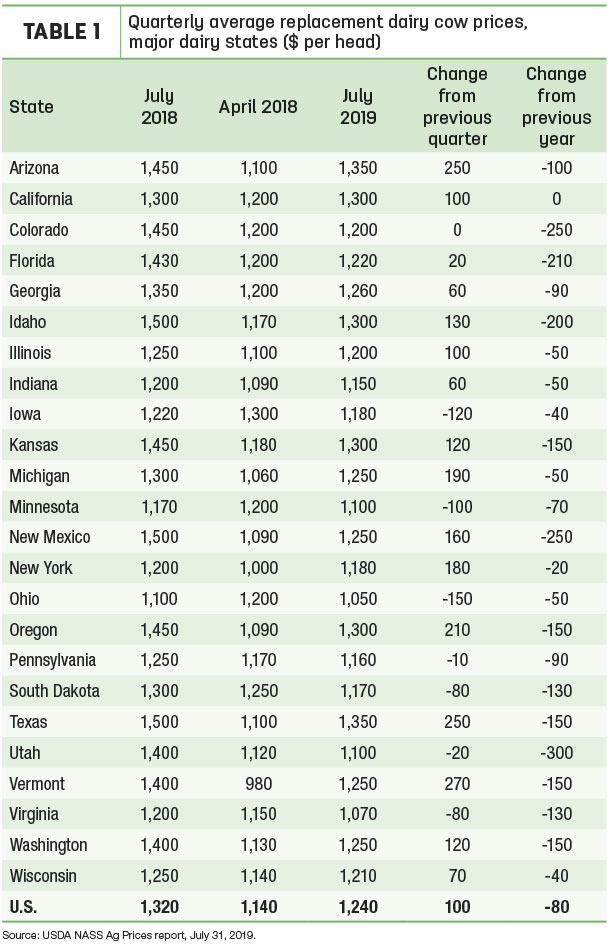

Preliminary July 2019 U.S. quarterly replacement dairy cow prices averaged $1,240 per head, up $100 from April 2019 but still $80 less than July 2018. Even with the increase, the U.S. average was near a two-decade low and 42% per head less than the latest peak of $2,120 in October 2014.

Among major dairy states (Table 1), highest July 2019 average prices were $1,350 in Arizona and Texas. Lowest average prices were $1,050 per head in Ohio and $1,070 in Virginia.

Texas and Oregon saw the biggest jump in replacement cow prices compared to April, up $250 and $210, respectively. Compared to the previous year, July 2019 average prices were down $300 in Utah and $250 in Colorado and New Mexico.

The USDA estimates are based on quarterly surveys (January, April, July and October) of dairy farmers in 23 major dairy states, as well as an annual survey (February) in all states, according to Mike Miller with USDA’s National Ag Statistics Service. The prices reflect those paid or received for cows that have had at least one calf and are sold for replacement purposes, not as cull cows. The report does not summarize auction market prices.

Dairy heifer exports: Stronger days ahead?

Foreign demand for U.S. dairy replacement heifers has remained lukewarm. While there was nothing exceptional about June export numbers, the sale of 1,085 head was the second-highest monthly total of the year. Of those, 979 went to Mexico and 59 moved to Canada. The remaining 47 head were exported to Colombia. June total shipments were valued at $1.6 million.

Through the first six months of 2019, dairy replacement heifer exports stand at 6,917 head, the smallest total for that period since 2016.

Despite the disappointing start to the year, 2019 dairy cattle exports could still finish the year strong, according to Tony Clayton, Clayton Agri-Marketing Inc., Jefferson City, Missouri.

China’s demand for protein is being complicated by African swine fever, leading to the depopulation of the country’s swine herd. In response to less pork, China’s dairy cattle are being slaughtered at a higher rate to provide beef.

One source of China’s dairy replacement cattle is Australia, and available supplies of quality dairy cattle from there are diminishing. That leaves potential market openings for U.S. dairy replacements in China, as well as other Australian markets, including Pakistan and Indonesia.

Clayton said a shipload of U.S. cattle has been confirmed for Pakistan for this October. There are other shipments looming for markets in Egypt and other Middle East countries this fall. Indonesia is pushing for a cattle health agreement with the U.S., and cattle could be headed there some time in 2020.

June cull cow prices mostly steady

June 2019 cull cow prices (beef and dairy combined) averaged $65.90 per hundredweight (cwt), up 30 cents from May and the highest average since July 2018. However, average prices through the first six months of 2019 are down about $4.85 per cwt from the same period a year ago and the lowest for the January-June average since 2010. ![]()

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke