In 2015, U.S. dairy producers paid $73 million dollars in premiums and fees to the USDA for the Margin Protection Program for Dairy (MPP). The USDA paid out $700,000 to producers. It’s that time again for producers to choose their margin protection coverage and, with those numbers, producers have started to think MPP isn’t worth the cost.

Through MPP, producers have the opportunity to buy a floor ranging from $4 to $8. When milk margins drop below the purchased floor, the producer gets paid. Here’s the catch: Just like any insurance, producers have to pay an expensive premium that increases in price with better coverage.

When MPP settlements stay above the purchased coverage, producers may see the floor protection as a wasted investment. In reality, producers should be happy that MPP hasn’t had to pay out millions because that means margins haven’t been catastrophic. Establishing a floor is an important aspect to protecting a dairy farm, but it can be costly.

While staying at the $4 catastrophic coverage and only paying the $100 fee looks attractive and affordable, it’s too low to offer any real price support for a dairy. The $6.50 coverage seems to be the sweet spot for both small and large dairies, hitting an affordable range with a high enough coverage to be useful.

A small dairy buying coverage for less than 4 million pounds has a nine-cent premium per hundredweight (cwt). To purchase the next level up at $7, the producer would have to pay 21.7 cents per cwt. A large dairy pays the same nine-cent premium for the first 4 million pounds; after that, the price jumps to 29 cents. If a large dairy wants $7 coverage, the premium is 83 cents.

It is important to look at all of the coverage choices, though; the MPP decision tool on fsa.usda.gov is helpful for producers who want to explore the costs of different levels of coverage.

A flexible hedging strategy to pair with MPP

You might consider a unique strategy we have developed when planning your margin this year. Revenue over feed plus (ROF+) is a risk management program to help producers cover the cost of MPP. ROF+ takes the main drivers of margins in milk production, the cost of feed and the price of milk, and blends them in this simple formula: milk – feed.

With ROF+, producers have the opportunity to sell a ceiling at $9 to pair with their MPP floor. When ROF+ settles below the ceiling, the producer is paid. The payout is calculated by taking the amount hedged multiplied by the option premium.

The option premium is a number determined by the market, and it changes as the market fluctuates. For those who are curious, those numbers are updated daily on our website (Ag Hedge Desk).

Generally, attractive option premiums are easier to obtain by hedging further out, where markets are less predictable. When margins are good and ROF+ settles above the ceiling, the producer has to pay the amount hedged multiplied by the option premium.

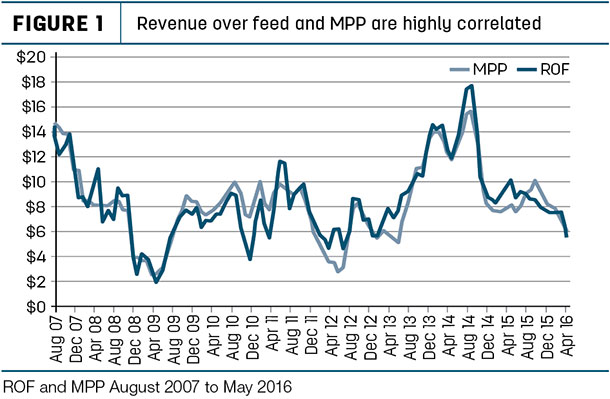

While ROF+ and MPP do not use the same formula to calculate prices and settlements, they are highly correlated, and both demonstrate similar basis behavior relative to actual dairy profit margins, as shown in Figure 1. ROF+ settles at the end of every month, unlike MPP’s two-month settlements.

Producers can use ROF+ to cover their MPP costs by calculating how much they need to hedge to match the amount spent on their MPP premiums. Using the MPP calculator on the United States Department of Agriculture Farm Service Agnency website, producers can easily calculate their MPP cost. Then they can take the MPP cost and divide it by the 2017 ROF+ option premium found online (Ag Hedge Desk).

The resulting number is the required hundredweights to hedge in order to break even.

Producers can hedge up to 50 percent of their yearly milk production in as small as 250-cwt contracts. While we encourage producers to hedge through ROF+ for the entire year, as they would MPP, in order to secure the best option premiums, they can choose to hedge one quarter at a time.

ROF+ is a uniquely flexible hedging program that lets producers create the perfect risk management plan for their dairy. There are no additional transaction costs and no margin calls to complicate the process. By using MPP as a jumping-off point, producers can build the coverage that’s right for them.

Case study: How it worked in 2016

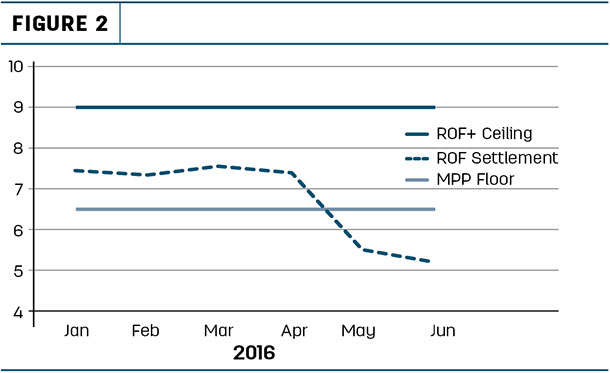

Here’s an example of a how a dairy would have been paid if using ROF+. This case study uses a real customer and actual settle prices. In this scenario, a producer signed up for MPP at the $6.50 floor for 12,000 cwt.

It cost him $1,180 for a year’s coverage. He chose to hedge the same amount, 12,000 cwt, through ROF+, signing up for 1,000 cwt per month at a 70-cent option premium. Here’s how the first six months settled: Each month, ROF+ settled below the set ceiling and the producer was paid $700, the option price (70 cents) multiplied by the quantity (1,000 cwt).

In the first six months of 2016, the producer was paid $4,200. MPP paid out in May-June but only $330. With ROF+ the producer was able to cover his MPP costs and net $3,350 on top of his milk profits.

With many risk management choices available, it is worth comparing the opportunities each presents before deciding on a MPP coverage. ROF+ is a flexible program that producers can shape to fit the needs of their dairy and their risk. ![]()

Tess Wilson is with CSC Arbitrage Group. Email Tess Wilson.

Note: ROF+ is offered by CSC Arbitrage group (Ag Hedge Desk), which specializes in trading agricultural products. Trading in futures products entails risks of loss which must be understood prior to trading and may not be appropriate for all investors.