For a dairy producer, the milk, feed and energy price fluctuations have a huge impact on cash flow, equity and profitability. So naturally, you want to know the outlook for 2014. If I used this space to write about what’s going to happen in the 2014 markets, the facts would change before the ink was dry.

I can’t tell you exactly when to buy or sell, or at what price level. So instead, let’s talk about how you should be thinking about commodity markets in 2014.

Let’s talk about setting targets. Making strategic sales and purchases. Methodically capturing a little bit more and a little bit more until you’ve built the best possible price while covering your risks.

In fact, let’s talk about approaching your management of the commodity markets with confidence and maybe even a little bit of attitude.

That’s right – attitude. Let’s be bullish on what we can accomplish in 2014, regardless of where the markets go.

That may take a slight attitude adjustment. Here’s why: When people talk about commodity marketing, the words “risk management” often come to mind. “Risk management” is a defensive attitude.

It’s the language of an industry still reeling from being unprepared and caught up in the old ways of doing things.

While we all need to protect against risk (and I certainly preach about the dangers of not doing so), the really progressive dairyman also thinks about capturing opportunity.

2014 is calling. I want you to be prepared, confident, methodical, proactive and unflappable.

Sell high, buy low

The question of when to buy or sell in any market is an age-old one and causes many hedgers and investors to freeze up.

Charles H. Dow, long-time editor of The Wall Street Journal and the founder of Dow Jones and Company, put it this way: “The maxim ‘buy cheap and sell dear’ is as old as speculation itself, but leaves unsolved the question of when a security or a commodity is cheap and when it is dear, and this is the vital point.”

If a dairy producer can figure out exactly when to sell milk and buy feed, he has the answer to the most vital question of 2014. So how do we set those trigger points? Dow dedicated his career to proving that the answer is in the charts.

Dow lived and worked at a time when prices were established by open outcry, and even then, by charting prices with a pencil and notebook, he could tell that by the time information was available to the public, prices had moved.

Dow began to plot prices in chart form and study the patterns. His work over time formed the basis for what we call “technical analysis” today.

Simply stated, technical analysis is the study of investor behavior and its effect on price action in various markets. Price history, time and volume traded are all combined in chart form, and the analyst can then study the charts and draw conclusions about what may happen. While analysts may have differing opinions, the data is objective.

By contrast, the majority of the news reports, articles, speeches at dairy industry meetings and opinions are based on fundamental analysis.

Fundamentals involve supply and demand forecasts, sales data, economic data, weather patterns and the like. People who analyze fundamentals base their opinions on all of these things. Which things receive more weight is subjective.

The right balance between fundamental and technical analysis is key. Definitely use fundamentals to form some ideas of what is possible. Then, when it comes to setting sell targets and triggers, it is our belief that those answers should be found in the data, not in fundamentals.

A breakout coming?

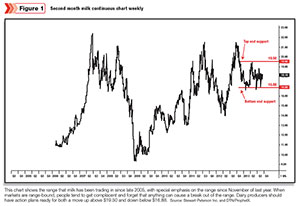

For example, Figure 1 depicts price action for milk since late 2005.

The chart shows that we have been trading in a range of $16.88 downside to $19.50 upside since about November 2012.

Click here or on the image at right to view it at full size in a new window.

That is what we call a range-bound market.

It is very choppy, not very trendy, and when markets trade this way, people can get complacent and comfortable with the range that it is in. Prices aren’t scary, and they aren’t exciting.

Yet we still need to be actively selling in increments because the market could break out at any time. Markets do not stay range-bound forever.

What technical analysis does is help us figure out at what price points we need to be prepared to act, and at what price points we need to make sure we have coverage. If prices break out below the $16.88 point, that is a signal a new trend is developing.

It is crucial to have action plans ready when that point is hit. These decisions should be prepared in advance, so there is no hesitation in the moment.

Despite what you may hear in the news at that point in time, at $16.88 the market is telling us that we have imminent downside risk, and we need to act without hesitation.

Your action plans may include selling a percentage of milk, perhaps purchasing put options and then resetting triggers for the next potential low, which in this case could be $14, which is where the next major support comes in.

Similarly, if the market were to break out above $19.50, we need to have an action plan. We would also need to reset our triggers for the next possible high, which in this case could be $21.50.

As you look ahead to 2014, remember that the catalysts for a breakout of the current range of milk prices are almost impossible to predict and could include:

• A crash in the U.S. dollar, which would support exports and therefore support milk prices

• An explosion in the U.S. dollar, which could be devastating to exports and hurt milk prices

• A dramatic change in the corn price, since milk prices are tied closely with corn prices

Any of these scenarios could create a breakout. Set your triggers so that you don’t miss the opportunity. Sell targets are best found in the data, not in the news.

This should be a particularly freeing thought for dairy producers as you head into 2014. You can base your buying and selling decisions on objective data, not market opinions.

Benefits of systems

Perhaps a production analogy will help you see how freeing it is to make decisions based on data, not opinion:

Anna Baldwin and Charles Dow lived at the same time in history – the late 1800s to early 1900s. Baldwin is the New Jersey farmwoman who patented the first milking machine. Thanks to Baldwin’s early thinking, our dairy industry’s shift toward automation has been nothing short of amazing.

Proponents of automated milking technology say there are fewer chances of human error. The automation brings a surprising calm to the parlor. Decisions about feeding, breeding and culling are made easier by the data collected and charted. And the dairy producer is more free to focus on other areas of the business.

All this change did not come quickly; nevertheless, our industry has found its way to better production systems.

Likewise, there are ways to systematize your approach to the markets, making decisions with consistency and discipline.

The charts will tell you when milk is a good value and selling a percentage of your production would be a good decision. Just as in production, many solid decisions made incrementally over time add up to success.

Another quote from Charles Dow reinforces the importance of being consistent and systematic: “If people with either large or small capital would look upon trading in stocks as an attempt to get 12 percent per annum on their money instead of 50 percent weekly, they would come out a good deal better in the long run.”

Think about how you will incrementally and strategically build the best possible price for yourself in 2014. Your market approach should focus on setting the triggers for action that will consistently capture value when the market tells you there is value.

These are exciting times for our industry, and with the right systems, you can go boldly and confidently into 2014. Protecting against risk, yes. And also making the most of every opportunity. PD

DISCLAIMER: Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. This material has been prepared by a sales or trading employee or agent of Stewart-Peterson and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson.