The USDA released its latest Ag Prices report on Oct. 29, including factors used to calculate September 2021 DMC margins and payments. Milk prices moved to a three-month high while corn and soybean meal prices softened.

Based on monthly average prices, the September DMC margin is $6.93 per hundredweight (cwt), $1.68 higher than August’s historic low and the largest margin since April 2021. Despite the improvement, it still marked the eighth straight month in which the DMC milk income margin was below $7 per cwt.

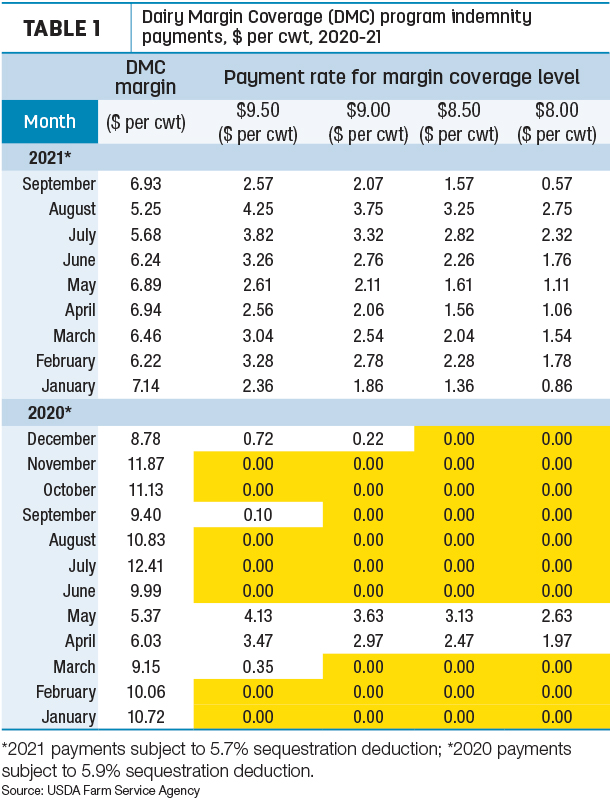

Dairy producers insured at the top $9.50 per cwt Tier I level will see an indemnity payment of about $2.57 per cwt (Table 1). That translates to an average of about $2,038 per 1 million pounds of milk.

Additionally, producers with Tier I margin coverage levels of $9, $8.50, $8, $7.50 and $7 per cwt will receive payments, as will producers with Tier II margin coverage levels at $8, $7.50 and $7 per cwt.

The September payments are on one-twelfth of a dairy operation’s covered annual production history, and DMC payments are subject to a 5.7% sequestration deduction in 2021.

Average milk price rises

The September 2021 announced U.S. average milk price rose 70 cents from August to $18.40 per cwt. September milk prices were higher than the month before in all 24 major dairy states (Table 2), with largest increases in Idaho and Iowa. Producers in four states (Florida, Georgia, Oregon and Virginia) saw average prices above $20 per cwt, with New Mexico ($16.10 per cwt) the only state where the average was under $17 per cwt.

Compared to a year earlier, the U.S. average milk price was also up 70 cents per cwt, with prices down in six states (Florida, Georgia, Minnesota, Ohio, Utah and Virginia).

Hay prices continue to climb

Dairy producers finally saw some relief in feed prices in September, although total costs still remain high.

- The average price for a blend of premium and all alfalfa hay used in DMC calculations was $226.50 per ton, up another $4.50 per ton from August and the highest ever under DMC or its predecessor, the Margin Protection Program for Dairy (MPP-Dairy). The higher average hay price came even though a previously announced change in the DMC alfalfa hay price factor has not yet been implemented.

- The average price for corn dropped 87 cents from August to $5.45 per bushel, the lowest since April.

- The cost of soybean meal fell for a fourth consecutive month, down more than $15 from August to $343.55 per ton. It’s the lowest since September 2020.

Those feedstuff prices yielded an average DMC total feed cost of $11.47 per cwt of milk sold (Table 3), down 96 cents from August and the lowest since April.

Year-to-date DMC payments

Through the first eight months of the year (covering January-August 2021), DMC indemnity payments had already totaled more than $981 million, according to the USDA’s monthly update, released Oct. 25. Year-to-date payments across all participating dairies averaged $51,566.

Margin outlook improving

As a forecaster of future margins, the DMC Decision Tool is currently not in operation.

However, rising milk prices should push margins somewhat higher, according to National Milk Producers Federation’s Peter Vitaliano, writing in the October 2021 Dairy Market Report.

Based on recent futures prices, the all-milk price will end the year almost $3.50 per cwt higher than in August, while the DMC margin will also increase to around $9.50 per cwt, since the DMC feed cost may not recede by more than $1 per cwt during that time.

The October 2021 DMC margin and any indemnity payments will be announced on Nov. 30. Factoring into the milk price, the October Federal Milk Marketing Order (FMMO) Class I base price is up 49 cents per cwt from September at $17.08 per cwt.

October FMMO Class III and Class IV milk prices were to be announced on Nov. 3, but current Chicago Mercantile Exchange (CME) futures prices at the close of trading on Oct. 29 indicate Class III price could be about $17.85 per cwt, up $1.32 from September, and the Class IV price could be $17.05 per cwt, up 69 cents.

At Progressive Dairy’s deadline, there were still no details related to multiple aspects of the DMC program that had been announced two months earlier:

- We don’t know when changes to dairy-quality hay prices used in DMC feed cost calculations will be implemented nor when any adjusted indemnity payments, retroactive to January 2020, will be distributed.

- The USDA has not provided details regarding the $580 million supplemental DMC program for small and medium dairy herds.

- There’s been no announcement regarding an enrollment period for the 2022 DMC program.

July 2021 mailbox, all-milk price spread steady

With FMMO producer price differentials (PPDs) mostly positive in July, the differences in two regular milk prices announced by USDA held steady. The spread between the average “all-milk” and “mailbox” prices was about 87 cents per cwt during the month, just 2 cents more than June.

The all-milk price is the estimated gross milk price received by dairy producers and includes quality, quantity and other premiums but does not include marketing costs and other deductions.

The mailbox price is the estimated net price received by producers for milk, including all payments received for milk sold and deducting costs associated with marketing.

The price announcements reflect similar – but not exactly the same – geographic areas. The USDA National Ag Statistics Service (NASS) reports monthly average all-milk prices for the 24 major dairy states. The mailbox prices are reported by the USDA’s Agricultural Marketing Service (AMS) and covers selected FMMO marketing areas. The AMS announcement of mailbox prices generally lag all-milk prices by a couple of months.

The difference in the two announced prices can create challenges to dairy risk management, since indemnity payments under DMC, Dairy Revenue Protection (Dairy-RP) and Livestock Gross Margin for Dairy (LGM-Dairy) programs are all based on the all-milk price, before any marketing cost deductions.

Through the first seven months of 2021, the USDA’s mailbox prices averaged about $1.12 per cwt less than average all-milk prices for the same months. During that period, all-milk prices averaged $17.99 per cwt, while mailbox prices averaged $16.87 per cwt. ![]()

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke