September 2018 U.S. milk production increased about 1.3 percent from the same month a year earlier, but that wasn’t the most striking number in USDA’s monthly Milk Production report, released Oct. 19. The more eye-popping numbers were related to the size of the U.S. herd, which were retroactively reduced for June, July and August.

Compared to previous reports, July 2018 cow numbers were cut 17,000 head and August’s numbers were revised downward 21,000 head. With preliminary September estimates now available, U.S. cow numbers totaled 9.367 million head, down 32,000 head from a year earlier and the lowest total since February 2017.

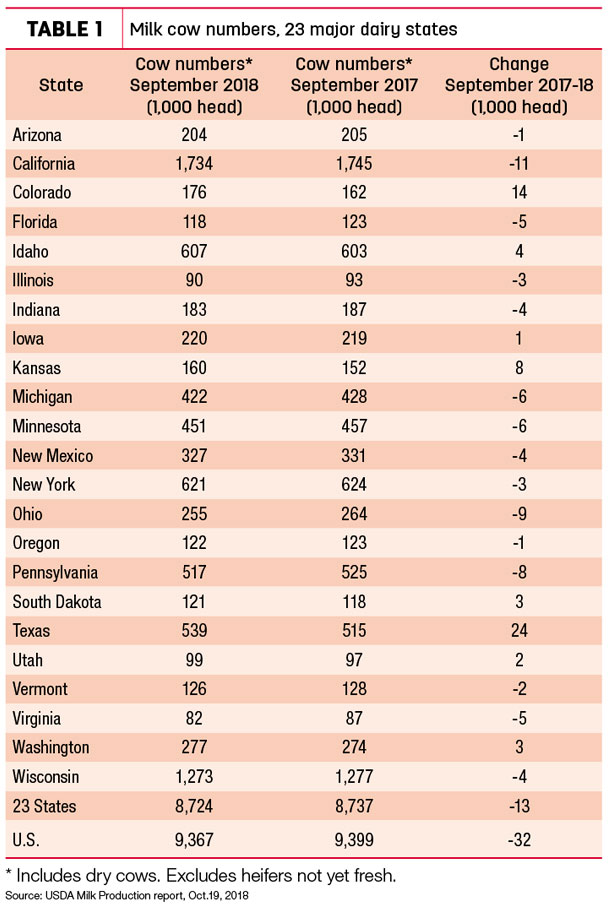

Cow numbers in the 23 major dairy states totaled 8.724 million head in September 2018, down 13,000 from a year earlier, and the lowest since April 2017.

As of Sept. 29, the number of dairy cows sent to slaughter under federal inspection totaled 2.336 million head, about 100,000 more than on the same date in 2017.

September 2017-18 recap at a glance

Reviewing the USDA estimates for September 2018 compared to September 2017:

- U.S. milk production: 17.38 billion pounds, up 1.3 percent

- U.S. cow numbers: 9.367 million, down 32,000 head

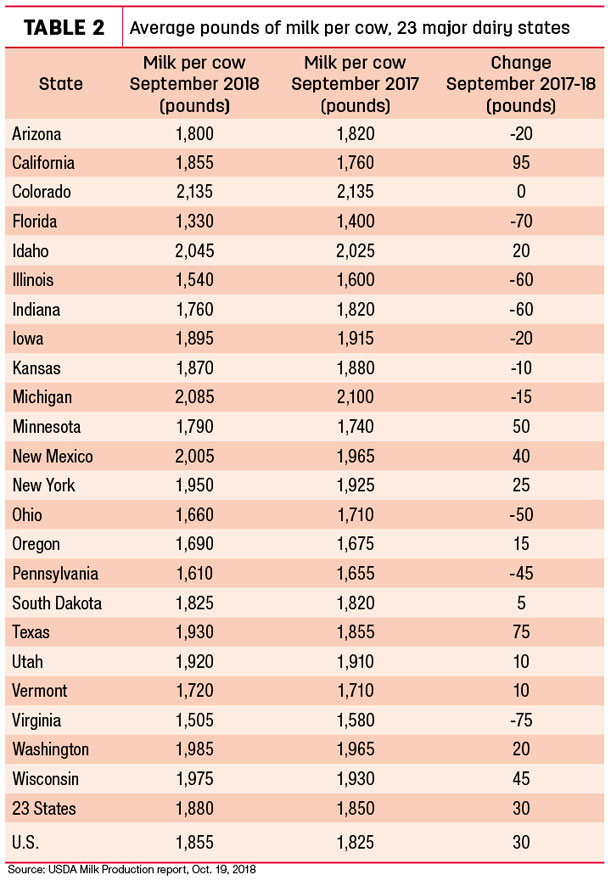

- U.S. average milk per cow per month: 1,855 pounds, up 30 pounds

- 23-state milk production: 16.41 billion pounds, up 1.5 percent

- 23-state cow numbers: 8.724 million, down 13,000 head

- 23-state average milk per cow per month: 1,880 pounds, up 30 pounds

Source: USDA Milk Production report, Oct. 19, 2018

While U.S. milk production continues to grow, several Southeast states have seen milk production declines for the period of April-September 2018. Compared to a year earlier, both Florida and Virginia output was down about 6 percent. Although not major dairy states, Alabama production was down more than 15 percent, Tennessee and Arkansas were each down about 7.5 percent, and Mississippi and Georgia were each down about 4 percent.

In contrast, Texas and Kansas each increased production nearly 8 percent over the six-month period compared to a year earlier, while Colorado was up almost 10 percent.

• Cow numbers: Focusing on September 2018, eights states increased cow numbers (Table 1) compared to September 2017, led by Texas (+24,000 head), Colorado (+14,000 head) and Kansas (+8,000 head). At 539,000 head, Texas cow numbers were also up 4,000 from the month before. Compared to a year earlier, California (-11,000 head), Ohio (-9,000 head) and Pennsylvania (-8,000 head) led decliners in September 2018. Cow numbers were down a combined 16,000 head in Michigan, Minnesota and Wisconsin.

• Milk per cow: With cow numbers down, it was increased milk output per cow that boosted overall milk production in September. California’s milk production per cow was up 95 pounds compared to a year earlier, with Texas cows each up 75 pounds of milk (Table 2). With storms and heat affecting productivity, Virginia (-75 pounds) and Florida (-70 pounds) led decliners.

• Milk production: On a percentage basis, greatest year-over-year milk production growth was in Texas and Colorado, both near 9 percent. California also posted a strong gain of 4.8 percent. Virginia and Florida were down 10.2 percent and 8.7 percent, respectively.

California led all states for milk production growth on a volume basis, up 146 million pounds compared to a year earlier. Texas, Wisconsin and Colorado combined to increase production another 164 million pounds. On the other hand, Pennsylvania production declined 37 million pounds from a year earlier, Ohio was down 28 million pounds and Michigan was down 19 million pounds. In each case, it was a combination of fewer cows and less milk per cow.

Dairy margins start October weaker

Dairy margins weakened over the first half of October on a combination of higher feed costs and lower milk prices, according to Commodity & Ingredient Hedging LLC. Margins remain positive and generally above average over the past 10 years, although not as attractive as they have been recently.

Milk prices have been slipping since early September despite some encouraging domestic and global indications. August dairy product exports were robust, mostly topping year-ago levels, with strong demand from Mexico for nonfat dry milk helping to chip away at large stockpiles.

In addition, a blistering drought this summer in the European Union has lowered milk production on the continent with concerns over tightening supply working to boost demand. The European Commission (EC) sold 2,499 metric tons of skim milk powder (SMP) from its intervention storage program. The EC now holds 485 million pounds of SMP in storage compared to over 800 million pounds at this time last year.

The USDA’s October World Ag Supply and Demand Estimates report showed a surprise reduction in the forecasts for both the corn and soybean crops.

November Class I base price weakens

The November 2018 Federal Milk Marketing Order (FMMO) Class I base price is $15.52 per hundredweight (cwt), down 81 cents from October and 89 cents less than November 2017’s price of $16.41 per cwt. California is now included in the FMMO system.

Through the first 11 months of 2018, the Class I base average is just $14.82 per cwt, about $1.59 less than the average for the same period in 2017.

Cutter cow price outlook weakens on seasonal marketing patterns

The USDA’s latest Livestock, Dairy and Poultry Outlook forecasts steady to weaker national average cutter cow prices to end 2018, with prices remaining mostly steady through 2019.

After averaging about $61.50 per cwt in the first half of 2018, third-quarter prices dipped to $57.74 per cwt and are expected to weaken further in the fourth quarter. Full-year 2019 price projections put the 2019 average at about $60 per cwt.

Beef cow culling traditionally picks up in fall after herd pregnancy checking; when open, thin, lame or poor temperament cows are removed from the herd, according to Heather Gessner, South Dakota State University Extension business management field specialist.

Additionally, through mid-October, U.S. dairy cull cow slaughter is running about 4 percent ahead of the same period a year earlier. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke