December 2017 U.S. milk production turned in another modest increase, up just 1.1 percent compared to the same month a year earlier. Troubling, however, is that the number of milk cows increased and is now at the highest level since August.

USDA: December recap

Reviewing the USDA estimates for December 2017 compared to December 2016:

• U.S. milk production: 17.04 billion pounds, up 1.1 percent

• U.S. cow numbers: 9.401 million, up 47,000 head

• U.S. average milk per cow per month: 1,908 pounds, up 11 pounds

• 23-state milk production: 16.97 billion pounds, up 1.2 percent

• 23-state cow numbers: 8.737 million, up 54,000 head

• 23-state average milk per cow per month: 1,943 pounds, up 11 pounds

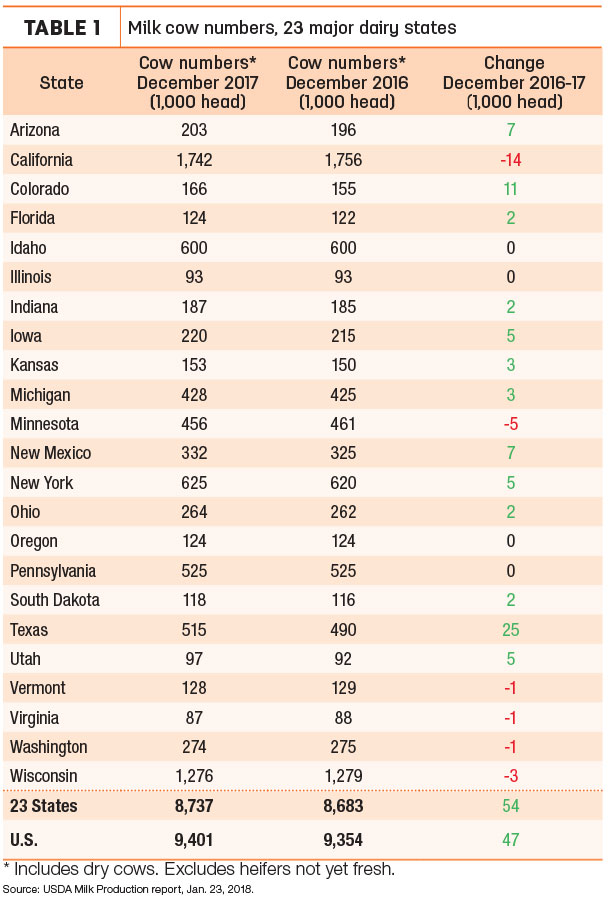

Cow numbers

Compared to a year earlier, the largest growth in cow numbers was in Texas (+25,000 head) and Colorado (+11,000 head), with New Mexico and Arizona each up 7,000 head (Table 1). California (-14,000 head) and Minnesota (-5,000 head) again led decliners.

Nationally, December milk cow numbers were up 3,000 head from November, the largest month-to-month increase since May.

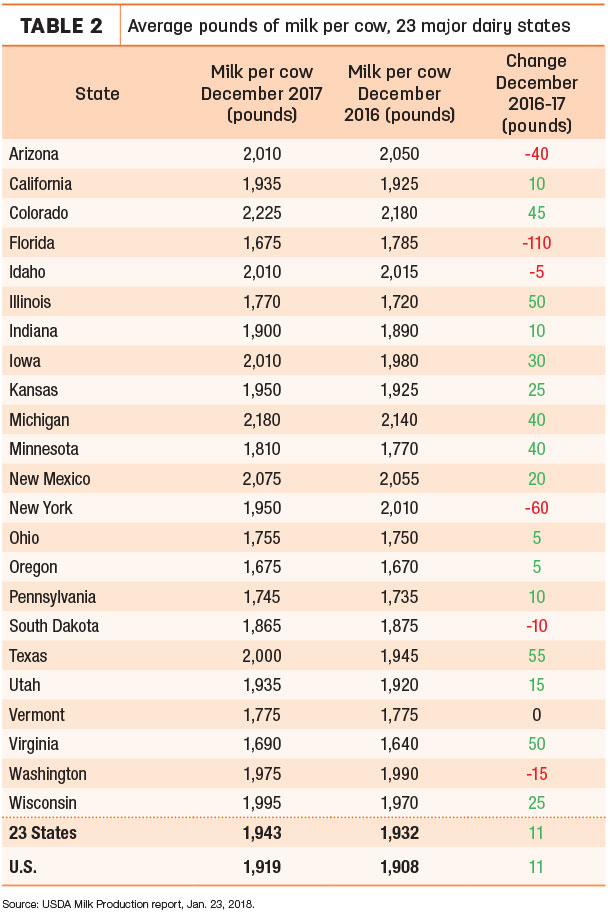

Milk per cow

December output per cow in Florida showed the most dramatic decline, down 110 pounds per cow compared to the same month a year earlier, as the fallout from Hurricane Irma continues (Table 2). Elsewhere, declines in monthly milk output per cow were reported in Arizona, Idaho, New York, South Dakota and Washington. Largest increases were in Texas, Illinois, Virginia and Colorado.

Milk production

On a percentage basis, December milk production was up 9.2 percent in Colorado, 8.1 percent in Texas and 6.2 percent in Utah.

Among the other largest states, Wisconsin production was up just 1 percent, while Pennsylvania output was up just 0.5 percent. Production in California (-0.3 percent), Idaho (-0.2 percent) and New York (-2.2 percent) were all lower. With the sharply lower milk per cow, Florida output was down 4.6 percent.

Quarter, year compared

The December estimates give us the first preliminary look at fourth quarter and annual totals for 2017.

• U.S. milk production in the October-December quarter was estimated at 53.1 billion pounds, up 1.1 percent from the same quarter in 2016. The average number of milk cows during the quarter was 9.4 million head, 3,000 head less than the July-September quarter, but 55,000 head more than the same period in 2016.

• U.S. milk production in 2017 was estimated at 215.4 billion pounds, up 1.4 percent from 2016. The average number of milk cows during the year was 9.392 million head, 64,000 head more than 2016.

Another good year of milk prices is needed to help dairy farmers recover financially from low milk prices experienced in 2015 and 2016, but it now looks like 2018 milk prices will average lower than 2017, Cropp said in his In his monthly Dairy Situation & Outlook report.

The lower milk prices during the first quarter of 2018 are being driven by relatively high milk production, a decline in beverage milk sales, slower growth in butter and cheese sales and a decline in nonfat dry milk/skim milk powder (NDM/SMP) exports all resulting in relatively high stocks levels.

Cropp’s price outlook is slightly more optimistic than the current futures market. He expects Class III prices in the $13s in the first quarter of 2018; $14s in the second quarter; low $15s in the third quarter; and the mid- to high $15s in the final quarter, averaging around $14.90 per hundredweight (cwt) for the year.

Class IV averages could be in the $13s through May; the $14s through September; and the low $15s in the last quarter, averaging about $14.25 per cwt for the year. Current dairy futures for Class III and Class IV show even lower prices.

Prices may well end up averaging a little higher, Cropp said. The low milk prices in the first half of the year could apply downward pressure on the number of milk cows and slow the increase in milk per cow. Dairy exports for the second half of the year could also do better than now expected.

Dairy cow slaughter, prices

With a larger dairy herd, the pace of 2017 dairy cow culling ended the year ahead of a year earlier, according to monthly USDA data. For December 2017, federally inspected milk cow slaughter was estimated at 247,300 head, 17,300 less than November 2017 but 3,600 more than December 2016. There was one fewer weekday in December 2017 compared to December 2016.

Dairy cows slaughtered under federal inspection were estimated at 2.988 million head in 2017, about 102,700 more than 2016.

USDA’s latest milk production report indicated the 2017 average U.S. dairy herd was about 64,000 head larger than last year. Based on culling totals, about 31.8 percent of the herd was culled in 2017, compared to 30.9 percent in 2016.

Including beef and dairy cows, the fourth-quarter 2017 cutter cow price averaged $58.68 per cwt, about $11 less than the previous quarter, according to USDA’s latest outlook report. The annual price average was $65.16 per cwt, down about $5 per cwt from 2016.

USDA’s latest projections estimate cutter cow prices will be in a range of $60 to $64 per cwt in the first quarter of 2017, weakening slightly later in the year.

USDA outlook

The USDA’s latest Livestock, Dairy and Poultry Outlook report forecasts continued milk production growth ahead, with cow numbers projected to rise through 2018. At 218.8 billion pounds, 2018 production would be up 1.6 percent from 2017. However, over the past four months of 2017, milk production growth averaged just 1.05 percent.

Preliminary average 2017 milk prices improved by about $1.35 per cwt from 2016, less than earlier forecasts. The USDA calculated the following averages for 2017: Class III – $16.17 per cwt; Class IV – $15.16 per cwt; all-milk – $17.65 per cwt.

Despite the modest growth in milk production, prices are expected to be weaker. Based on current estimates, 2018 prices could look similar to 2016. USDA estimated the following averages (mid-point of range): Class III – $14.65 per cwt; Class IV – $14 per cwt; all-milk – $16.20 per cwt. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke