After a few of months of modest gains, January 2018 U.S. milk production picked up steam, jumping 1.8 percent compared to the same month a year earlier. With a 5,000-head increase from December, there were more cows in U.S. herds in January than in any month in 2017.

USDA: January recap

Reviewing the USDA estimates for January 2018 compared to January 2017:

• U.S. milk production: 18.45 billion pounds, up 1.8 percent

• U.S. cow numbers: 9.405 million, up 46,000 head

• U.S. average milk per cow per month: 1,962 pounds, up 25 pounds

• 23-state milk production: 17.29 billion pounds, up 1.8 percent

• 23-state cow numbers: 8.74 million, up 49,000 head

• 23-state average milk per cow per month: 1,979 pounds, up 24 pounds

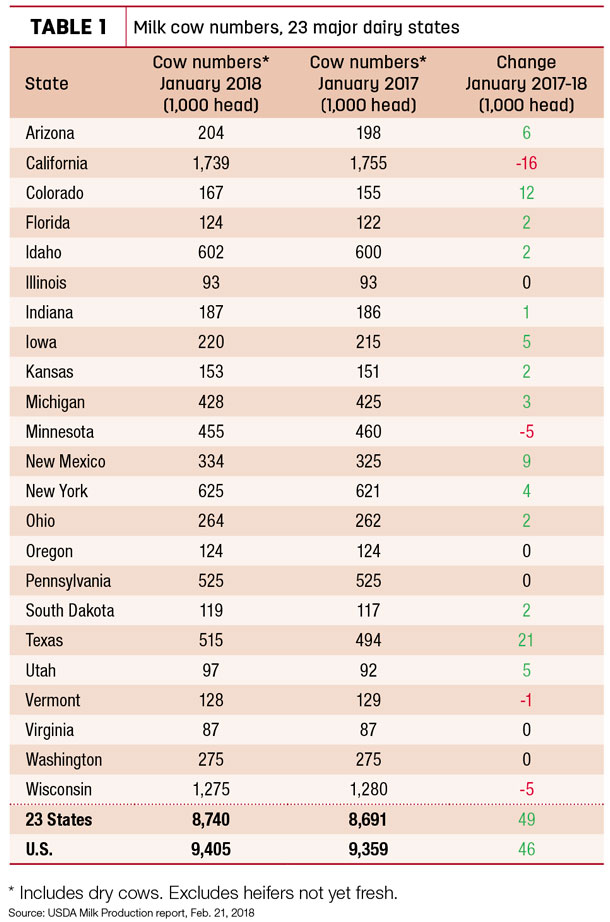

Cow numbers

Compared to a year earlier, the largest growth in cow numbers was in Texas (+21,000 head) and Colorado (+12,000 head), with New Mexico (+9,000 head) and Arizona (+6,000 head) also posting significant gains (Table 1). California (-16,000 head) and Minnesota and Wisconsin (each -5,000 head) are leading decliners.

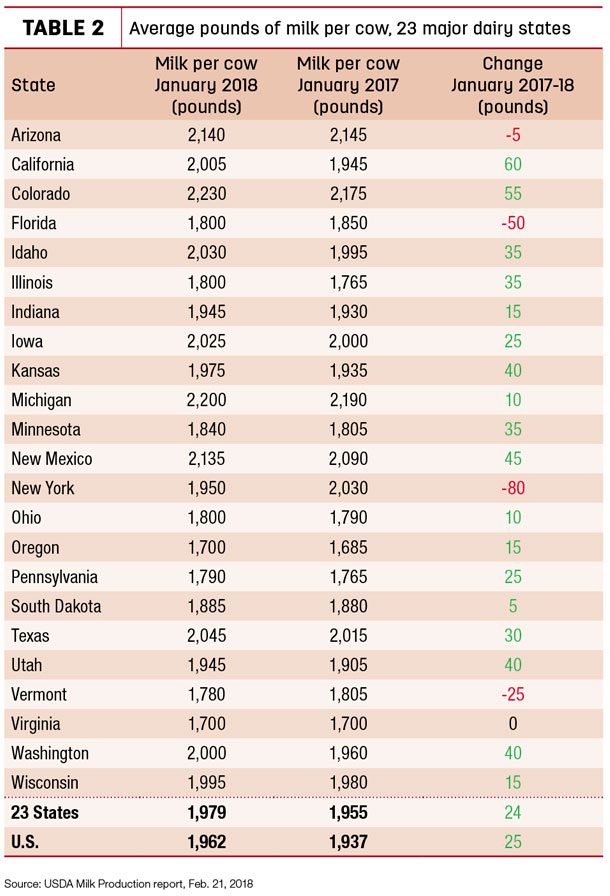

Milk per cow

After weak year-over-year gains in monthly milk production per cow through the latter half of 2017, January output per cow also increased more dramatically. Compared to a year earlier, January 2018 per-cow production was up 60 pounds in California and 55 pounds in Colorado (Table 2), offsetting an 80-pound drop in New York and a 50-pound decline in Florida.

Milk production

On a percentage basis, January milk production was up 10.2 percent in Colorado and 5.8 percent in Texas. Even California milk production rose, up 2.2 percent from the same month a year earlier, and Idaho milk production grew 2.1 percent.

Among the other largest states, Wisconsin production was up just 0.4 percent, while Pennsylvania output was up 1.4 percent. Dairy economics may be catching up to Michigan, where milk production grew a modest 1.2 percent. New York production slumped, down 3.3 percent. With lower milk per cow, Florida output was down 1.3 percent, as the impact of Hurricane Irma may be lingering.

Numbers, numbers and more numbers

• USDA outlook. Milk production estimates are lower, but questions about domestic demand and heavy global competition make 2018 prices look a lot like 2016, according to the USDA’s latest Livestock, Dairy and Poultry Outlook report. The 2018 milk production estimate was cut 100 million pounds from last month’s forecast, to 218.7 billion pounds. If realized, it would be up 1.5 percent from 2017. Cow numbers are expected to average over 9.4 million head, each yielding an average of 23,230 pounds of milk.

Based on current estimates, USDA projected the following 2018 averages (midpoint of range): Class III – $14.55 per hundredweight (cwt); Class IV – $13.75 per cwt; all-milk – $16.05 per cwt. By comparison, 2016 averages were: Class III – $14.87 per cwt; Class IV – $13.77 per cwt; and all-milk – $16.30 per cwt. Highest prices are forecast for the fourth quarter of the year.

• Margins start February flat. After weakening over the last half of January, dairy income margins were flat to slightly higher over the first half of February, according to Commodity & Ingredient Hedging LLC. A recovery in milk prices helped offset the impact of corn and soybean meal prices. Margins still remain negative through the first half of 2018, and well below average from a historical perspective. Projections are more positive for the second half of the year, but only just above breakeven.

While global dairy stocks remain high and there are concerns moving into the Northern Hemisphere’s spring flush season, it would appear that much of the negative bias in dairy market fundamentals may have already been fully digested. On a negative note, feed costs – particularly soybean meal prices – have started to advance on drought concerns in Argentina.

• Economic woes hitting organic producers, too. Most organic producers are receiving lower pay prices than one year ago, and there is little to suggest prices will increase soon, according to the USDA’s Organic Dairy Market News.

The price trend could diminish thoughts of modernization or infrastructure improvements on family organic dairy operations. For some operations, downsizing in cow numbers, acreage or both is planned. The more challenging environment may also deflect potential new transitioning into organic dairy production.

There is increased nervousness among some organic dairy producers as to debt repayment. Some lenders are being more conservative in maintaining credit line levels. Some loan restructuring has been and will be occurring.

The pulling back on organic milk production complicates the incentive to add processing capacity.

The impact stretches to organic cull cow prices and premiums. Organic cows auctioned for slaughter at an Oregon market, Feb. 1, averaged $58.58 per cwt compared to $56.42 per cwt for all conventional cows.

• December, total 2017 fluid milk sales lower. December 2017 total U.S. packaged fluid milk sales turned in weaker numbers compared to a year earlier, pulling total year 2017 sales down more than 2 percent from 2016.

December 2017 sales were estimated at just over 4.1 billion pounds, down 4 percent from December 2016, according to the USDA’s Dairy Market News. Monthly U.S. sales of conventional products totaled 3.9 billion pounds, down 4.1 percent from the previous year, while sales of organic products, at 215 million pounds, were down 0.9 percent. Organic represented nearly 5.2 percent of total sales for the month.

Unlike previous months, even sales of conventional whole milk were down compared to December a year earlier. Sales of organic whole and organic flavored fat-reduced milk were the only categories to reflect increases from the year before.

For 2017, U.S. fluid milk sales totaled about 48 billion pounds, down 2.2 percent compared to a year earlier. Sales of conventional products totaled 45.5 billion pounds, down 2.3 percent. Sales of organic products, at 2.6 billion pounds, were unchanged. Organic represented nearly 5.4 percent of total sales for the year.

• Global Dairy Trade index flat. After two consecutive strong increases in Global Dairy Trade (GDT) dairy product prices, the price index turned flat, dipping 0.5 percent in the Feb. 20 auction.

The price index for the Feb. 6 auction was up 5.9 percent, on top of a 4.9 percent increase on Jan. 16.

Among major products, Feb. 20 auction prices were higher for butter [up 1.1 percent, to $5,334 per metric ton (MT)] and whole milk powder [up 0.3 percent, to $3,246 per MT]. Prices were lower for cheddar cheese [down 1.3 percent, to $3,686 per MT] and skim milk powder [down 3 percent, to $1,832 per MT]

The next GDT auction is March 6. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke