Digest Highlights: There’s no news on MPP-Dairy enrollment period yet. Maryland & Virginia co-op apologizes for reduced pay price. One-fourth of U.S. dairy herd is in ‘drought’ areas. Find a summary of this and other news here.

No information on MPP-Dairy enrollment yet

As of March 6, the USDA Farm Service Agency was still finalizing details before reopening the 2018 enrollment period for Margin Protection Program for Dairy (MPP-Dairy). A budget bill making changes to MPP-Dairy – including a provision calling for a 90-day sign-up period – was signed into law on Feb. 9. The sign-up period will be for 90 days, but exact dates have not yet been announced.

Maryland & Virginia Milk Producers Co-op issues apology for reducing advance prices

Officials of Maryland & Virginia Milk Producers Cooperative took the unique step of issuing an apology to co-op members after reducing its announced February advance price and providing members little notice of the decrease.

“At a time when dairy farmers are struggling to make ends meet, this puts an unexpected burden on our members,” the co-op acknowledged in a media statement released March 5.

In a Feb. 27 letter, Maryland & Virginia CEO and treasurer Jay Bryant informed co-op members the advance pay price would be $10 per hundredweight (cwt) in Federal Milk Marketing Orders (FMMO) 1 and 33, and $12.62 per cwt in FMMOs 5 and 7.

Bryant said the reductions were necessary as the co-op managed “through a tight cash position, made tighter by unforeseen mechanical issues at two key plant operations in late January and early February.”

Two cooperative processing facilities in Maryland, an ingredients plant in Laurel and a fluid bottling plant in Landover, were shut down for mechanical issues in February. Less product to sell and the shorter month for sales resulted in less receivables. The statement said co-op officials were pursuing loan structure options to better meet its needs and help alleviate some of the pressure on cash usage.

“Maryland & Virginia’s Board and Management reassure its members and stakeholders that the cooperative is still in business. We’re navigating a challenging marketplace, just as our members are doing on their individual farms. Know that we’re fighting for a brighter future for our cooperative and its members,” the statement concluded.

Maryland & Virginia Milk Producers Cooperative is owned and operated by nearly 1,500 dairy farm families from Pennsylvania to Florida. The co-op’s 98th annual meeting will begin on March 27 at Liberty Mountain Resort in Carroll Valley, Pennsylvania, and will continue at the Hickory Metro Convention Center on March 29 in Hickory, North Carolina.

One-fourth of U.S. cows in drought areas

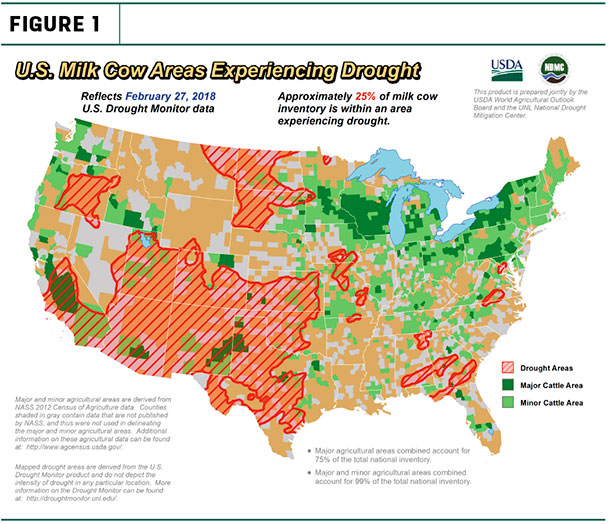

The USDA’s World Agricultural Outlook Board estimated 25 percent of the nation’s milk cows were located in areas experiencing drought as of Feb. 27 (see Figure 1). The weekly U.S. Drought Monitor overlays areas experiencing drought with maps of major production areas for hay, alfalfa hay, corn, soybeans and other crops, as well as primary dairy and all cattle areas.

While there has been moisture improvement in many areas east of the Mississippi River, a large droughty swath covers most of the Southwest, including major dairy areas in Texas, New Mexico, Arizona and California.

The report also showed about 31 percent of major alfalfa hay production areas were in areas experiencing drought. In addition to the Southwest, large portions of North Dakota, South Dakota, Montana and Oregon were under drought conditions at the end of February.

Canadian dairy farmer to share supply management perspective

Ralph Dietrich, chair of the Dairy Farmers of Ontario, will visit Wisconsin to share his perspective on pros and cons of the Canadian dairy supply management program. Hosted by the Wisconsin Farmers Union, five forums will held around the state, March 13-15, to discuss whether elements of the Canadian system could be incorporated into the U.S. dairy industry to balance milk supply and demand.

Dietrich will describe how new farmers get started in a quota-based system, how processors participate and what impact inventory management has had on Canadian dairy prices.

The forum schedule includes:

• March 13, 11:30 a.m.-2:30 p.m., 29 Pines/Sleep Inn & Suites Conference Center, Eau Claire.

• March 13, 7:30-9:30 p.m., Korner Kitchen, W4890 Cty. Rd. H, Edgar.

• March 14, 11:30 a.m.-2:30 p.m., Holiday Inn Conference Center, 625 Rolling Meadows Dr., Fond du Lac.

• March 15, 11:30 a.m.-2:30 p.m., Dodger Bowl Banquet Center, 318 King St., Dodgeville.

• March 15, 7:30-9:30 p.m., Nordic Lanes, 511 N. Main St., Westby.

The programs are free and include a free meal. RSVP to Wisconsin Farmers Union by calling (715) 723-5561 or visit their website.

LGM-Dairy refresher webinar planned

With renewed interest in the Livestock Gross Margin for Dairy (LGM-Dairy) federal dairy safety net program, a “refresher” webinar will be offered on March 28, 9:30-11 a.m. (Central).

Brian Gould, extension dairy economics professor with the University of Wisconsin, will provide:

• The Fundamentals of USDA’s LGM-Dairy Program; and

• An Overview of the University of Wisconsin LGM-Dairy Analyzer Software System.

Ron Mortensen, of Dairy Gross Margin LLC will discuss:

• The Nuts & Bolts of Preparing for a Monthly Contract Offering;

• Mechanics of Submitting an Insurance Application; and

• Common Insurance Contract Designs.

A question-answer session will follow the formal presentations.

Preregistration is not required, but participation is limited. Producers and dairy industry participants are encouraged to join the meeting in groups.

Online connection begins 15 minutes before the webinar using GoToMeeting. Join the webinar from your computer, tablet or smartphone via this GoToMeeting link.

You can also join via phone by dialing (571) 317-3112. The meeting access code is: 548-769-381

For further information or for instructions to join via a video-conferencing system or Cisco device, contact Gould at (608) 263-3212.

The recorded webinar will also be available as an MP4 file from the Understanding Dairy Markets website.

Funding caps for LGM-Dairy were lifted in a federal budget bill signed into law in early February. And, while margin insurance premiums were sharply reduced under MPP-Dairy, premiums for large-herd producers remain cost-prohibitive.

Finally, U.S. Agriculture Secretary Sonny Perdue allowed dairy farmers to opt out of the 2018 MPP-Dairy program, paving the way for dairy farmers to participate in LGM-Dairy. Participation in both programs simultaneously is prohibited.

Margins end February generally weaker

Dairy margins were mixed over the second half of February, but generally weaker following a continued advance in corn and soybean meal prices while the milk market held relatively steady, according to Commodity & Ingredient Hedging LLC. Margins still remain negative through the first half of 2018, and well below average from a historical perspective. Margins are projected to be positive – but only just above breakeven – through the second half of the year.

Milk prices have held steady over the past couple weeks, but remain depressed due to heavy milk production and stocks.

Feed costs continue to increase, with both corn and soybean meal moving higher due to ongoing drought concerns in Argentina.

California 4a, 4b prices stabilizing?

California’s February 2018 Class 4a (butter) and 4b (cheese) milk prices stabilized a bit, but both are down about $2.50 per cwt from a year ago.

The February Class 4a price is $12.72 per cwt, down 21 cents from January, $2.68 less than February 2017 and the lowest since May 2016. The February 4b price is $13.38 per cwt, up a penny from January, but $2.43 less than February 2017 and the lowest since June 2016.

February Class III, IV prices lower

2018 federal order Class III and Class IV milk prices continue to look a lot like 2016.

The February Class III price is $13.40 per cwt, down 60 cents from January and $3.48 less than February 2017. It’s the lowest since June 2016.

The February Class IV price is $12.87 per cwt, down 26 cents from January and $2.72 less than February a year ago. It’s the lowest since April 2016.

Global Dairy Trade index flat

Global Dairy Trade (GDT) dairy product prices were mixed in the auction held March 6, with the overall index flat for a second consecutive event.

The price index for the auction was down 0.6 percent. Among major products, prices were higher for cheddar cheese [up 1.7 percent, to $3,759 per metric ton (MT)] and skim milk powder [up 5.5 percent, to $2,051 per MT], but lower for butter [down 1 percent, to $5,280 per MT] and whole milk powder [down 0.8 percent, to $3,232 per MT].

The next GDT auction is March 20.

Agriculture has legitimate fears if aluminum, steel import tariffs initiate trade war

If import tariffs on aluminum and steel initiate retaliatory action by foreign countries, U.S. agriculture has reason to be concerned, according to analysis by the American Farm Bureau Federation. That’s because many of U.S. agriculture’s top international customers are also top producers of aluminum and steel, and agriculture is frequently the first retaliatory shot in a trade war.

A review of trade data from USDA’s Foreign Agricultural Service reveals 33 percent of 2017 U.S. agricultural exports went to the top aluminum-producing countries. Even more stark, 39 percent of U.S. agricultural exports in 2017 went to the top steel-producing countries.

On March 1, President Trump announced plans to impose tariffs on steel and aluminum imports into the U.S. using his authority under Section 232 of the Trade Expansion Act of 1962. He plans tariff measures of 25 percent on steel imports and 10 percent on aluminum imports. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke