Digest Highlights: New Zealand culling herds with Mycoplasma bovis. More cottonseed should be available. Florida FMMO surcharge approved to cover hurricane costs. Find a summary of this and other news here.

New Zealand culling herds with Mycoplasma bovis

New Zealand’s Ministry for Primary Industries (MPI) has determined that all dairy cattle on properties infected with Mycoplasma bovis will be culled.

The decision impacts an estimated 22,300 cows. Statistics New Zealand estimated there were about 6.5 million dairy cattle on farms at the end of December 2017.

Mycoplasma bovis is a bacterium that can cause serious health conditions in cattle, including mastitis that doesn’t respond to treatment, pneumonia, arthritis and late-term abortions.

MPI officials want to eradicate the disease before it becomes well-established. Milk testing from every farm in New Zealand is now almost complete. In total, entire herds on all 28 “infected properties,” mainly on New Zealand’s South Island, will be depopulated. Six of the infected properties have already been cleared of nearly 5,000 animals since the disease was identified last July.

All farmers impacted by the depopulation will be compensated. Once farms are depopulated, cleaned and left vacant for 60 days, those farmers can start rebuilding disease-free herds from scratch.

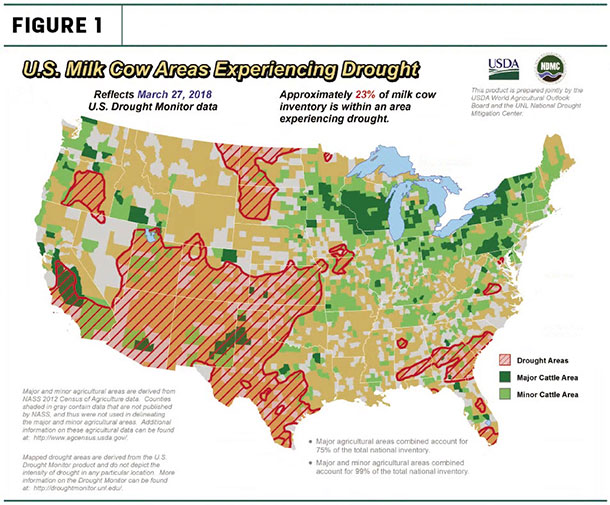

23 percent of U.S. dairy cows in drought areas

With improving moisture conditions in Missouri, the USDA’s World Agricultural Outlook Board estimated 23 percent of the nation’s milk cows were located in areas experiencing drought as of March 27 (see Figure 1). The weekly U.S. Drought Monitor overlays areas experiencing drought with maps of major production areas for hay, alfalfa hay, corn, soybeans and other crops, as well as primary dairy and all cattle areas.

Moisture levels improved in Missouri and parts of South Dakota, but a large droughty swath continues to cover most of the Southwest, including major dairy areas in Texas, New Mexico, Arizona and California.

The report also showed about 27 percent of major alfalfa hay production areas were in areas experiencing drought, a 4 percent improvement over a month earlier.

Florida FMMO surcharge approved to cover hurricane costs

The USDA’s Agricultural Marketing Service proposed an amendment temporarily adding a surcharge on milk marketed through the Florida Federal Milk Marketing Order (FMMO) to help recover costs and losses resulting from Hurricane Irma.

The amendment, published in the March 30, 2018, Federal Register, would raise milk prices 9 cents per hundredweight (cwt) for a period of seven months. The money would be dispersed to milk handlers and producers for costs incurred between Sept. 6-15, 2017.

All Florida pool plants serviced by the cooperatives at the time of the hurricane were shut down for at least one day, with five pool plants shutting down for at least three days. As a result, the cooperatives not only took losses on moving milk outside their normal marketing areas, but they were also forced to dump milk, which had no home.

Last December, USDA conducted a public hearing to consider a request for a temporary surcharge from five dairy co-ops handling milk in the Florida FMMO. The proposal was submitted by attorney Marvin Beshore on behalf of Southeast Milk, Dairy Farmers of America, Premier Milk, Maryland and Virginia Milk Producers Cooperative Association, and Lone Star Milk Producers. Those co-ops market in excess of 90 percent of the producer milk pooled on the Florida order.

The proposed amendment would reimburse handlers for marketing expenses and losses in four categories: transportation costs to deliver loads to other than their normal receiving plants; lost location value due to selling milk in lower location value zones; milk dumped at farms or on tankers, and skim milk dumped at plants; and distressed milk sales.

There is no comment period on the proposed amendment, but it requires approval through a referendum, which is yet to be scheduled. As such, the potential effective date has not been determined.

As a temporary surcharge, assessment funds will be collected by the market administrator. The action is expected to raise consumer milk prices about 1 cent per cwt during the seven-month period.

2018 soybean acreage to surpass corn; cottonseed acres to jump

Cottonseed feeders take note: Cotton appears to be the biggest winner in the competition for U.S. cropping acreage in 2018, according to the USDA’s annual Prospective Plantings report, released March 29.

The Prospective Plantings report provides the first official, survey-based estimates of U.S. farmers’ 2018 planting intentions. Acreage estimates are based on surveys conducted during the first two weeks of March from a sample of approximately 82,900 U.S. farm operators. Key findings in the report are:

• U.S. soybean growers intend to plant 89 million acres of soybeans in 2018, down 1 percent from last year. Planted acreage intentions for soybeans are down or unchanged in 20 of the 31 estimating states. The largest increase is expected in Indiana with 6.1 million acres, an increase of 150,000 acres from 2017. If realized, the planted area of soybeans in Indiana, Kentucky, North Dakota, Pennsylvania and Wisconsin will be the largest on record.

• Corn growers intend to plant 88 million acres in 2018, down 2 percent from last year. If realized this will be the lowest planted acreage since 2015. Compared with last year, planted acreage is expected to be down or unchanged in 33 of the 48 states estimated.

• Although the decline is small, U.S. hay acreage attrition will continue. 2018 dry hay acreage was estimated at 53.7 million acres, down 58,000 acres (1 percent) from a year ago. If realized, this will represent the second lowest total U.S. hay harvested area since 1908, behind only 2016. On an acreage basis, four states are expected to increase area for hay harvest by more than 120,000 acres, led by Montana (+150,000 acres) and Ohio (+140,000 acres). Others are Minnesota and Oklahoma (both +120,000 acres). Producers in Montana, North Dakota and South Dakota are optimistic about harvesting more acres than last year to replenish reduced stocks resulting from a dry 2017 production cycle.

In contrast, states expected to reduce hay harvest area are Pennsylvania (-170,000 acres), Missouri (-100,000 acres) and Oregon, Kentucky and New York (down 90,000, 80,000 and 70,000 acres, respectively). States in the Southeast are planning to harvest fewer acres than in 2017.

Among the top dairy states, California, Wisconsin, Idaho, Pennsylvania and New York are expected to reduce hay acreage, with Texas unchanged and only Michigan increasing acreage (+20,000). Record lows for all hay harvested area are expected in California and Wisconsin in 2018.

• All cotton-planted area for 2018 is expected to total 13.5 million acres, 7 percent above last year.

Dairy groups applaud U.S.-South Korea trade agreement

Officials with the National Milk Producers Federation (NMPF) and the U.S. Dairy Export Council (USDEC) applauded successful U.S.- South Korean free trade agreement (KORUS) negotiations that preserve markets for the U.S. dairy industry.

South Korea was the fifth-largest U.S. dairy export market in 2017, accounting for $280 million in U.S. dairy sales. It is also the second-largest buyer of U.S. cheese, after Mexico.

Leading up to the KORUS negotiations in early October 2017, USDEC and NMPF encouraged an approach that would address specific U.S. concerns, including that of customs procedures, while preserving the agreement. U.S. dairy exporters have repeatedly encountered challenges with South Korea’s interpretation of which goods qualify as those originating from the U.S. This meant that even goods produced in the U.S. with American-made ingredients and certified as such by the USDA sometimes faced rejection. The agreement puts U.S. companies, shipping products, manufacturers and American-made milk on the same footing with dairy competitors from other countries.

USDEC, Chinese university establish dairy innovation center

China’s Jiangnan University and the USDEC have formed a new innovation partnership designed to spur U.S. dairy export growth in China. Jiangnan University’s Vice President Xu Yan and USDEC President and CEO Tom Vilsack signed a memorandum of understanding (MOU) formalizing the relationship on March 30.

USDEC expects the MOU will deliver three major benefits:

1. Encourage the development of innovative, China-friendly product formulations that incorporate U.S. dairy ingredients, particularly whey and milk proteins and skim milk powder.

2. Enable U.S. dairy suppliers to be more engaged with and responsive to China’s food industry through access to in-market facilities and opportunities for jointly pursuing innovation projects that leverage U.S. dairy ingredient functionality, versatility and nutrition.

3. Enrich students’ academic experiences in Jiangnan University’s dairy science and technology programs with practical hands-on research and development skills using U.S. dairy to jump-start careers upon graduation.

The agreement follows a series of USDEC-led efforts aimed at building relationships in China and removing barriers to trade to level the playing field with competitors, including last year’s MOU on U.S. dairy plant registration and the unilateral reduction in Chinese cheese tariffs.

NMPF to review CWT export assistance program

The NMPF's member cooperatives will evaluate the 15-year-old Cooperatives Working Together (CWT) export assistance program to see if changes are warranted. Writing in his monthly CEO Corner column, Jim Mulhern, NMPF president and CEO, outlined potential changes under consideration.

CWT initially supported both dairy herd retirements and product exports. Since 2010, CWT’s exclusive focus has been enhancing exports of a mix of dairy products providing the most lift for farm-level milk prices, including American-style cheeses and butter. Over its lifespan, CWT has helped its member cooperatives move more than 900 million pounds of cheese, butter products and whole milk powder into export markets, representing the milk equivalent of 11.1 billion pounds.

With global dairy export markets changing, the CWT board recently formulated a new strategic assessment of the program. CWT’s member cooperatives are reviewing a series of proposed improvements in its overall strategic mission and plan. The goal is to incorporate the new approaches when CWT is reauthorized for 2019 and beyond.

Among the strategies under consideration for CWT are the following recommendations:

• Expand the range of exports to engage more products, shippers and customers.

• Adjust the bidding process to facilitate longer-term contracts.

• Encourage higher-value marketing strategies in retail and food service channels.

• Develop improved market intelligence on prices and market needs.

• Maximize collaboration with other farmer-funded efforts, such as the USDEC and Dairy Management Inc. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke