In this column, Progressive Dairy summarizes issues in the news and attempts to describe how they might affect dairy farmers. Look for more extensive background and details at Progressive Dairy. Editor's note: This article has been updated to include additional information from the USDA regarding "mailbox" prices.

Items in this column are compiled from Progressive Dairy staff news sources. Send news items to Dave Natzke.

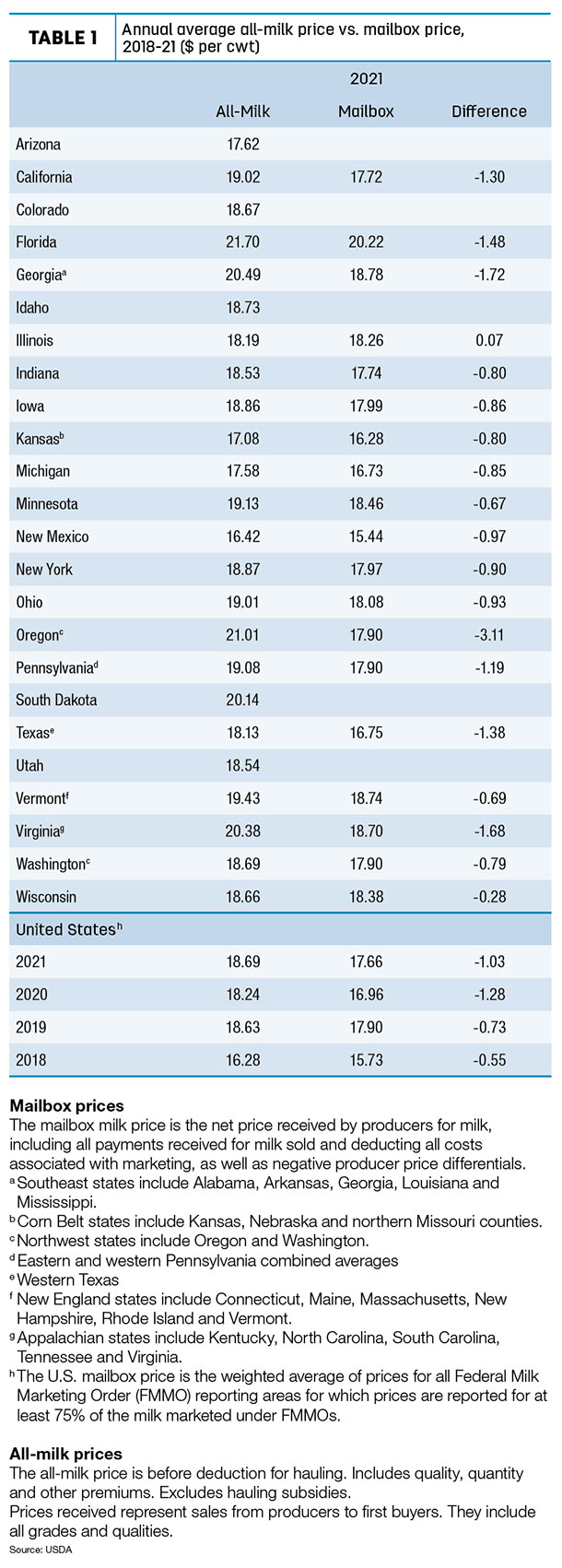

2021 MILK PRICES

What happened?

Full-year 2021 weighted “mailbox” milk prices averaged about $1 per hundredweight (cwt) less than announced average “all-milk” prices for the same period, based on a preliminary look at two USDA milk price announcements.

During 2021, all-milk prices averaged $18.69 per cwt, up 45 cents from the $18.24 percent average in 2020 (Table 1). The 2021 weighted average mailbox price averaged $17.69 per cwt, up 73 cents from $16.96 per cwt in 2020.

What’s ahead?

The difference in the two announced prices can affect dairy risk management planning, since indemnity payments under the Dairy Margin Coverage (DMC), Dairy Revenue Protection (Dairy-RP) and Livestock Gross Margin for Dairy (LGM-Dairy) programs are all based on the all-milk price, before any marketing cost deductions.

Bottom line

With market disruptions from the COVID-19 pandemic, including depooling and negative producer price differentials (PPDs), the spread between all-milk and mailbox prices had hit $1.28 per cwt in 2020, after settling at 73 cents and 55 cents in 2019 and 2018, respectively.

As Progressive Dairy notes each year, there’s a disclaimer of sorts. Comparing the all-milk price and mailbox price isn’t exactly apples to apples.

The all-milk price is the estimated gross milk price received by dairy producers for all grades and qualities of milk sold to first buyers, before marketing costs and other deductions. The price includes quality, quantity and other premiums, but hauling subsidies are excluded.

All-milk prices are reported monthly by the USDA National Ag Statistics Service (NASS).

The mailbox price is the estimated net price received by producers for milk, including all payments received for milk sold and deducting costs associated with marketing. Data included in all payments for milk sold are over-order premiums; quality, component, breed and volume premiums; payouts from state-run over-order pricing pools; payments from superpool organizations or marketing agencies in common; payouts from programs offering seasonal production bonuses; and monthly distributions of cooperative earnings. Annual distributions of cooperative profits/earnings or equity repayments are not included.

Included in mailbox price costs associated with marketing milk are hauling charges; cooperative dues, assessments, equity deductions/capital retains and reblends; the Federal Milk Marketing Order (FMMO) deduction for marketing services; and federally mandated assessments such as the dairy checkoff and budget sequestration deductions.

Mailbox prices are reported monthly by the USDA’s Agricultural Marketing Service (AMS) but generally lag all-milk price announcements by a month or more.

Geographies may differ

The price announcements also reflect similar – but not exactly the same – geographic areas. The NASS reports monthly average all-milk prices for the 24 major dairy states. The mailbox prices reported by the USDA’s AMS cover selected FMMO marketing areas.

For example, while NASS reports an all-milk price for Georgia, the mailbox price lumps Georgia with other Southeast states: Alabama, Arkansas, Louisiana and Mississippi. Similarly, Kansas is part of the Corn Belt states; Oregon and Washington are combined in the Northwest states; Vermont is among six New England states; and Virginia is clustered with Kentucky, North Carolina, South Carolina and Tennessee among Appalachian states.

In Table 1, Progressive Dairy attempts to align the state-level NASS all-milk prices and the AMS FMMO marketing area prices as closely as possible.