DAIRY MARGIN COVERAGE

(DMC) PROGRAM

What happened?

With expiration of the Margin Protection Program for Dairy (MPP-Dairy) at the end of 2018, the USDA has been calculating milk income over feed cost margins under its replacement, the Dairy Margin Coverage (DMC) program.

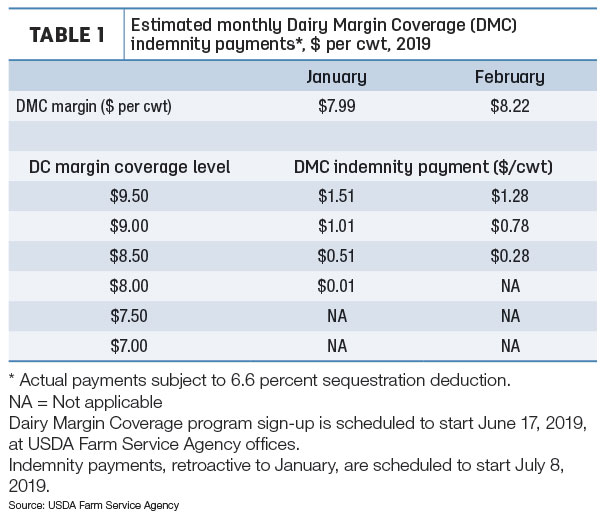

The DMC margin was $7.99 per hundredweight (cwt) in January and $8.22 per cwt in February (Table 1).

For dairy operations electing the top DMC coverage level of $9.50 per cwt on their first 5 million pounds of their annual production history, that translates into gross DMC indemnity payments of $1.51 and $1.28 per cwt in January and February, respectively. (Remember, all federal government payments are subject to a 6.6 percent sequestration deduction, so the actual payment will be lower.)

For an example herd with annual production history of 3 million pounds of milk and electing to cover the maximum allowable 95 percent of that milk (2.85 million pounds), DMC payments would be made on 2,375 hundredweights per month (2.85 million pounds divided by 100 divided by 12).

If protected at $9.50 per cwt, the 2,375 hundredweights would yield gross indemnity payments of $3,586 for January and $3,040 for February, for a total of $6,626. Subtracting the sequestration deduction of about $438 for January-February, the two-month payment is about $6,189.

The premium for $9.50 margin coverage is 15 cents per cwt, or $4,275 for the full year. Thus, the example dairy would see a net return – above full-year premium costs – of $1,914 in January-February alone.

What’s next?

March and April DMC margins will be announced on April 30 and May 31, respectively. DMC signup starts June 17, so margins and estimated indemnity payments for the first four months of the year will be known even before signup begins. Market outlooks have been improving but, as of April 9, DMC margins were forecast to remain below $9.50 per cwt through August 2019.

Initial indemnity payments to eligible dairy producers are scheduled to begin July 8. Payments will be retroactive to January.

If you decide to participate in DMC, you have an additional decision to make: Do you lock in your margin coverage level for the full five-year length of the program and receive a 25 percent discount on the annual premium (11.25 cents per cwt versus 15 cents per cwt) or pay the higher premium and retain the flexibility to make your coverage decision annually?

Bottom line

I’m not a dairy market adviser, but I’ve heard it 25 times over the past few months: Participation in DMC at the $9.50-per-cwt coverage level on the first 5 million pounds of your milk production history is a “no-brainer” for 2019.

‘DAIRY’ HAY PRICES

What happened?

One of the sharpest criticisms of the old MPP-Dairy program was the formula used to calculate feed costs. That formula hasn’t changed under DMC.

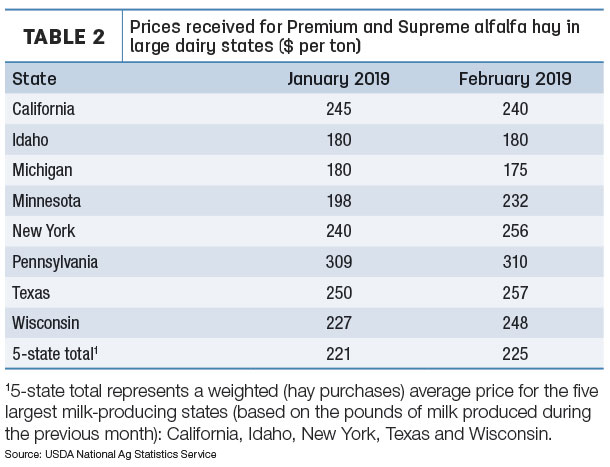

However, in an effort to more accurately evaluate dairy farmer feed costs under federal dairy safety net programs, the 2018 Farm Bill mandated the USDA to begin reporting average “dairy-quality” hay prices in the top five milk-producing states. The USDA’s National Ag Statistics Service began reporting prices for Premium and Supreme alfalfa hay in its monthly Ag Prices report. The report actually lists hay prices in eight states and an average for the top five: California, Idaho, New York, Texas and Wisconsin (Table 2).

Based on those prices, January and February 2019 dairy-quality hay prices averaged $221 and $225 per ton, respectively. That compares to $181 and $180 per ton for all alfalfa hay during the same two months.

It’s only hypothetical, but if the average of high-quality alfalfa prices was incorporated into the new DMC program, what would the impact be?

First, a review. A carryover from MPP-Dairy, the DMC average feed cost for each month is calculated by summing three numbers:

- The corn price per bushel times 1.0728

- The soybean meal price per ton times 0.00735

- The alfalfa hay price per ton times 0.0137

Under that formula, the January 2019 U.S. average alfalfa hay price of $181 per ton created a DMC hay price factor of $2.48, while the dairy-quality hay price averaged $221 per ton would have led to a $3.03 hay price factor, a difference of 55 cents per cwt.

As noted above, the USDA previously announced a January 2019 margin of $7.99 per cwt, but the higher hay price cuts that to $7.44 per cwt. That would have translated into a January DMC payment of $2.06 per cwt for a producer insured at the $9.50-per-cwt level.

Similarly, the U.S. average alfalfa hay price of $180 per ton in February created a DMC dairy ration hay price factor of $2.47 per cwt. The higher dairy-quality alfalfa hay price would have raised the hay price factor another 62 cents to $3.08 per cwt. Thus, February’s announced margin of $8.22 per cwt would have fallen 62 cents to $7.60 per cwt, resulting in a DMC indemnity payment of $1.90 per cwt for a producer insured at the $9.50-per-cwt level.

What’s next?

Probably not much. Just a hunch, but with the U.S. fiscal year 2020 budget deficit estimated at more than $1 trillion, and current U.S. debt estimated at more than $22 trillion, the Congressional Budget Office won’t be recommending the higher hay price be used in DMC calculations anytime soon.

Bottom line

To be clear, the new NASS dairy-quality hay prices are not part of the DMC calculations. They do, however, help call attention to the higher feed costs dairy farmers face compared to those calculated using the U.S. average alfalfa hay price.

MPP-DAIRY: LIMITED EDITION

What happened?

Last month in this column, I discussed a “retroactive” MPP-Dairy enrollment period for producers who had signed up for Livestock Gross Margin for Dairy (LGM-Dairy) in 2018 and therefore were originally prohibited from participating in MPP-Dairy. In early April, the USDA’s Farm Service Agency sent a notice to state and county officials, opening another retroactive MPP-Dairy sign-up period, this one for operations which had ceased marketing milk in the first half of 2018.

What’s next?

There were MPP-Dairy payments every month between February and June of 2018. However, operations that stopped marketing milk in early 2018 can only apply for indemnity payments during the months they were marketing milk. Premiums for buy-up coverage will be adjusted accordingly. Eligible dairy operations must provide all of the following:

- Form CCC-782 with 2018 coverage elections

- A copy of the final month milk check statement to verify the last day and month the dairy operation commercially marketed milk in 2018

- A check for the $100 administrative fee if it has not been paid, waived or previously refunded for 2018.

Bottom line

If you fall into the category described above – or were an LGM-Dairy participant and still haven’t taken advantage of that retroactive sign-up period – you must act fast. Deadline for both enrollment periods is May 10 at county USDA FSA offices. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke