You’re busy – milking cows, managing employees and preparing year-end financials. With that in mind, Progressive Dairyman looks at issues in the news impacting you and your dairy business. In recognition of your time, we’ll attempt to summarize recent events or actions making dairy headlines and reported in our weekly digital newsletter, Progressive Dairyman Extra. Then, we’ll try to put that news into perspective and briefly describe how it might affect you.

MARKET FACILITATION PAYMENTS

What happened?

Last September, U.S. Ag Secretary Sonny Perdue released details of a $4.7 billion Market Facilitation Program (MFP), providing direct payments to producers of select commodities to offset financial losses suffered due to ongoing trade/tariff wars.

Dairy’s share of the payments was just $127.4 million, or the equivalent of 6 cents per hundredweight (cwt) of a dairy operation’s annual milk production history. Eligible dairy farmers have until Jan. 15, 2019, to apply for the first round of direct payments at their local USDA Farm Service Agency offices.

What’s next?

At the end of October, Perdue said a second round of MFP payments would be issued, likely beginning in December. Other details have not been announced at Progressive Dairyman’s deadline, but it’s widely assumed the payments will be the same as the first round.

Perdue also said there are no MFP payments planned for 2019, saying he believed markets lost to retaliatory tariffs will be restored, and trade agreements with other countries will enhance trade.

Dairy organization leaders were deeply disappointed in the level of dairy payments in the first round and have asked for much, much more. In a letter to the USDA, National Milk Producers Federation Chairman and Missouri dairy farmer Randy Mooney cited four studies illustrating milk producers will have experienced lost income of between $1.15 billion and $1.5 billion in the second half of 2018.

Although there has been a new trade agreement with the leading U.S. dairy export market, Mexico, as part of the U.S./Mexico/Canada Agreement (USMCA), that agreement has not been ratified and likely won’t be until early 2019. A deadline to lift retaliatory tariffs has not been revealed. And there’s been no movement on an agreement with another major dairy buyer, China.

AIR EMISSION REPORTING EXEMPTION

What happened?

The EPA took the next step to formalize a rule granting livestock operations an exemption from manure air emission reporting. The proposed rule, prepared for publication in the Federal Register, expressly lists “animal waste from farms” as exempt from reporting requirements. Publication in the Federal Register initiates a public comment period prior to being officially finalized.

What’s next?

The rule is the final piece of implementation of the Fair Agricultural Reporting Method (FARM) Act, passed by Congress last April.

But will this be the last word? We’ll see.

In late September, numerous environmental advocacy groups filed a lawsuit against the EPA, challenging the agency’s authority to exempt livestock operations from reporting manure-related air emissions (ammonia and hydrogen sulfide) under two federal laws, the Comprehensive Environmental Response, Compensation and Liability Act of 1980 (CERCLA) and the Emergency Planning and Community Right-to-Know Act of 1986 (EPCRA).

DAIRY REVENUE PROTECTION

What happened?

Sales of federally subsidized milk revenue insurance endorsements under the new Dairy Revenue Protection (Dairy-RP) program started in October and, as of Progressive Dairyman’s deadline, had been ongoing for four weeks.

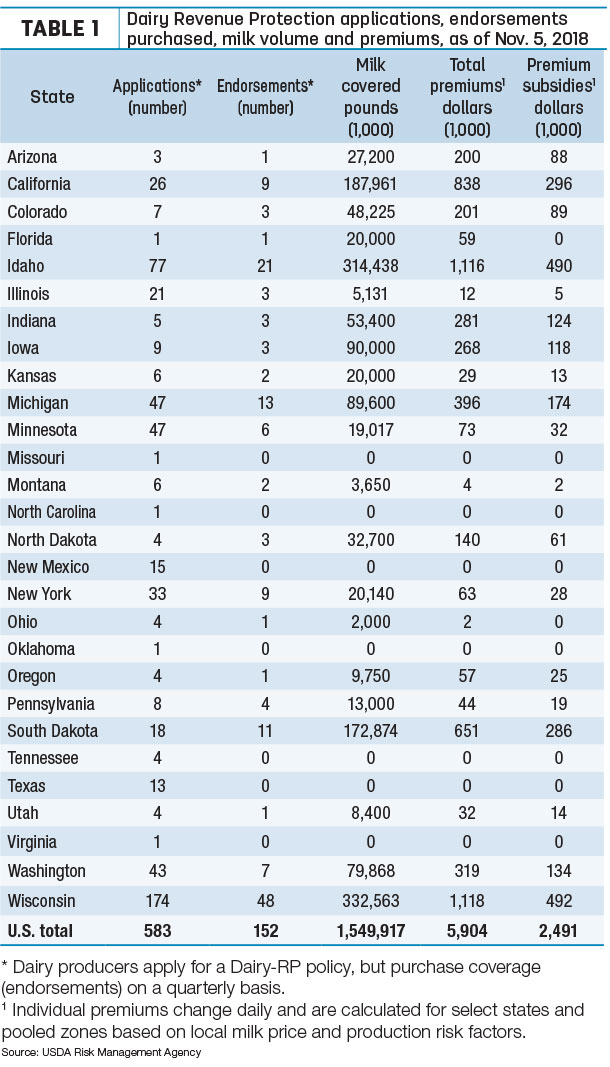

Based on information from the USDA’s Risk Management Agency as of Nov. 5, 583 dairy producers had filed applications (Table 1).

A reminder: Dairy producers apply for a Dairy-RP policy but purchase coverage, called “endorsements,” on a quarterly basis.

Of the applications, 152 quarterly endorsements had been purchased, covering 1.55 billion pounds of milk. All but one of the endorsements was purchased at the 95 percent coverage level; the other was at 90 percent.

Largest milk volumes protected under the program were in Idaho and Wisconsin, followed by California and South Dakota. Total premium costs on purchased endorsements were about $5.9 million, with USDA RMA subsidies covering about $2.5 million of that.

What’s next?

Dairy-RP allows producers to insure milk revenue for up to five quarters. The final sales date to cover milk revenue in the first quarter of 2019 is Dec. 14. However, premiums had still not been established for the “fifth quarter” (the first quarter of 2020).

What is the right approach/strategy for each dairy? That will depend on any number of factors, and the right answer to that question will evolve as the program gets a few quarters of operation under its belt, according to Ryan Yonkman, a licensed insurance agent with Rice Dairy Risk Services LLC, offering Dairy-RP policies in 20 states. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke