With more than 15 percent of the nation’s milk production (on a total solids basis) exported in 2013, the U.S. is a global dairy marketer. Milk production in New Zealand, the European Union (EU) or other countries has as much impact on farm milk prices as production in California or Wisconsin. Due to this impact, it is important for dairy farmers to know what is happening in milk production in other countries.

My source for world milk production is the USDA’s Foreign Agricultural Service (FAS). Through its extensive network of foreign service officers throughout the world, FAS collects the best data available. The FAS, through the publication “Dairy: World Markets & Trade,” publishes milk production data for 11 countries and the EU. (Currently, the EU is composed of 28 countries.)

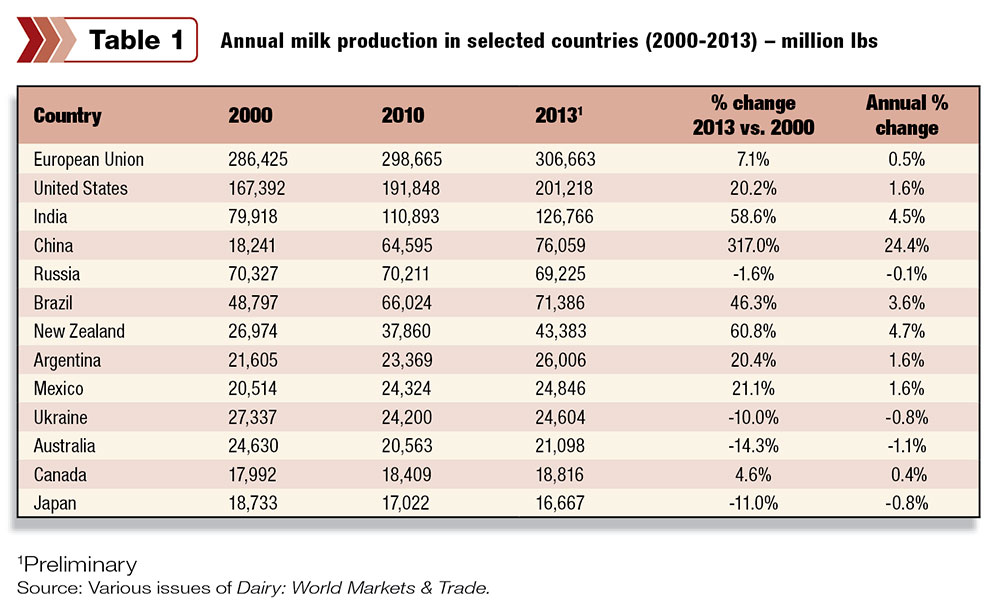

These countries, along with the U.S., account for about 75 percent of the world’s cow milk production and almost all international dairy trade. As seen in Table 1 , the EU is the world’s number one milk producer, producing over 300 billion pounds of milk in 2013. Rounding out the top five is the U.S., followed by India, China and Russia.

Since 2000, China has increased its milk production over 300 percent, the greatest production increase of the countries listed. The Chinese government has and continues to actively encourage expansion of its dairy industry, including foreign investment in dairy farms. (The April 1, 2014 Progressive Dairyman included an interview with one such dairy farm.)

New Zealand, the world’s leading dairy exporting country, increased its milk production more than 60 percent since 2000 but still only produces slightly more milk than the state of California. India, the world’s third-largest milk-producing entity, is increasing its milk production at about three times the annual rate of the U.S.

Note that Ukraine, a daily news-maker, ranks ninth in world milk production. Ukraine is a major European milk producer and is called the “bread basket” of Europe, one of the reasons for its geopolitical significance.

Per-capita milk production

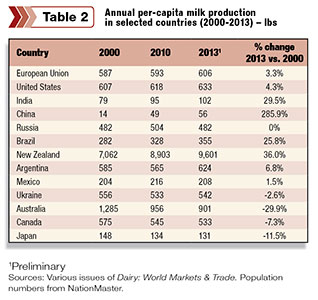

Annually, the Central Federal Order Market Administrator publishes per-capita milk production numbers, by U.S. state, to better show milk supply versus demand. I borrowed the same concept and applied it to individual countries, as shown in Table 2 .

Per-capita milk production shows three things: how well a country is meeting its domestic dairy demand, whether the country’s milk supply is growing more or less than its population and which countries show excess milk production.

The central order uses two numbers to put demand and supply in perspective. The first is 300 pounds of milk per capita to satisfy fluid and soft product demand. The second is 600 pounds of milk per capita to meet total dairy demand.

Per-capita production above 600 pounds shows excess milk. Granted, these per-capita numbers are too high for developing countries; however, they do help put an individual country’s per-capita milk production in perspective.

As seen in Table 2, only the EU and four countries – Argentina, Australia, New Zealand and the U.S. – have per-capita dairy production greater than 600 pounds. In fact, these five entities are the major world dairy exporters. Also, note that Australia and New Zealand are the only two countries with significant per-capita dairy production greater than 600 pounds.

The impact of Australia’s long drought is most likely a major reason for that country’s per-capita milk production declining almost 30 percent since 2000. It is easy to see why New Zealand, with 9,601 pounds of per-capita milk production, exports about 90 percent of its total milk production.

China’s almost 300 percent increase in per-capita milk production since 2000 is more impressive when one considers that China’s population increased about 100 million from 2000 to 2013.

Future

Looking ahead, what changes can we expect in milk production for the major dairy trading countries? A major change in the EU occurs on March 31, 2015, when the quota system ends. Will the end of quota increase or decrease EU milk production? If milk production increases, expect the increase to enter world dairy trade due to the EU population remaining flat.

Now let’s turn to the Southern Hemisphere. Having spent time in Argentina, Australia and New Zealand, I will use my personal observations. Australia has the land to add more dairy cows, and production is increasing this season. However, many remember and still are recovering from the serious drought, which may hinder expansion.

Dairying is profitable in New Zealand, and the country has one of the world’s lowest production costs. But how many more cows can the island nation add? Can the Kiwis supplement their grass-based system to increase production per cow?

Even though Australia and New Zealand export most of their milk production, milk production combined in those countries is less than the combined production of California and Wisconsin.

At one time, I and many others anticipated Argentina with its vast grasslands and low production costs would become a greater player in the dairy industry. However, it appears the country’s political and economic challenges are hindering future growth.

In the U.S., milk production has increased about 1.5 percent per year since 2000. A recent USDA report projects the U.S. will continue to increase production around that rate through 2023. With U.S. dairy consumption fairly flat, the increased production will need to be marketed internationally.

Now to India and China, the world’s fourth and fifth milk-producing countries and home to 35 percent of the world’s population. Look for those countries to lead the world in future milk production growth. However, all increases in milk production will most likely be utilized domestically due to their growing demand for dairy products.

As stated earlier, the U.S. is a global dairy marketer. What happens in milk production in other countries impacts a dairy farmer’s milk check in this country. Just as we watch domestic milk production, we must now watch world milk production as well. PD

Calvin Covington is a retired dairy cooperative CEO and now does some farming, consulting, writing and public speaking .

Calvin Covington

Retired Dairy Co-op Executive