A number of milk prices are published each month. They include: Class I, II, III and IV; Class I Mover; butterfat, protein and other solids; quota and overbase; producer price differential; and blend. All of these prices are important and contribute to determining the price dairy farmers receive for their milk production. But at the end of the month, the most important price to a dairy farmer is the mailbox price. This is the milk price paid to dairy farmers for their milk production after all deductions.

In other words, it is the money a dairy farmer puts into the bank account. The mailbox price includes all payments received for milk, including volume, quality, component and over-order premiums, but does not include MILC payments or annual cooperative distribution or equity payments.

It is the price after deductions such as milk hauling; cooperative dues and retains; cooperative operating and marketing costs; and promotion assessments.

Every dairy farmer has their own mailbox price. However, the USDA’s Agricultural Marketing Service publishes monthly mailbox prices for various regions within Federal Milk Marketing Orders with a weighted average for all regions reported. In California, the state’s dairy division publishes an average mailbox price for the entire state.

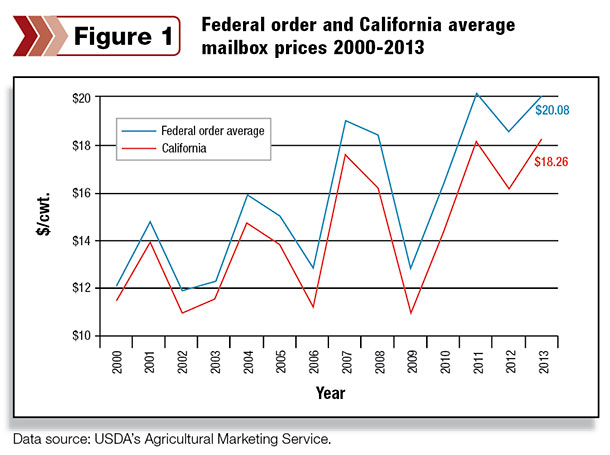

Annual mailbox averages from 2000 to 2013 for the federal order-reporting areas and California are depicted in Figure 1. The highest federal order mailbox price was $20.19 per hundredweight (cwt) in 2011, while the highest California mailbox price was $18.26 per cwt in 2013. No doubt 2014 will shatter these previous records.

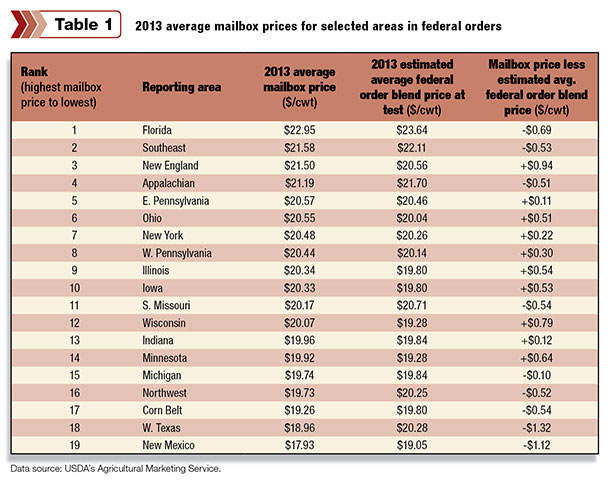

Table 1 shows the 2013 average mailbox prices for federal order reporting areas ranked from highest to lowest. Florida, with its high Class I utilization and differentials, is consistently at the top of the list, while West Texas and New Mexico are at the bottom.

Useful tool

Comparing mailbox prices to federal order blend prices is a useful tool. See the last column in Table 1? Let me explain. Milk plants regulated under federal orders are required to pay dairy farmers or their cooperatives the blend price at the plant’s location. This is a minimum price.

The difference (plus or minus) between the mailbox and blend price provides an indication of conditions in the marketing area. Let me point out, mailbox prices are announced at the average component test for the reporting area, while the blend price is announced at 3.5 percent fat. Plus, most orders have location adjustments within the order.

Mailbox prices are an average of prices across multiple locations, while the order blend price is announced at one location. To make a more accurate comparison, an estimated average blend price adjusted for test and location was calculated.

If the mailbox price is higher than the blend price, milk buyers most likely are paying premiums above the minimum blend price. These premiums could be based on volume, quality or components. Or the plant could be paying a premium in the form of a lower milk-hauling charge, thus reducing the hauling deduction.

Markets with mailbox prices higher than the blend are generally markets with many plants competing for the local milk production. It is not uncommon for milk demand to be greater than milk supply in these markets. In such markets, there are sufficient plants to handle the local milk production, which does not require milk to be transported long distances to find a home.

If the mailbox price is lower than the blend price, this indicates the opposite of the previous is occurring. Such markets may have a limited number of milk buyers, thus reducing competition for a milk supply.

Premiums in these markets are low or nonexistent. In the case of cooperatives, premiums received on milk marketed may not cover marketing or the cooperatives’ expenses. For some areas, milk is transported long distances in order to reach the market. All of these result in a mailbox price lower than the blend price.

Last year, as shown in Table 1, the New England reporting area had an average mailbox price $0.94 per cwt higher than the estimated blend price, the highest difference of any reporting area. Other areas with mailbox prices higher than order blend prices were Wisconsin, Minnesota, Ohio, New York and both Pennsylvania areas.

These areas are competitive with many milk buyers procuring milk. Milk buyers pay a variety of premiums to attract milk production, which results in mailbox prices higher than the blend price.

The three reporting areas, Appalachian, Florida and Southeast, are located in orders with high Class I utilizations and the highest blend prices in the country. All three of these areas have mailbox prices lower than the blend price.

This is not totally unexpected in a fluid-milk market due to the high costs of servicing such markets. In addition, due to higher prices in the Southeast milk markets and a limited number of milk buyers, there is competition among milk sellers seeking a fluid market, thus putting downward pressure on over-order premiums.

The two reporting areas with the lowest mailbox prices in relation to the blend price are West Texas and New Mexico. Both areas have mailbox prices greater than $1 per cwt lower than blend prices. Milk in these areas travel long distances from farm to market, and over-order premiums are relatively low.

In summary, the mailbox price is a dairy farmer’s most important milk price. It is what goes into the bank. Regularly watching mailbox prices and comparing them to minimum regulated price is a helpful tool. PD

Calvin Covington is a retired dairy cooperative CEO and now does some farming, consulting, writing and public speaking.

Calvin Covington

Retired Dairy Cooperative CEO