There’s something farmers do when watching a weather forecast prior to chopping hay. It’s the same thing that’s done before an alfalfa or corn variety gets chosen – or a hand is revealed in a game of poker.

In all of these moments, probability is being applied. A mathematical term, probability measures the likelihood that something will occur. When we aren’t certain of an outcome, we rely on probability to guide decision-making.

When making seed and harvesting decisions, you likely rely on a few pieces of good information and past experiences. Generally, nothing more is needed.

Marketing is different. Assessing probability involves a lot of technical and fundamental analysis, and a heavy dose of number-crunching. The extra work has its benefits; chiefly, the least and most likely price levels come into better focus. In turn, with well-researched, reliable information in hand, you can better focus marketing strategies.

Probabilities for 2016 feed prices

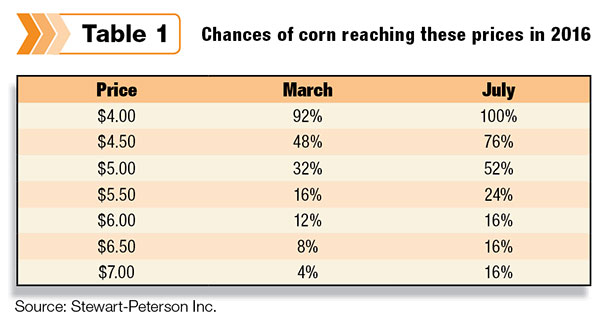

What might feed prices look like this year after assessment of the mathematical probabilities? To find out, we researched annual corn futures contracts and following-year prices over the past 25 years. Looking at year-to-year price increases, we determined likelihoods for reaching certain price levels this year (Table 1), expressed in percentages.

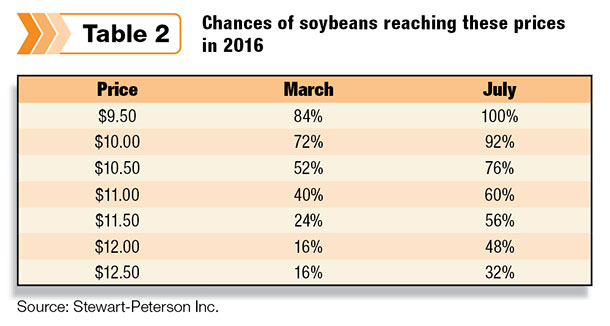

We applied the same research to soybeans (Table 2).

The analysis revealed that, despite downward price pressure having been the predominant scenario reported for 2016, there is a strong likelihood feed prices will rise during the year. Before that can happen, the markets will need to see some proof, which we’ll get to in a moment.

Commodity markets tend to move on three variables: perception, momentum and attitude. As we head into 2016, the general perception is that the U.S. has ample inventory and supply of corn and soybeans.

This fuels belief that feed prices aren’t likely to increase, putting a lid on momentum and preventing a move toward higher prices. Consequently, attitude toward feed remains bullish. These three variables feed off each other until one of them changes.

Changes is in the air

Several factors and trends support the case for higher feed prices this year. Whether or not prices rise remains to be seen. However, there is more upward price risk for feed cost increases than there is downward potential to save money by assuming prices will remain low.

This alone is reason to avoid becoming complacent with the favorable feed prices we in the dairy industry have been experiencing.

Let’s look at what’s behind the case for higher feed prices and what you can do to prepare for the possibilities.

1. Stocks-to-usage ratio

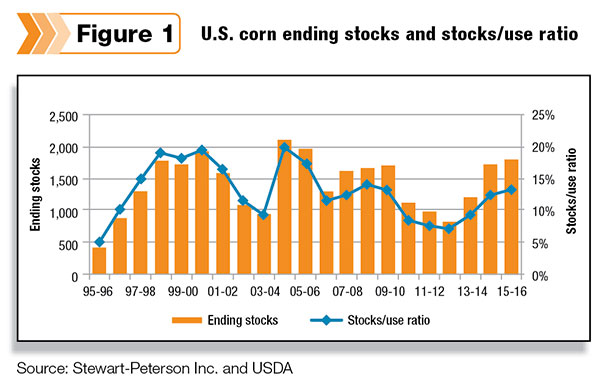

Current ending corn stocks of 1.8 billion bushels suggest there is ample supply on hand (Figure 1). However, ending stocks do not give a complete supply picture.

For that, we look at the stocks-to-usage ratio, which measures the relationship between supply and demand. Since 1995, the stocks-to-usage ratio has spanned just under 5 percent to about 21 percent. At 13.6 percent, the 2015 stocks-to-usage ratio tells us the supply cushion is more tenuous than what is generally perceived.

Through analysis, we can project carryout and stocks to usage for 2016 based on assumptive yield numbers. It wouldn’t take much disruption in supply to push the current stocks-to-usage ratio into the 10 percent range, which likely would result in a bearish price trend for feed buyers.

2. U.S. Dollar Index

The U.S. Dollar Index has been in a sideways trading range since March 2015. When it breaks out, we expect it will have a strong effect on feed prices to either the high or low side.

The Federal Reserve Bank’s policy on interest rates may influence the dollar’s direction. Rate increases could lead to a stronger dollar, in turn keeping feed prices low. A weaker dollar could lead prices higher.

In December 2015, the Federal Reserve Bank announced its first interest rate hike in 10 years, which bolstered the dollar. But since the start of the year, the dollar has dropped from approximately 100 to 96, as of the second week of February. Yet while the Fed bears watching, our research shows an imperfect correlation between higher interest rates and a stronger dollar.

3. Changes in weather

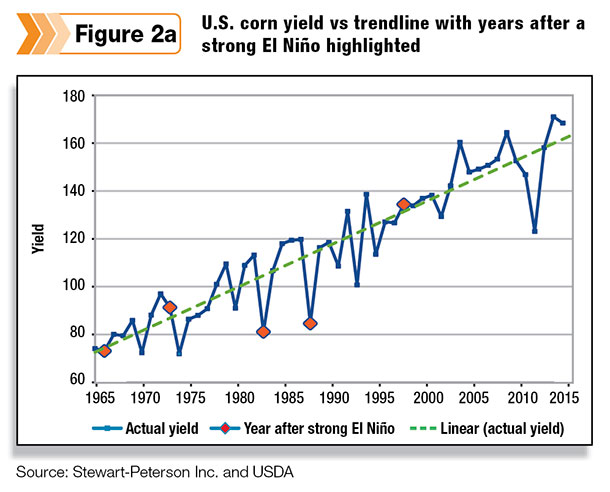

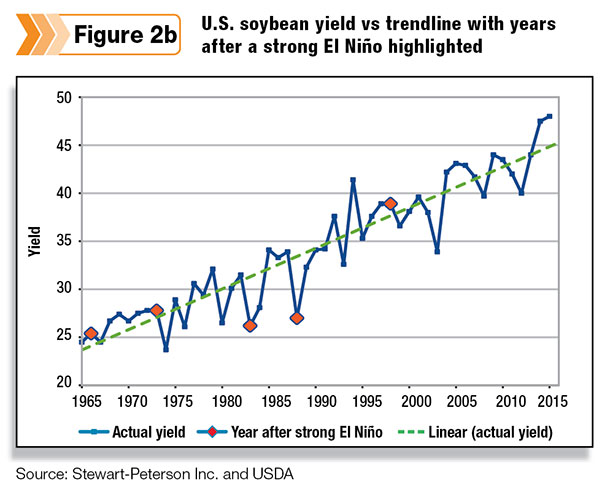

Once the 2015 El Niño pattern wraps up, weather patterns will shift. La Niña likely will arrive next, bringing dry weather to the Grain Belt. Historically speaking, corn and soybean yields in the years following El Niño have varied, at times coming in slightly higher and other times materially lower (Figures 2a and 2b).

4. Following the money

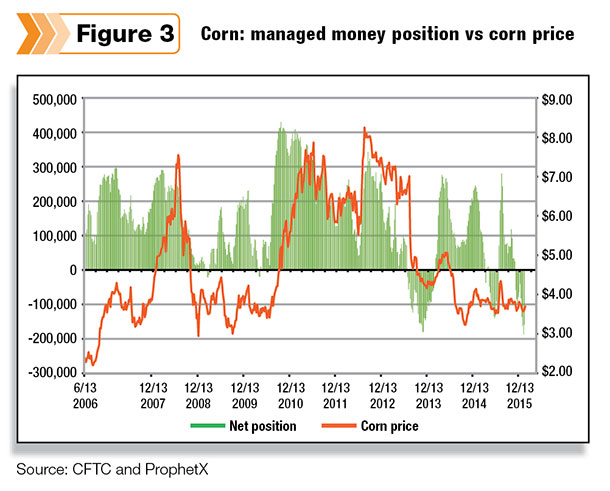

When you follow the money, you see how hedge fund action correlates with price (Figure 3).

Although investors have avoided purchasing commodities for more than one year, and feed prices have remained low, investors historically do not remain bearish for long.

A change in trend usually signals a change in sentiment. Keep an eye on managed money positions versus the corn price. When you see hedge funds getting back into commodities, we likely also will see feed prices rise.

5. Soybean meal after a record crop

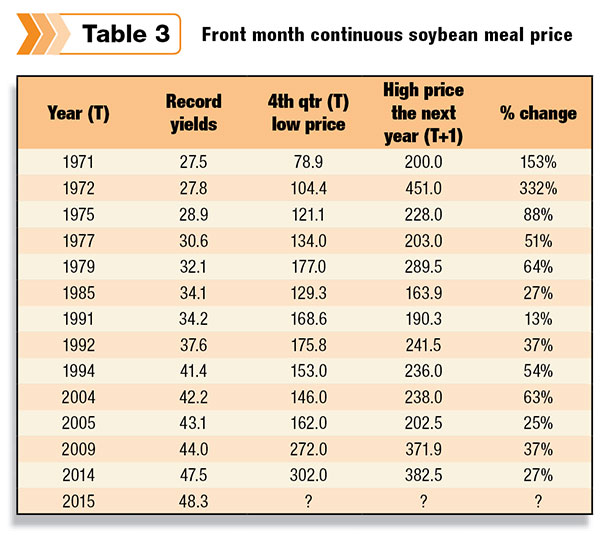

You may recall market conditions in 2014 when soybeans were on their way to another annual record yield. Soybean meal price sentiment was decidedly bearish, and then the market rallied. The soybean meal price increased 27 percent from the 2014 low to the 2015 high.

Whenever we’ve experienced a record soybean yield, the following year we’ve seen soybean meal rally 75 percent on average. This trend dates back to 1970. Most price increases have ranged from 25 to 80 percent (Table 3).

If you exclude large rallies from the 1970s, soybean meal rallies following a record crop have still averaged about 35 percent. In short, a record yield doesn’t guarantee preservation of low prices.

How to prepare

Feed buyers should be acting on today’s low prices, insuring against the risk that prices will go up. Again, there’s more upward price risk for feed cost increases than there is downward potential to save more on costs. You can prepare for any price scenario that might unfold this year by turning to your price management toolbox and incrementally securing inventory. PD

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.

-

Patrick Patton

- Chief Operating Officer

- Stewart-Peterson Inc.

- Email Patrick Patton