In a previous issue, we spent some time discussing the need to address feed costs. While I believe that the discussion was simple enough for all to comprehend, I am reminded of a quote once shared with me. “The power of redundancy is in the repetition.” Given the circumstances currently surrounding the market, there is just cause to be a zealot concerning feed costs and personal supplies. Let’s dig deeper.

What risks do I face in 2013 regarding feed?

The two biggest are the most obvious – cost and availability. Let’s address these risks and lay out some strategies for overcoming them. Why is availability a risk? One word can answer that question: That word is drought.

For example, 2012 corn silage tonnage was among the worst seen since the 1988 drought year. Producers across the country scrambled to find enough acreage to fill their bunkers. In many cases, they had to travel twice as far to find enough available crop to bring in the necessary amount of forage.

Even then, producers have had to purchase dried corn or other corn substitutes to supplement the lesser-quality silage that is now packed and covered in the bunker. The added trucking cost of procuring all of this extra silage just added insult to injury.

After having lived through this scenario once, one must ask, “What will the 2013 feed situation look like if we get a repeat weather performance from 2012?” Are you prepared to go just as far or perhaps farther to achieve the same goal? Even if you can find it, what will you pay for it?

This starts to raise the question of land and our access to it. Could we be better served by growing our individual land base and raising our own feed?

While there are countless spreadsheet tools available online, the validity of such a pursuit can be boiled down to fair market value for feed and land.

If you estimate the non-land feed costs near $500 per acre and consider spot corn futures prices north of $7 per bushel and a trend line yield of roughly 160, it is easy to estimate that one could pay just over $600 per acre for land rent and at the same time procure a corn base for $7 per bushel.

If you can rent the land for less, your cost of feed is all the lesser.

Alternatively, one could also begin to purchase necessary inputs now through a number of other means. One strategy that many have worked in recent years is that of silage/forage contracts. This captures the crop that comes from an established land base and keeps local bushels from entering the open market to be secured by the highest bidder.

As these contracts are established, it is wise to consider building in pricing provisions that allow you the ability to establish a price well before harvest. Such provisions as these allow you the ability to escape a runaway drought pricing scenario.

Still others (especially those faced with extreme shortages in 2012) have forced their nutritionists to become creative with rations, using bakery byproducts, candy rejects, varying forms of fodder, etc. Let’s not look past some of these things.

Another solution may be that of building a bigger commodity shed and storing larger supplies of hay, concentrates, etc. If this is a thought you are analyzing, there are several things you must consider. First and foremost, you must not look past the cost of shrink.

What amount of spoilage and waste will occur by long-term storage of large supplies of said feedstuff? Obviously, one cannot look past the cost of construction either. These considerations have led others toward making increased forward contract commitments with their various feed vendors.

This is not a bad idea. However, since vendors of feed are also subject to the availability of supply in the open market, a good discussion should also be had with them regarding their contracting and ability to source product.

The bottom line with any of these discussions is to make sure you have available feed in the event that 2013 is the second year of a crop-limiting drought. The next-most important element in that conversation will be price. However, the best pricing in the world doesn’t feed cows; feed does.

So how do we best manage the price?

Obviously, there is no hard and fast answer to this question. The solution will be as unique as the individual asking the question and the manner by which they are sourcing their feed.

However, in any of the situations discussed previously, the price will already be established through raising the crop, contracting, building personal inventories, etc.

What if, after all of this planning, taking these initiatives, planning construction or otherwise, the crop year ends up being normal, corn and soybean supplies build to comfortable levels, and prices fall significantly? It would appear at first glance that all of this effort is for naught.

After such undertakings, it is not uncommon for the manager to count his toil as wasted and then go off on a tangent about never doing that again. Only when the disaster is fully realized does one count his efforts as being worth it.

That element of human nature is what often makes risk management difficult over the long term. In this particular instance, there is a way to have your cake and eat it too.

By taking the aforementioned actions, you have first and foremost created a dependable supply. Additionally, you have created a known price for your operation.

By taking the next step, you can also participate in lower prices should they come. That step is to use options on corn and soybean meal futures to give you the capacity and flexibility to realize lower prices in the event that they become real.

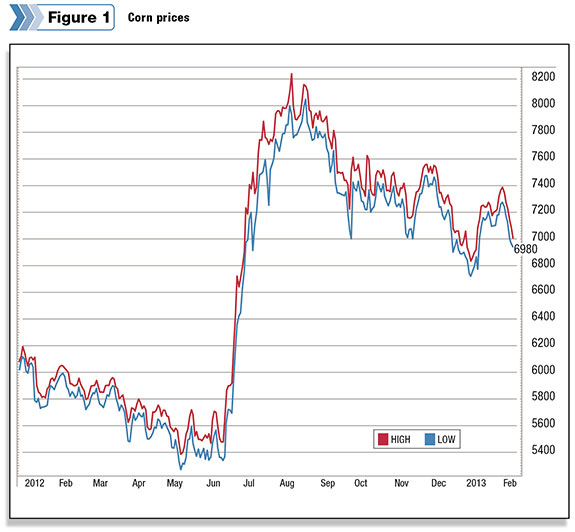

One example of this is to buy a put option. This is the simplest and easiest means to accomplish this. See Figure 1 .

In this example, you pay the premium of 26 cents per bushel (use your conversion formula to convert back to tons of silage if so desired) to allow you the opportunity to see price opportunities below $6.70 per bushel.

If the market should move to $6 per bushel as we work toward expiration, your commodity account will be credited $0.70 per bushel to be used by you to offset (lower) the original contracted price of your feed.

Now you have established a means by which you can secure supply (contracting or other methods discussed earlier in this article), establish a maximum cost (cost of feed plus cost of buying the put option) and create an opportunity to realize lower feed prices.

In a year like 2013, where uncertainty is the only known, such a strategy is a perfect way to get feed … covered! PD

UPDATE: Since the publication of this article, Mike North has left First Capitol Ag and is now the president of Commodity Risk Management Group. Contact him by email .

Mike North

Sr. Risk Management Adviser

First Capitol Ag