With feed prices escalating rapidly in recent years, many dairy producers have cut back on certain ingredients in order to minimize their ingredient costs. Of course, a cheaper and, more importantly, less energy-dense ration is often associated with reduced milk production.

They key is whether the reduced feed expenditures offset the reduced revenues from selling a lower quantity of milk â assuming that a cheaper ration does have a depressing impact on milk productivity.

Though there are a number of opinions on the efficacy of such a feeding strategy, there has been a lot of interest in this approach.

For that reason, a number of profit maximization ration formulation models were developed.

As opposed to the more common least-cost formulation models, where the aim is to provide the necessary amount of feed needed to provide a specified level of milk production at the minimum cost subject to meeting the nutritional needs of the cow, the price of milk is a key determinant.

In essence, a profit maximization ration formulation model formulates a ration that results in the maximum profit for a user based on the price of feed, the quantity of feed used, the price of milk and the quantity of milk generated by feeding this ration.

The idea is to maximize the difference between the revenues from producing a certain quantity of milk and the feed costs associated with producing this certain quantity of milk.

One big difference between the least-cost and profit maximization models is that use of the latter may not result in maximum milk production, which for many in the industry is anathema.

As part of some work I did in graduate school, economically optimized ration formulations were used to test whether California dairy producers who implemented price risk management strategies on both the input and output sides achieved significantly higher net returns as measured by milk income minus feed costs compared to producers who bought feed and sold milk on the spot market.

Two ration formulation models were developed, a least-cost and a profit maximization. The least-cost method formulates a ration that meets the nutritional requirements of a lactating cow at the lowest possible cost for a given level of milk production.

The profit maximization model incorporates into its algorithm a production function between net energy intake and milk production that increases at a decreasing rate.

For todayâs high-producing cows, after being supplied with enough energy to meet maintenance requirements, all additional energy is partitioned for milk production.

Up to a certain point, depending on the price of milk and the price of feed, the cost of providing additional feed units is more than offset by the revenues derived by the extra milk produced from the larger quantities of feed consumed.

The profit maximization model used formulates a ration using both feed and milk prices where the cost of the last unit of feed provided is equal to the revenues of the last unit of milk produced.

One of the key considerations of the profit maximization model is its use of various milk production functions.

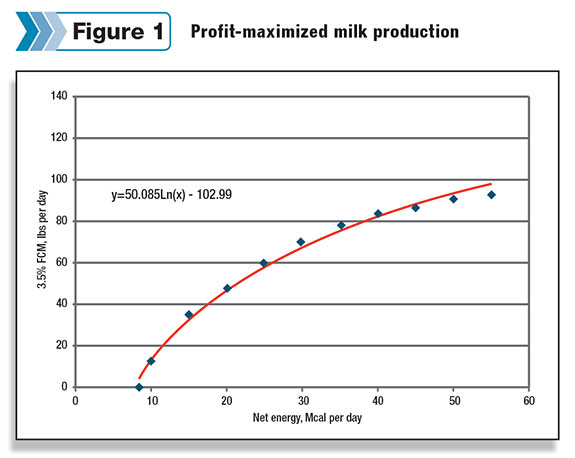

These production functions plot milk production on the y-axis and net energy on the x-axis (see Figure 1 ).

The curve starts at some point along the x-axis with no milk production, as a certain level of energy is needed just for maintenance purposes.

As the amount of energy intake increases, the response in milk production is even greater, as just an incremental rise in energy consumed triggers a greater jump in milk production.

Initially, for each additional unit of energy the increase in milk production is even greater.

At some point, however, the rate of increase in milk production per unit of extra energy provided begins to decline. Eventually, the cost of providing the extra energy will equal the revenues of the additional milk generated.

As additional net energy is consumed, the milk production curve plateaus and even declines, as the extra energy will spawn a variety of feeding disorders.

The most essential element, then, of a profit maximum formulation is that point on the milk response curve where the value of the next unit of milk equals the cost of energy needed to produce it and the computer formulates a ration for that level of production.

Formulating a feed ration is a classic example of mathematical programming. Mathematical programming is often used to find the optimal or most efficient way of using limited resources to achieve an objective while either maximizing profits or minimizing costs.

A profit maximization model maximizes net returns, which is equal to milk revenues minus feed costs. These ration formulations are known as optimization models and are characterized by one or more decisions that have to be made and constraints on the alternatives faced by the decision-makers.

As noted at the beginning of this article, use of the profit maximization models may not result in maximum milk production.

This is due to the formula optimizing for the maximum difference between total revenues (milk quantity x milk price) and total feed costs (feed quantity x feed price) as opposed to maximum production.

Results from my work that I referenced earlier showed that profit maximization not only achieved higher returns than using a least-cost model but also had the highest production so milk output was maximized.

Much of the reason has to do with the milk production function referenced earlier. Economists refer to this as the law of diminishing returns. The more a cow is fed, the more energy is apportioned to milk production as opposed to providing for maintenance.

After covering her maintenance needs, all additional energy is diverted to milk production, so the amount of feed used for maintenance becomes smaller or diminishes as a percent of total feed fed.

That is why producers often acknowledge that the last few pounds of milk produced per cow is the cheapest milk produced.

While use of the profit maximization model is an interesting academic exercise, there have not been too many practical applications made available. One reason is that milk prices are part of the equation, and the optimization process requires a set milk price to be selected.

Dairy producers are paid once a month from their cooperatives and that price fluctuates monthly. Of course, milk prices can be set using instruments such as forward contracts, futures and options.

The fact is that only a small percent of producers utilize these price risk management tools, but that is another article for another day. PD

Joel Karlin

Market Analyst

Western Milling