I know you’ve heard it before but, given the current volatility in both the milk and feed prices, I thought now would be a good time to review the importance of hedging the milk-feed margin. Some of you are more familiar with hedging your milk price, while some may be more familiar with hedging feed prices.

Either way it is important to look at how the two relate to each other and, most importantly, how they relate to your profit margin.

Milk hedging is new for many people, but the general concept is to protect your milk price from declining to an unsustainable level for your business.

While there are several different strategies you can employ, and different outlets you can use to hedge (broker, co-ops, milk plant, etc.), the concept and process is fairly consistent. Producers make milk and sell that milk; risk management is used to protect the future sale price of that milk.

On a broad scale, feed hedging is more popular for dairymen than milk hedging, but it often happens more naturally or even without notice.

Many producers will book several months’ worth of purchased feed with their supplier, grow a portion of their feed needs or even fix their basis.

While these types of hedges may be done without a lot of preparation, they are still hedges and will ultimately impact the feed price.

Although feed hedging is more popular, it is also more diverse and therefore can be harder to get a handle on the actual feed costs for the upcoming months.

If you are going to hedge your milk price for the upcoming months, it is important to know what your feed costs will be and what your risks are if feed prices increase.

When hedging either milk or feed, you want to make sure you are managing both sides of the equation – milk and feed.

For example, if you only hedged your feed price, and then milk and feed prices declined drastically, you could end up with high feed prices (which are hedged) and low milk prices.

Or if you hedge only your milk price and then prices move significantly higher, you may be stuck with low milk prices (hedged) and high feed prices.

Both of these scenarios could have been avoided if the milk-feed margin was analyzed and both the milk and feed prices were hedged when the opportunity existed.

Although it is not necessary to hedge your milk and feed on the same day, it is important to understand the current relationship between the milk price and feed price – and it is important to be realistic about your price volatility risk.

In other words, if you catch yourself thinking, “There is no way the milk price will go to $13.00,” that should not factor into your risk management strategy.

Both milk and feed prices can drop or rise rapidly, and without a foreseeable reason, so create a strategy that works at all price points.

So where do you start? Let’s start from scratch and assume you have nothing hedged for milk or feed and that includes no homegrown feed.

To get a better idea of what our opportunities are to hedge milk and feed, and the margin between the two, I look at a milk-feed ratio.

In order to do this I have converted the protein and energy requirements in a typical ration to just corn and soybean meal equivalents.

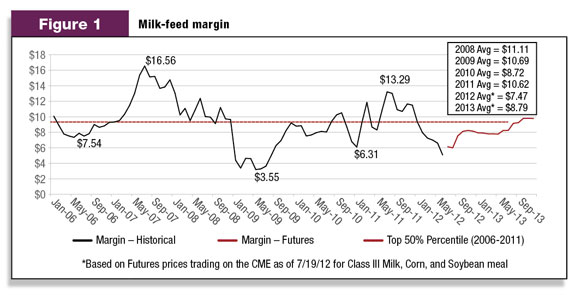

This default milk-feed margin is one hundredweight of milk, roughly 45 pounds of corn and roughly 17 pounds of soybean meal. By looking at this milk price minus feed cost margin we can get an idea of where the milk-feed margin has been in recent years and where it is currently trading in the futures market.

While each farm is different and their price needs will vary, I use this margin and the 50th percentile mark as a rule of thumb. In short, if the milk-feed margin is above the 50th percentile mark, then it may be a good time to hedge both milk and feed.

Rather than use a rule of thumb, I prefer to calculate the milk-feed margin specifically for an individual farm and determine how that milk-feed margin relates to their profitability.

For example, we may determine that a milk-feed margin of $8.50 is profitable for a specific farm. We would then look to hedge the milk and feed prices when the margin is at or above $8.50.

By hedging both the milk and the feed prices, producers often feel more comfortable and secure hedging further out into the future.

By reducing the majority of the price volatility risk, producers can make long-term hedging decisions and take advantage of opportunities that may exist as far as 24 months into the future.

Many producers are starting to get nervous about the 2013 milk price and they’re looking to hedge their price. I am not opposed to hedging the 2013 price, but if you are hedging your milk price it is critical to also hedge your feed prices – or at least knowingly assume the feed price volatility risk.

Recently the corn futures price for the upcoming month has increased over $1 per bushel in less than two weeks. While the milk futures price has also increased, it has not increased as quickly as the corn price. This discrepancy had resulted in a decrease in current milk-feed margin.

I point this out because many producers are relieved that the milk price is improving but, in reality, the milk-feed margin is shrinking.While this may not be an issue if your feed prices are already fixed for the upcoming months, if you have to purchase some or all of your feed needs, your profit margins may be negatively impacted.

To get started, I suggest working with someone who has an understanding of both your milk and feed price risks for the upcoming months and upcoming years. A professional should be able to help you get a better understanding of your risks and, once you understand your operation’s risks, you can then work to manage them.

Your risk management choices are plentiful – and while that might seem overwhelming at first, it allows you to get a better hedge strategy for your unique operation. PD

Katie Krupa is the director of producer services with Chicago-based Rice Dairy , a boutique brokerage firm offering guidance, analysis, and execution services on futures, options, spot and forward markets.

There is risk of loss trading commodity futures and options. Past results are not indicative of future results.

-

Katie Krupa

- Director of Producer Services

- Rice Dairy

- Email Katie Krupa