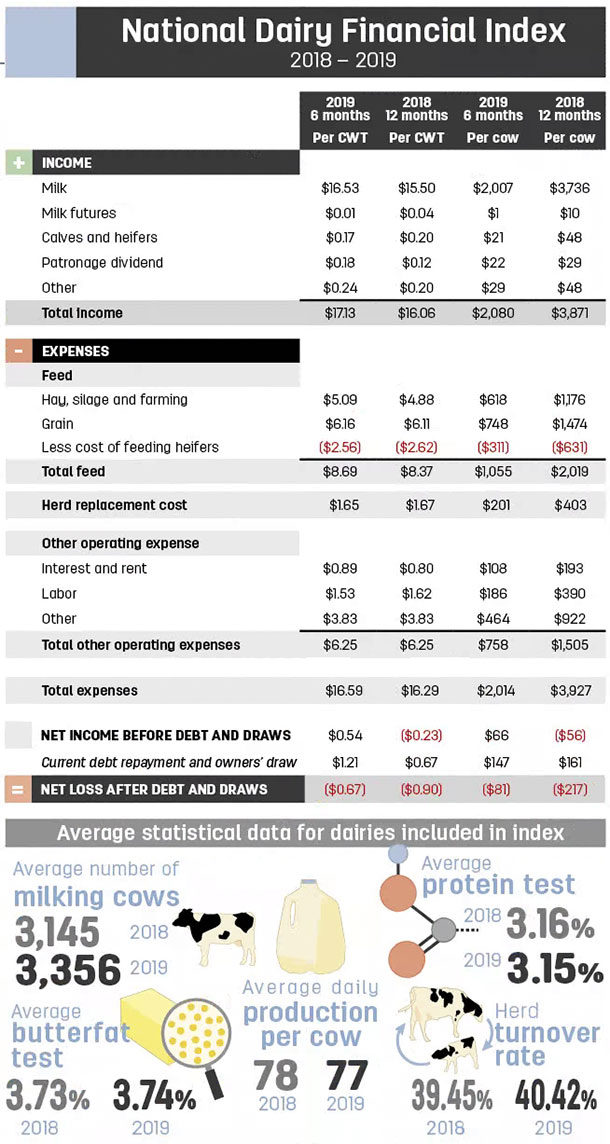

The accompanying illustrated index is the preliminary report from about 50 of our national clients’ average operating results, comparing the year 2018 with the first six months of 2019. Our usual, more comprehensive reports will be finalized in about a month.

The index reports the average milking herd size as 3,356 and 3,145 milking cows, per day, for the 2019 period and calendar year 2018 respectively. The production per-cow, per-day and component tests are nearly identical for both accounting periods. A notable observation with the “herd turnover rate” shows this year’s cull rate is continuing to run higher than in previous years. The financial impact of this will be discussed later in this article.

Comparing the average total income for the two periods, the 2019 period shows an improved milk price over 2018 by $1.03 per hundredweight (cwt) of milk shipped. This producer pay price increase is welcomed but defies the dairy industry market indicators. With the U.S. and world milk production increasing, reduced U.S. trade with China and near-record-high Class 3 and Class 4 milk product inventories, one would expect lower milk prices to match those received in 2018.

Despite this year’s improved milk price, the current and projected milk prices are still too low for the vast majority of dairy farmers to operate a sustained dairy business. Those dairy farmers who are still producing milk today have endured the last four years of below-breakeven milk prices. The $1.03 improved milk price for 2019 is welcomed but still falls far short to return most dairy producers to modest profitability.

There is considerable speculation that when and if the China trade deficit/disputes are settled, U.S. agriculture will thrive, including dairy. If China will equalize trade with the U.S., dairy could prosper and, with higher demand, prices could improve considerably. And in anticipation of these events, producers should immediately insist upon their cooperative board members to implement “supply to match profitable demand” marketing restraints to avoid milk overproduction that will lead us back to unprofitable milk prices.

Dairy feed costs for the first six months of 2019 reflect only a small cost increase over 2018 feed costs. Dairy feed costs for the last half of 2019 could go up by as much as $1 per cwt. The late planting of the 2019 corn crop throughout the country is likely to return low quantity and quality yields, requiring dairy farmers to seek costly off-farm feed supplements. Prices for quality hay has remained very high throughout many areas of the West.

One of the greatest feed cost factors looming over our Western horizon is the potential negative impact of the settlement of the trade dispute with China. It is anticipated that considerable quantities of U.S. grain inventories will be sold to China and, if so, dairy farmer feed costs could rise dramatically, returning us to the $7-per-bushel-corn era.

With these feed cost uncertainties, one should look really hard at either locking in long-term commodity prices or investigating into the USDA’s Livestock Gross Margin (LGM) insurance program, which will protect not only milk price but also will protect against rising feed costs.

Dairy farm herd replacement costs continue to be higher for 2019 than what they have been in previous years. Many dairy farmers have produced far too many replacement heifers, and these excess numbers of animals are entering overcrowded dairy herds, thereby causing increased dairy cow culling to make room in the barns. This extra culling has caused an increase in operating costs and, with no reasonable market to sell these excess animals, the lower beef prices will continue to be churned through dairy herds.

Click here or on the image above to view it at full size in a new window.

Included in the other operating costs in the cost study are two notable expense categories: labor and interest expense. Labor availability and cost continue to challenge dairy farmers. The cost to find and retain qualified farm workers has become a major concern. Without an immigration policy farmers can work with, farm labor costs are very likely to rise. With interest costs easing somewhat recently, farm debt payments may go down by a small amount.

Recent producer pay price improvement over 2018 levels is welcomed by producers. These slightly higher prices will not, however, bring most dairy farms enough profitability for sustainability. While producers passively wait for the industry to correct itself, farm equity is eroding, and industry farm consolidation will continue. From 2009 to 2018 we have seen the average herd size increase approximately 49.4%. The number of dairies over this same period has dropped from 54,942 to 37,468.

With more than 80% of milk marketed through cooperatives, a collaborative effort among co-ops to “balance milk supply with profitable demand” is well within the realm of possibility at the co-op level as well as delivering this message to policymakers at the federal level and thereby permanently serving to protect farm sustainability. However, this change will not happen unless producers insist upon it through their co-op leadership. ![]()

Gary Genske is a CPA with Genske, Mulder & Co. LLP.