In 2000, Malcolm Gladwell authored a book titled “The Tipping Point.” The tipping point, as he defines it, is that magic moment when an idea, trend or social behavior crosses a threshold, tips and spreads like wildfire. Just as a single sick person can start an epidemic of the flu, so too can a small but precisely targeted push cause a fashion trend, the popularity of a new product, a drop in the crime rate.

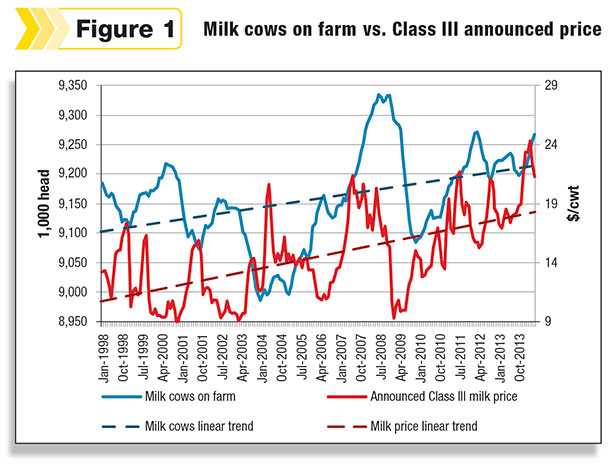

This concept can be applied nicely to the relationship between milk price and its reaction to cow numbers (and consequently production/milk supply). See Figure 1.

Before we discuss this relationship further, let us also flesh out another trend that is important to understanding production – the productivity trend.

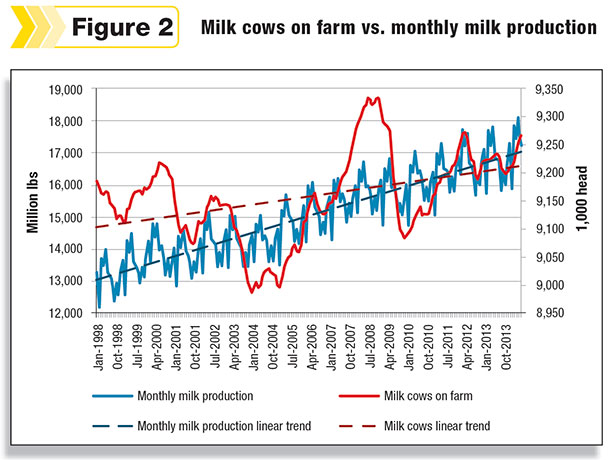

When viewing cow numbers and production as recorded by NASS over the past 16 years, one can see a general ebb and flow to the population, while production monthly milk production has dampened those ebbs and flows by deviating only slightly from its trend. This has allowed for the trend of milk production to grow at a faster rate than that of the growth of the herd.

If you look closely at Figure 2, you will notice the very gentle adherence in milk production to the corresponding changes in cow numbers. This speaks volumes about the quality of management administered by today’s producers.

Essentially, the take-away from this is that it requires fewer cows to produce greater volumes of milk. So as the cow herd grows, the growth in gross milk production volume grows at a faster pace. This becomes important as we try to draw conclusions about the cow herd and its individual effect on price.

When looking closely at Figure 1, there are several observations that can be made. First, we recognize that there is an age-old inverse relationship between cow numbers and price. Simply put, the cow herd would grow to a point whereby the corresponding milk production was more than the market could bear.

Prices would move lower, consequently causing greater culling, fewer cows and less available milk supply to processors. A shrinking milk supply would shorten product inventories, and consequently, cause buyers to pay more for product. This would create the obvious effect of rising milk prices, which in turn would cause growth in cow numbers. … And the cycle would repeat.

Second, there is a lead and a lag that is shared between the two. Cow numbers will grow to a place where more milk is available than can be handled, and then prices will fall, causing cow numbers to fall shortly thereafter.

Prices will fall only so long before product buyers begin bidding for product, causing milk prices to rise. Shortly thereafter, cow numbers will rise. The change in cow numbers or price are not met with an immediate response by the other. There is a lag. Generally, cows chase prices.

Bringing it home, this is really a discussion about profitability. Greater profitability grows the herd. Conversely, shrinking profitability reduces the herd. Markets are always in search of equilibrium, but always go further than believed necessary until a tipping point is reached.

Third, the relative fluctuation of cow numbers to price prior to 2009 was greater than it has been since. A few things play into this. The devastation of 2009 acted as a major reset switch in the marketplace. It not only sent a quarter million cows to slaughter, but also cut prices in half.

There wasn’t much room for prices to drop further. In terms of recent history, it would have also been hard for cow numbers to shrink much either. Since then, export demand has grown at a pace unequalled in history.

On top of this, milk production was hit by back-to-back droughts in the U.S. and then New Zealand. While cow numbers did not drop significantly, production was scaled back. Since 2009, the inverse relationship between cow numbers and milk price has been much more subdued.

Since the summer of 2011, cow numbers have fluctuated in a range of only 73,000 cows. The cow population has not been this stable since the 2003-2006 time period. All of this is to say that the response of cow numbers to price has been a bit more muted in the last five years but is still present.

So where are we going with all of this? The U.S. cow herd is now just 68,000 at the time of this writing from the summer 2008 high of 9.334 million head. Very likely, we have grown even closer as you read this. The all-consuming discussion for 2014 has been about demand.

Meanwhile, very quietly, the cow herd and production growth throughout the U.S. and around the world has continued to chase the opportunity created by this demand.

There comes a point where production infrastructure is built to where it overwhelms the demand that is currently so popular to talk about. We call this the tipping point. It is that “magic” moment all dairymen fear and all market-savvy participants prepare for.

There will be a lot of discussion about how demand has infinite reaches and that there is no cause for prices to go down … until they do. When that day comes, many will act surprised. However, they need not be.

Perhaps the best parallel to this story is found in the corn market. While dairymen celebrate the fact that corn prices have fallen, grain farmers everywhere live in an astonished disgust with current market levels. Ongoing world demand through the 2012 drought drove U.S. grain farmers to expand their operations, and following the devastation of that year, grew corn production to a record level.

However, American producers weren’t alone in their efforts. Others around the globe joined in on the action. Production soared. Now prices have fallen to the lowest levels in five marketing years and to levels well below the average cost of production.

This is the cycle they live with. It is the very cycle that we must understand, appreciate and embrace. Prices have driven dairymen towards growth and expansion. With cow numbers approaching modern records and expanding infrastructure allowing that growth to continue, it will not take long before the tipping point is reached and milk prices respond accordingly. Be prepared for that moment. PD

UPDATE: Since the publication of this article, Mike North has left First Capitol Ag and is now the president of Commodity Risk Management Group. Contact him by email.

Mike North

Sr. Risk Management Adviser

First Capitol Ag