For every market there is a chart. The chart defines that market’s price over time. However, what makes up a price? What influences its movements? Some will say supply and demand. Others will contest that we are in a new era, where algorithmic trading and computer-generated order flow dictate price. Still more will suggest that the volatility that comes as a function of speculative money flow and the war that wages between fundamentalists and technicians have an influence. Whatever flavor you choose, one thing is certain … it moves.

What is more interesting is what happens as it moves. The milk market makes for an interesting case study as we examine this observation. Markets have risen after a very dramatic fall. Producers are feeling more comfortable with their circumstances. Bankers are breathing easier. Suppliers are looking forward to better years ahead. Prices have improved. But will they stay here? The answer is a simple one … No! Markets will do what they do best. They will move!

As prices continue to move and adjust, people will be monitoring actual value relative to their expectations of the future. This expectation is often a reflection of what the producer and his/her neighbors agree is a “fair price.” A “fair price,” as you can imagine, rests several dollars per hundredweight over one’s breakeven price.

It is no wonder that when prices move lower, the world does not seem fair. Anxiety, denial and fear grip the producer as he watches opportunity pass. Desperation and panic set in as they watch their cash flows take on darker shades of red. Producers begin to realize that they have yet again missed an opportunity. Statements like “If only I would have …” or “I could have …” or “I knew that I should have …” are tossed around frequently. The “woulda, coulda, shoulda’s” create a sense of self-defeat that makes one feel like waving the white flag of surrender. Hopelessness and depression define the human psyche. How could it get any worse?

But, alas, it is over! The market begins to rebound. Hope bubbles until optimism boils over. This new brighter outlook breeds an excitement that grows to a stage of euphoria that people seldom experience. Producers start to feel like they can fly. Times are good. The market begins its move lower and we repeat the cycle once more.

What frustrates me is hearing of how this cycle leads to bad decision-making. Over and over, people allow the desperation of bad times to temper their activity during improving times.

In 2001, buyers began offering contracts to shore up long-term supplies of milk. It was not a conspiracy or a means to cut the throat of the producer. It was a service added to both aid the producer and create a consistent, long-term milk flow. Producers flocked to this offering after experiencing the pain of $10 milk that defined 2000.

Like 2001, we often hear of producers that, in their effort to avoid the pain of $10, sell $13 milk only to watch the price go to $16, $18 or $20 per hundredweight. When this happens, producers curse the contract’s very existence. All manner of evil is spoken about the market. They rue the day they considered such a strategy.

It happened in 2001. What is worse is that it happened again in 2004, and then again in 2007. It is a cycle that continues.

In December, it was estimated that more than 100 million Americans resolved to lose weight in the new year. The gyms got crowded. Would-be “losers” watched the scale, monitoring even the slightest variation of weight. The TV was overrun by some sort of abdominal workout and health food sales went through the roof. By now, most people’s resolution to lose weight has already been broken. There is no longer a line to get on the elliptical machine. And ad space is filling up with the “get ready for spring” message.

Opportunity came and left and the once-resolved majority are still trying to fit in last year’s jeans. This is not because their plan to lose weight was poor. Rather, they failed to deal with themselves, their habits, their weaknesses, and more importantly, their emotions.

The story is no different in the world of marketing and price risk management. People spend so much time charting price that they often forget about the emotions they experienced as those prices unfolded. The chart of your emotion should be watched much closer than the price chart your eyes are often glued on. If producers would write down how they felt and what decisions they made as a result of that emotional response to price, their risk management success would move to a much higher plane.

Can we agree on something? Let’s agree to not allow this emotional roller coaster to dictate our reaction to price opportunity. As you navigate your marketing plan, please do this – chart yourself.

As you track your emotions, spend some time thinking of the past. What were your best years emotionally? What were your worst? It is interesting that as I ask this question in crowds, I often find that their emotions very closely follow price.

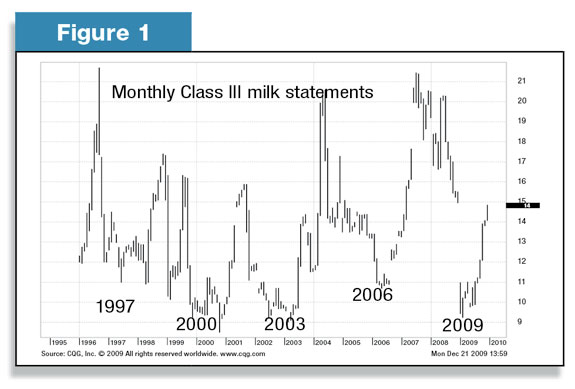

See Figure 1. Do you find yourself rising and falling emotionally as the price tide comes in and draws out? As we monitor ourselves, it is often good to have some sort of bias or expectation about price.

Frequently, people ask me “Mike, where is price going to go?” That is, frankly, a question that merits no response. No one knows. The question I often ask in response is, “What will you do with such information? Are you asking simply to know? Or are you trying to formulate a plan?” No one knows where price will go. The man who thinks he knows displays to everyone how little he actually does know.

Of all markets, however, the milk market has created a historical pattern that must be respected. As we work back to higher prices, bear in mind that we will again return to lower ones. The math makes it pretty clear what the market suggests could happen in 2012. However, action must be taken when times are getting better to ward off the effect of falling prices as times get worse.

The higher prices go, the more active you must become. Though capitalizing on milk prices will be important as we go forward, you must also balance this with your feed purchases. Trying to go at this process one-sided or getting overconfident of price direction is usually a prescription for a high degree of pain and discomfort. Case in point: even though this chart may be highly suggestive of coming opportunity and disappointment, it also reminds us subtly of our risk along the way.

In this same chart, you will notice that the milk market often incurs setbacks as it recovers from previous price corrections. Carry adequate protection (I recommend a put strategy of some sort) as you prepare for potentially more aggressive actions later (not necessary if you are holding puts).

People often suggest we would be better off with more stable prices that move little and seldom change. They are not suggesting this because it would do their business better. The root of that comment comes from a desire to get off of the emotional roller coaster. I grant you that wish. However, that does not mean that something will magically appear and your life will forever change. I challenge you to understand you.

Price cycles create more emotional predictability than market certainty. If you can pattern yourself, you can corner the market of “you”. Doing so will help you more clearly see opportunity through the lens of reality. I bid you well. PD

UPDATE: Since the publication of this article, Mike North has left First Capitol Ag and is now the president of Commodity Risk Management Group. Contact him by email .

-

Mike North

- Milk Marketing Specialist

- First Ag Capitol