Not only do you need to be able to offer compensation packages that are competitive amongst your peers and other industries, but you also want to incentivize high-level managers to treat the business as their own. Depending on the goals of the business owner, and the structure of the business, there are several options businesses can explore to accomplish both. Here we look at three of the methods that are prevalent in business planning today: the Profits Interest LLC, Deferred Compensation Plans, and Phantom Stock.

PROFITS INTEREST LLCs

With the prevalence of the LLC as the entity structure of choice for most farm businesses, the profits-interest model gives business owners a tool to transfer profits and ownership to a key employee, without requiring the gift or sale of any equity.

Tim Moag, CPA, is a director at Freed Maxick CPAs that specializes in agribusiness. He explains his preference for the profits-interest model as follows:

“A Profits Interest LLC is a great tool to attract, retain and reward non-family farm managers and key employees. They are presented an opportunity to participate in the future profits and growth of the farm without having to ‘buy-in’ to the farm. Their ownership interest is earned, not received as a gift. Current owners don’t give up ownership but maintain existing equity and share a ‘smaller slice of a larger pie’.”

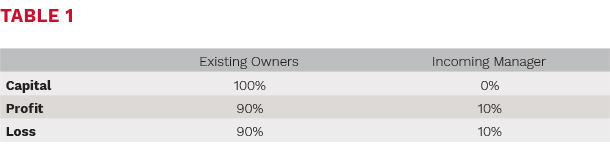

One of the key properties of an LLC that gives it flexibility is that a member’s ownership, or capital percentage, does not have to be equal to their profit percentage. A Profits Interest LLC structure uses this principal to allow incoming members to grow their ownership percentage by allocating them a higher percentage of the profits than their ownership percentage and compensating them for their labor and management with a guaranteed payment rather than a draw. For example, let’s say a manager was offered a 10 percent profits interest without contributing any capital, and the business was currently worth $5,000,000. Their opening percentages would appear as follows:

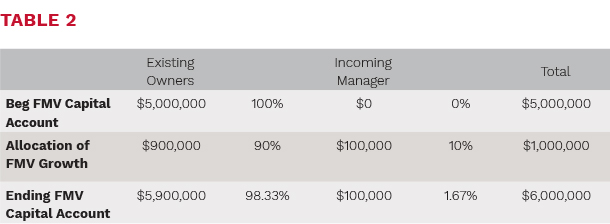

In the first year, the business had true fair market value (FMV) growth (not necessarily tax profit) of $1,000,000, after owners’ guaranteed payments (a form of cash compensation for owners that is treated for tax and equity purposes more like a salary than a draw). Profits would be allocated and equity earned as follows:

While the actual calculation is a bit more complex in real life, you can see in this example that, as Moag noted above, a profits-interest model is effectively transferring future equity growth, not prior accumulated equity. While the existing owners’ percentage of ownership decreased, their total equity still grew, and they did not give up any of the $5 million of equity that they began with.

While the actual calculation is a bit more complex in real life, you can see in this example that, as Moag noted above, a profits-interest model is effectively transferring future equity growth, not prior accumulated equity. While the existing owners’ percentage of ownership decreased, their total equity still grew, and they did not give up any of the $5 million of equity that they began with.

As long as the percentage of profits allocated to an owner is higher than their capital percentage, and the business shows profits, their equity percentage will continue to grow. However, if the business is not profitable, the incoming owner now also shares in those losses, allowing them to fully participate in the risk of the business.

When looking at a Profits Interest LLC as an option, it is critical that you work with good advisors, including an attorney who specializes in agricultural business agreements, and a tax accountant or consultant who understands the model and can ensure that it will be implemented continuously. In order for this model to continue to work effectively, the above calculation needs to be done each year, taking into account draws, contributions, and special tax allocations.

DEFERRED COMPENSATION PLANS

Another method of compensating high level managers which does not include ownership in the business is Nonqualified Deferred Compensation Plans (NQDC). The simple definition of an NQDC plan is an agreement between the employer and employee to defer a portion of their compensation to a later date. The amount deferred or contributed is not subject to qualified plan limits (such as a 401K). Unless the business is structured as a C Corporation, these plans are not available to owners, but rather to top employee managers.

While there are different types of plans, and setting them up requires working closely with an advisor who thoroughly understands their nuances, there are a few basic principles. One is that the compensation is tax-deferred (until it is distributed at the later, agreed-upon date), as long as the employee cannot materially access it. Distributions can be elected before 59½. The plan is generally only available to a few of the highest-level managers in the business, not your entire workforce.

Plans are generally unfunded, meaning funds are not set aside directly to fund the pending liability. Should funds be set aside, they need to be subject to substantive risk of forfeiture as a general asset of the business. In this way, it accomplishes many of the same goals as a profits-interest model, without the manager taking any actual business ownership.

Mark Modzeleski, CFS, CLTC, AIF, CFBS, president and financial advisor at Legacy Wealth Advisors, agrees that as agricultural businesses continue to expand, attracting and retaining talent is becoming more and more of a challenge. He is finding these plans to be a valuable instrument to this end.

“Designing a different way of compensating a key person is going to be critical. The corporate world has been using these techniques for years, and now agricultural businesses are adopting these types of agreements as well. Nonqualified deferred compensation plans will be a critical tool in maintaining and retaining talent on our farms and in our industry.”

PHANTOM STOCK

While LLCs have become the most popular type of entity, some farm businesses are still structured as a corporation, in which case the profits-interest model isn’t an option. Those business may want to consider the use of phantom stock instead. Phantom stock, as the name implies, is a method of compensation that essentially entitles the recipient to the value growth they would have earned had they been issued stock. To simplify, let’s say the business has 100 shares of stock, and a key manager was issued 10 shares of phantom stock. While the manager would receive no actual ownership in the business, they would earn 10 percent of the business growth going forward.

It’s important to remember that in all of these instances, the growth in value is not actual cash compensation, but rather an accounting of value available to the manager at some future date. How and when this value can be accessed or liquidated by the manager is determined by a legal agreement, such as phantom stock agreement, deferred compensation plan agreement, or in the case of an LLC, a buy-sell agreement. Working with your business advisors to determine what options fit your business goals can help you structure a compensation plan that not only helps you attract the best management talent, but incentivizes them to make the business perform to its highest potential. ![]()

IMAGE: Getty Images.

Anna Richards is a dairy farm business management specialist with PRO-DAIRY. Email Anna Richards.

This article appeared in PRO-DAIRY’s The Manager in December 2019. To learn more about Cornell CALS PRO-DAIRY program, visit PRO-DAIRY Cornell CALS.