When you think about price potential for feed in 2017, it’s important to look back at where we’ve been lately. The last four years have ended with record-breaking or near-record-breaking corn production and demand that has kept pace.

Last year, farmers produced the all-time record of 15.2 billion bushels of corn. Since 2013, farmers have produced no less than 13.6 billion bushels of corn. We have to go back to 2012 for a significant drop-off in production.

Will farmers produce a fifth record or near-record crop this year? That is what will be needed for prices to remain at current levels once you factor in projections for continued strong demand.

The November 2016 World Agriculture Supply and Demand Estimates report projected 2016-2017 marketing year corn demand to be 14.6 billion bushels. That is 600 million bushels fewer than the recent 15.2-billion-bushel crop. Thus, it appears there is no supply-demand issue for the time being.

But it won’t take much of a drop in production – or a negative crop event in South America – to begin putting upward pressure on feed prices, assuming demand levels hold.

Let’s look at a range of scenarios for corn and soybean production, demand and price. Using some simple math, you can begin to develop or enhance plans for purchasing feed in 2017.

Potential for $6 corn ahead

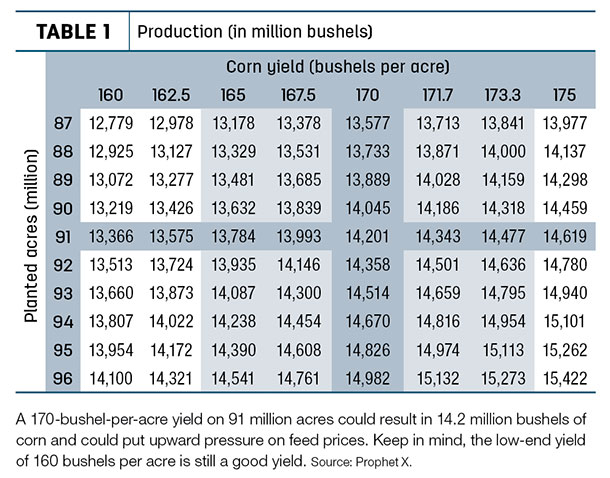

Farmers are projected to plant 91 million acres of corn this year. For our research, we plotted estimated production numbers based on yields ranging from 160 to 175 bushels per acre (Table 1).

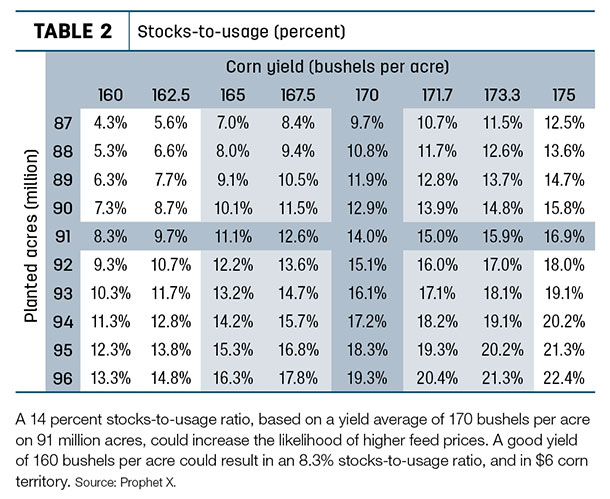

Next, we looked at the stocks-to-usage percentage for the same yield range. The percentages indicated tell you what the supply picture could look like for each average yield (Table 2).

Next, we looked at the stocks-to-usage percentage for the same yield range. The percentages indicated tell you what the supply picture could look like for each average yield (Table 2).

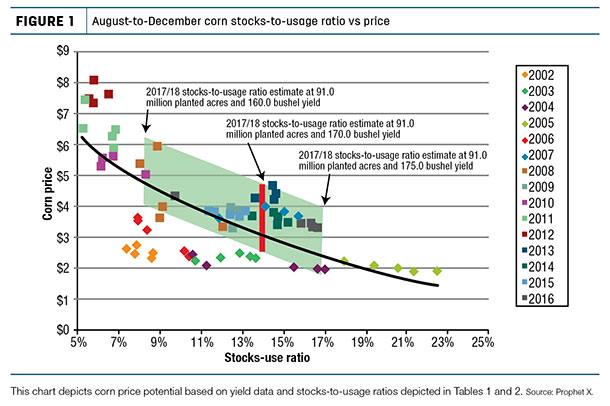

On the low end, an average corn yield of 160 bushels per acre could result in an 8.3 percent stocks-to-usage ratio on 91 million acres. In terms of price, that translates into the potential for $6-plus corn (Figure 1).

Even if farmers achieve an average yield of 170 bushels per acre on the same number of acres, $5 corn could be within reach.

Even if farmers achieve an average yield of 170 bushels per acre on the same number of acres, $5 corn could be within reach.

For corn prices to remain low or move lower from here, we likely need a yield average of 175 bushels per acre. This could keep corn prices under $4 per bushel.

Price potential for beans

Using the same model we used for corn, let’s look at potential feed price scenarios based on a range of average yields on 88 million planted soybean acres. Soybean acres are expected to increase by 5 million or so, as soybeans look to provide better projected returns per acre at current price levels.

For soymeal prices to remain low or go lower, soybean growers will likely need to produce an average yield of 48 bushels per acre or higher, which would mean at least matching the second-best yield ever (2015). An average yield of 48 bushels per acre could result in prices under $290 per ton.

At an average yield of 46 bushels per acre, our research shows soymeal prices could climb to $380 per ton. An average yield of 44 bushels per acre could result in a significant tightening of carryout. Unless prices rise to ration demand, beans could top $400 per ton in this scenario.

The last time we saw a 44-bushel yield for beans was 2013, as key growing areas in the U.S. turned hot and dry in late July and early August. We don’t believe we need a catastrophe to see bean prices back in the teens and meal prices over $400 per ton.

Potential for being caught off-guard

Maybe you’re familiar with the old Wile E. Coyote and Roadrunner cartoons. Each episode featured a series of failed attempts by the coyote to catch the speedy Roadrunner.

Sometimes, however, the Roadrunner turned the tables and snuck up on the coyote. Startled from being caught off-guard, the coyote usually froze or made a big mistake.

As a feed buyer, you have to be careful not to put yourself in the coyote’s position. It pays to think about feed price potential right now – rather than after U.S. farmers get their crops in the ground – so gradual changes in price don’t sneak up on you.

One of the first places to look for clues is South America. Farmers in Argentina harvest their crop from March to May. Brazilian farmers harvest from now until March. In areas of Argentina, farmers have received significant rainfall, causing major flooding.

In northern areas of Brazil, farmers have been reporting dry conditions. If current adverse weather continues, and altered production estimates result in lower supply, demand pressure will begin to creep upward.

In addition to South American crops, the U.S. planting intentions report will be released March 31. What if there’s a material drop in the number of acres farmers intend to plant to corn that exceeds current expectations? After that, what if we experience a wet spring that delays planting? Or a dry summer?

Each of these factors throughout the season has the ability to influence price in small ways that go unnoticed by feed buyers until it’s too late. We experienced this type of slow, upward rise in price in 2008.

Another potential factor is the new White House administration’s policies on trade. The threat of a trade war has already caused a drop in the U.S. dollar. Promises to increase infrastructure spending and implement tax cuts could raise expectations for inflation, prompting speculators to pour money into commodities.

At the same time, the Federal Reserve could implement multiple interest rate hikes to fight a rise in inflation, which could bolster the dollar.

It’s impossible to know what’s going to happen in politics or farmers’ fields until it actually does happen. To plan feed buying strategies well, put strategies in place now so that you’re protected for any event. ![]()

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.

-

Patrick Patton

- President

- Stewart-Peterson

- Email Patrick Patton