Our company has produced averages of our dairy clients’ profit and loss reports on a quarterly basis for dairies across the nation for many years. These reports provide our clients and others in the industry with valuable benchmarking data, which is difficult to obtain from other sources.

These profit and loss reports are sorted by geographical region and type of dairy operation. These reports are available several months after each quarter end due to the time required to gather all of our clients’ data.

In order to provide more current data on the current financial conditions facing the dairy industry, we have created the National Dairy Advanced Index. The index figures will be available within 75 days after the end of the quarter and will highlight trends in the major income and expense categories.

As much as conditions allow, the same dairies will be included in the index to maximize comparability between time periods. The dairies used are from across the nation.

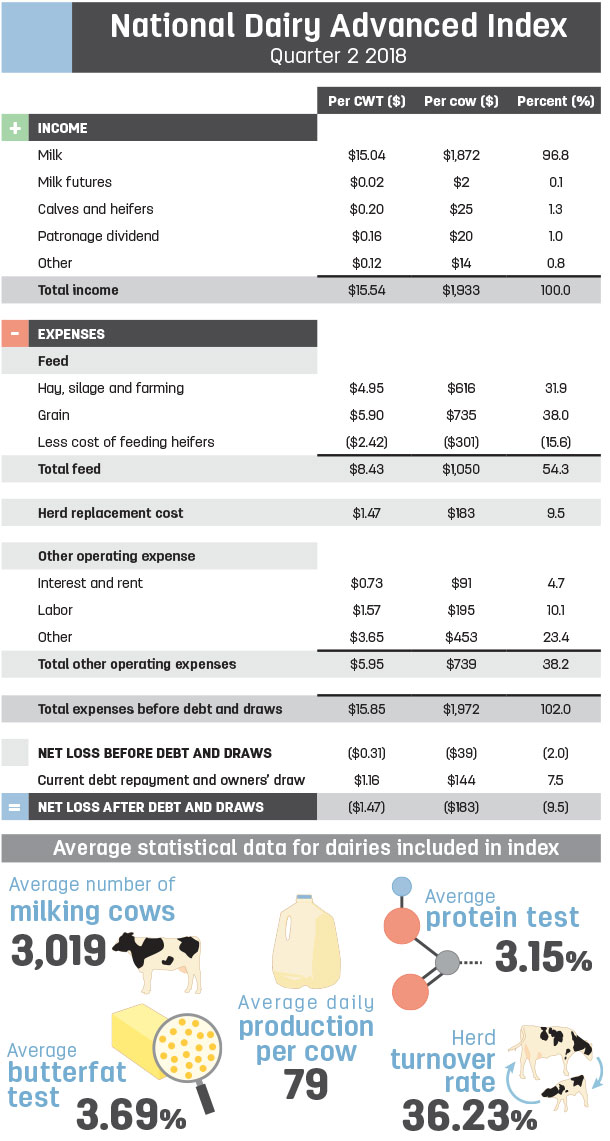

Our second-quarter 2018 index includes 45 dairies from 13 states. The dairies in the index have an average of approximately 3,019 milking cows and average daily production of 79 pounds per cow.

Some key points from the second-quarter 2018 index:

- Average milk price came in at $15.04 per hundredweight, a decrease of 7 cents per hundredweight from the first quarter of 2018.

- As expected, production increased during the spring months of the second quarter. Production increased from 77 pounds per cow in the first quarter of 2018 to 79 pounds per cow for the first six months of 2018.

- Feed costs decreased 10 cents to $8.43 per hundredweight. Most dairies saw a modest decrease in their feed costs this quarter compared to first-quarter 2018.

- Labor continues to be high at $1.57 per hundredweight. Many regions continue to face a labor shortage.

- Interest and rent remain high at 73 cents per hundredweight. Many dairies are increasing borrowing levels in 2018 due to sustained losses, and interest rates continue to rise.

- The index shows an average net loss from operations of 31 cents per hundredweight for the six months ending June 30.

Many of our clients are struggling with the milk price they have faced in the first six months of 2018. They are short on liquidity, and the balances on their lines of credit may be approaching borrowing limits. To fully understand the cash flow situation, it is important to remember what is not included in net income:

-

Debt service. Loan principal repayment is not considered an expense but is a significant cash outflow. This will become a more significant factor as debt levels increase.

- Personal expenses/draws. Although these are not business expenses, they are just as necessary.

For the second half of 2018, we expect rising milk prices to be partially offset by continuing high labor costs and increasing interest expense. ![]()

If you have any comments on the index, email us (Genske, Mudder & Company)

Daniel Tevis is a CPA with Genske, Mulder & Co. LLP

Quarter 2 2018

Click here or on the image above to view it at full size in a new window.