Enterprise accounting lists the gross income and expenses for specific parts of your farm’s operation (the enterprises). Ultimately, it provides a more complete view of the areas of the operation that perhaps aren’t as efficient as they could or should be. It also identifies areas that are performing well and can be expanded on.

You can use an enterprise budget to compare your costs to those of other producers, which will help determine if your farm’s costs are high or low. If your costs are high, it’s easier to pinpoint which specific areas you need to analyze for cost control. An enterprise budget can also help determine which strategies to use to control costs, such as changes in production practices or input sources.

Heifer management

There are many enterprises that can be measured separately on a dairy farm. An analysis of the income and expenses for each enterprise helps managers make adjustments to improve operations as a whole. Some of these enterprises can include:

- Milking herd

- Replacement heifers

- Herd replacement cost

- Feed (both purchased and grown)

- Cropping

- Steer-raising

- Dry cows and calves

Let’s take a moment to look at replacement heifers as part of herd replacement cost. In the current low-margin environment, we’ve noticed that a lot of dairies have been reevaluating their heifer management strategies. In the past, dairies would raise surplus heifers (and use sexed semen) to provide more-than-adequate heifer inventories to cover involuntary cull rates and death loss. Additionally, operators had the luxury of maintaining surplus heifers for expansion purposes.

But in the current environment, a lot of dairies have postponed their expansion plans, so it no longer makes sense to carry such large heifer inventories, especially considering the cost. For example, let’s say a dairy with a 1,000-cow herd carried an extra 10% in inventory. Assuming it costs about $1,800 to raise a heifer and you get $600 from a cull, that’s a loss of $1,200. When you apply that to the 10% of oversupply (100 head of cattle), then raising the extra animals resulted in $120,000 being added to your herd replacement cost.

Another consideration is the average age of the herd. When operators were raising excess heifers, the average first-calf heifer might be 40% to 45% of the herd. Because a second-lactation cow milks more than the first, and so on, operators started looking at the lost milk income per stall they were experiencing with such a young herd. They eventually realized they had to let the average age of their cows mature a bit. The result was more production per cow while lowering their herd replacement costs.

Taking action

Heifer management and herd replacement cost are just two enterprises to consider. Once you’ve broken your operation down into its various enterprises, it’s time to analyze where you can make improvements and to recognize where you are doing well and expand upon those areas. Ultimately, it’s about measuring trends over time and discovering what you can and can’t control.

Doing so can help determine whether you should continue to perform certain enterprise operations in-house or outsource them by comparing your current performance to expected results from the alternative. For example, should you custom raise your heifers out of state, or should you reduce your heifer inventory and raise them yourself? Should you buy feed for heifers or grow your own? You can also compare your operations to your competitors. Are the more efficient neighboring farms custom raising heifers in other states? These are the types of enterprise management decisions operations need to make.

Within each enterprise, it’s important to analyze what your direct costs and allocation costs are. Costs related to equipment, management, utilities and insurance, for example, all need to be allocated across the different enterprises.

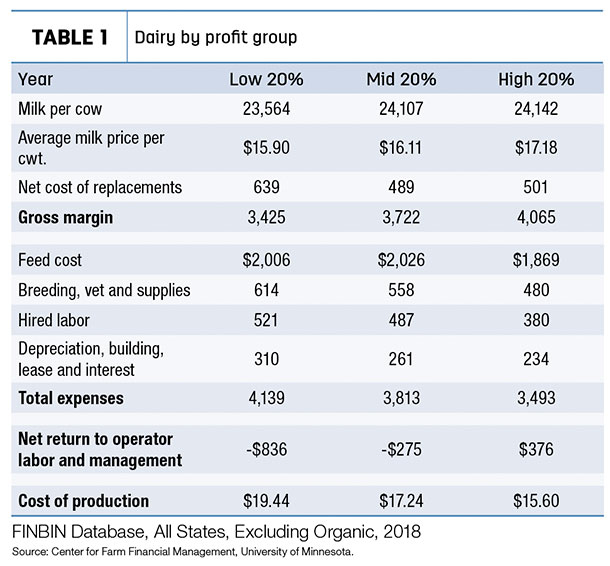

Table 1 looks at U.S. dairy farms by profit group – low 20%, mid 20% and high 20% – and breaks them down into various income and expense categories, including milk per cow, milk price and hired labor costs. As you can see, the high-performing operations are the ones able to keep costs low and their production high, resulting in a significantly lower cost of production than the lower-performing operations.

After four-and-a-half years of low milk prices, keeping your cost of production as low as possible separates the operations that are likely to survive from those more likely to have greater financial difficulty. It’s about separating what’s controllable from what’s uncontrollable, and you do that by budgeting for your operation’s various enterprises. ![]()

The opinions, estimates and projections, if any, contained in this article are those of the authors. BMO Harris Bank endeavors to ensure that the contents have been compiled or derived from sources that it believes to be reliable and which it believes contain information and opinions which are accurate and complete. However, the authors and BMO Harris Bank take no responsibility for any errors or omissions and accepts no liability whatsoever for any loss (whether direct or consequential) arising from any use of or reliance on this article or its contents. This article is for informational purposes only.

Visit BMO Harris Bank for more agriculture industry insights.

Donald J. Adams is BMO Harris Bank Senior Vice President, Agribusiness Banking. Contact Donald J. Adams.

-

Sam Miller

- Managing Director, Head of Agriculture Banking

- BMO Harris Bank

- Email Sam Miller