Entry into farming is all too often thought of and treated as an event. At some undetermined date the farmer will “turn it all over” to the successor. After all, for years the farmer has been saying, “Someday, son/daughter/niece/nephew (circle the appropriate), this will all be yours.”

The “someday” date is never set, there has been little or no planning and the decisions and plans are never made. Days lengthen to weeks that lengthen to months that lengthen to years that lengthen to decades and suddenly a health crisis or death of the owner is the “someday.” No current estate plan is in place, no documentation of the equity of the successor and no management responsibility or training for the successor. The business is doomed to failure and the successor never realized his or her dream of being a farm business owner. Their career in farming has been as the “farmer’s boy,” the 65-year-old whose father made all the decisions, never retired and allowed or required the successor to learn to manage the farm business.

So why don’t farmers plan? Farmers, not unlike most entrepreneurs, do not like to plan; they like to do whatever it is that they do. Farmers like to plant, harvest, raise cows, milk cows and all the associated activities involved in farming. Planning is complicated and many farmers don’t know where to start. Should we form a corporation, partnership, limited liability company? What about wills and trusts and estate taxes? Lastly, succession planning requires considering retirement, old age and, yes, ultimately, death. These are not the topics that most of us want to ponder. And all the necessary and urgent daily activities take precedent over the important planning for the long-term future of the farm family business and the farm family.

Recent research by the Beginning Farmer Center at Iowa State University revealed that only 27 percent of Iowa farmers have identified a successor for the farm family business. Only 23 percent of those surveyed indicated they would retire. Of the 77 percent who will retire or semi-retire, less than half have discussed their plan with anyone. (A copy of the entire report is available at www.extension.iastate.edu/bfc )

When and how should farm family business succession planning begin? Ideally a potential successor should be identified as early as possible and planning should begin immediately. If the successor is a child of the farmer, planning should begin when the child is born. If the successor is not a family member, planning should begin when the decision is made to have a successor. In the event there is no successor, succession planning will not have a detrimental effect on the farm business and will most likely increase profitability and reduce risks.

The “how to begin” is a more difficult question to answer. The fundamental question is one of values. It has been said that we never do anything that we do not want to do, but we will do things we do not like to do. We want to do that which we value. The starting point in all succession planning is identifying the values of those involved. It is the values of the parties that will create their picture of the future for themselves, individually and as a family, and for the farm family business. Once the picture, the vision of the future, is known, it becomes much easier to establish the goals that will achieve that future that will be valued by all involved.

All too often the focus is on the transfer of assets, the mitigation or elimination of costs, including taxes and the choice of business entity. All these are important, but none provide for the transfer of the management of the farm business. Transferring managerial decision-making and therefore the control of the business requires the operating generation to relinquish, give up, that control and decision making. If the management is not transferred the result is the “farmer’s boy” situation. Does the owner generation value retaining managerial control more than transferring the farm business to a succeeding generation? If it is the former, the farm business will, in all likelihood, cease to exist when the owner dies. If it is the latter, the farm business will continue to operate as an independent farm family business. It is a question of values that is critical in determining whether or not the farm business will continue for another generation.

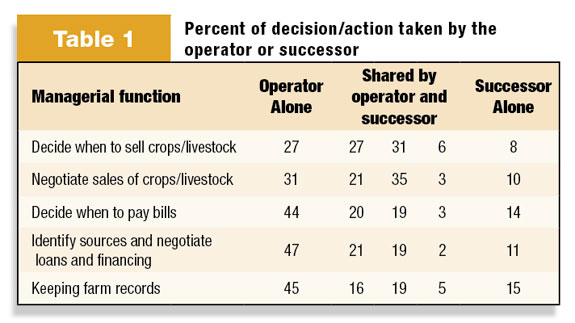

Table 1 indicates the percent of the owner/operators of farm family business who have transferred the listed managerial function/decision to the successor.

Obviously the transfer of management must correspond with the competency of the successor to make the decisions that are necessary to manage the farm family business. As with any business, new employees begin with little authority, responsibility and accountability for upper-level strategic management decisions. New employees begin with the authority and responsibility to make operational decisions. As their experience and training progresses their responsibilities and authority is increased. Eventually, after demonstrating competency with the operations of the business, they are given the authority and responsibility for strategic decisions and, ultimately, for the management and direction of the business.

The timing of the progression from operational management to strategic management can determine the success or failure of the succession plan. Too much responsibility too soon may lead to poor decisions due to lack of experience and training. Delaying the delegation of managerial decision-making authority and responsibility may cause the successor to leave or to lose interest in the farm family business.

The owner generation and the successor generation need to establish a mutually agreed-upon timeline with defined and definite time periods for transitions to take place. The transitions or tipping points are when the training and requisite transfer of management should be complete. The timeline and the tipping points are the objective measures by which progress may be assessed and problems may be discovered and corrective action taken.

Farm succession planning is not easy. It requires commitment of all involved and the discipline to adhere to the timeline and tipping points. Even though it is not easy, many farm families successfully complete a farm business succession plan and those farm family businesses will continue for the next generation. It has been said and it is true that we do not inherit our farm from our parents; we borrow it from our children. When and how you return it to your successor is your decision. PD

-

John R. Baker

- Attorney

- Iowa State University

- Email John R. Baker