When it comes to the “right” amount of debt, farm business owners sometimes feel like “you’re damned if you do and damned if you don’t.” Borrowing money can be risky, but on the other hand, not investing in the business could limit opportunity and put the farm at a significant competitive disadvantage over time.

The owner’s role as financial manager is to walk a tightrope in terms of how much debt they carry to fund capital reinvestment.

When used properly, debt is a tool that can help a business effectively leverage its equity capital. The end result can be improved efficiency and profitability, expanding for future viability and farm transfer or to allow additional family members to join the business.

The conundrum for producers is on how much debt they feel is OK. I see a large range of debt levels, anywhere from zero to over $8,000 per cow. Your operation’s current debt is a result of all the capital investment decisions made over the years, combined with any operating losses you may have incurred and borrowed to help cover them.

Typically, debt is expressed on a per-cow basis because the cow is your primary producing unit. Historically, farms have steadily increased their average debt as prices for land and equipment have increased and the price they get for milk has risen.

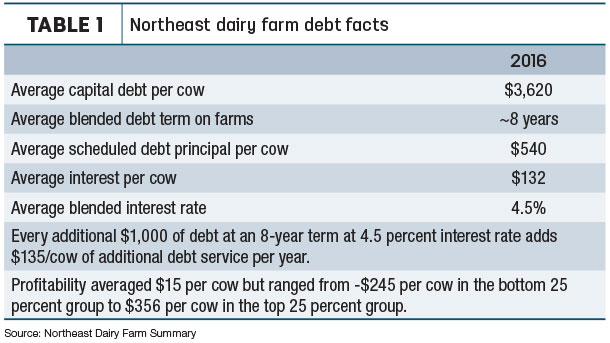

Our Northeast Dairy Farm Summary showed the average capital debt – intermediate and long-term debt, but excluding things like trade payables and operating lines of credit – was over $3,620 per cow as of the end of 2016. That is a far cry from the $2,500 average debt per cow just 10 to 15 years ago.

Debt can have a significant impact on an operation’s cash flow – both positively and negatively – depending on the investment. The key to making debt a positive to both the farm’s short- and long-term profitability is that the investment behind the debt must add more to income than it adds to debt service.

We need to be careful measuring all investment on a cash flow basis. If investment comes with what lenders call “lost capital,” it can have a significant negative impact on equity on a farm’s balance sheet. Lost capital refers to when an investment adds less to the value of a property than its cost.

For example, a new building may cost $100,000, but only increase the property value by half that. The $50,000 difference is referred to as lost capital. This doesn’t necessarily mean the building is a poor investment, only that the full value of it is unlikely to be recovered in a sale.

Typically, lost capital occurs on investments like barns, parlors, bunker silos and manure storage. Other considerations include tax liability implications of investments. Some investments can delay tax liability, effectively improving cash flows at tax time. Make sure to consider the impact an investment could have on your farm’s cash flow, tax liability and balance sheet before you invest.

What do current economic conditions tell us about debt repayment capacity?

We are in a different economic situation than pre-2014. With lower milk prices and higher debt levels, many producers have found themselves in a negative cash flow situation. Dairy producers should know their scheduled debt principal repayment per cow and total basis.

This number tells you how much debt you are scheduled to repay if you can cash flow your operating expenses and debt payments.

Another important factor is your projected cash flow excess or deficit for the year. If you can’t cash flow, you are essentially reducing the amount of debt you are repaying for the year. The difference between how much debt principal you repay and how much you borrow back for operating and capital expenditures is net debt paydown or net debt borrowing.

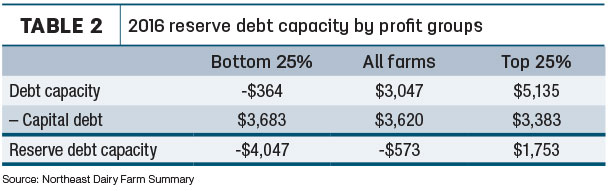

Based on 2016 Northeast benchmark numbers, the average farm was able to pay all expenses and cash flow $454 per cow in debt service. Using an eight-year blended debt term (BDT) at a 4.5 percent interest rate, that translates to a debt carrying capacity of $3,047 per cow (average debt per cow was $3,620).

As expected, the 25 percent of farms in the “top profit” group were able to handle a debt repayment capacity of $765 per cow, translating to about $5,135 in debt carrying capacity per cow. The interesting thing here is that top profit farms tend to have less debt per cow than the average farm.

This data tells me that current economic conditions make it hard for the “average” farm to handle current average debt load in the Northeast. Yes, 2017 milk prices are shaping up to be $1.50 per hundredweight (cwt) better than 2016, but the reality is that 2017 might end up being the high milk price in the current three-year cycle.

That means the outlook for the next few years may not be much different than the previous three years, with milk prices remaining in the $14 to $18 range. Under those economic conditions, producers may need to adjust their thinking in terms of how much debt they can handle, and the rate at which they reinvest in capital on their farms.

What factors affect a farm’s debt repayment capacity?

There are many factors affecting how much debt an operation can effectively handle. Those include:

-

Interest rates. The higher the interest rate, the higher the scheduled debt service payment.

-

Blended debt term. BDT is a measure of how many years it would take to pay existing debt off if you didn’t borrow anything further and kept the same monthly debt payments. The longer the blended debt term, the lower the scheduled debt principal payment, which may help with cash flow. The downside to a longer BDT is more interest paid over the life of the loan.

-

Revolving borrowing ability. The availability of short-term operating capital to help the operation get through times of tight seasonal cash flows. Having revolving lines of credit from a lender can avoid building payables with vendors and the high rate of interest that can come with vendor financing.

- Profit. The combination of milk price per cwt received, production per cow and expenses per cwt produced – efficiency and operating earnings. Hands down, this is the factor that can have the most influence on how much debt service an operation can handle.

A better way to evaluate debt repayment capacity

With the wide range in profit per cow and debt carrying capacity, I believe there is a better way to look at debt levels. It involves looking past the cow, to profitability. Since profitability has the most impact on the amount of debt a farm can service, it seems logical to use earnings as the foundation to evaluate a farm’s debt carrying capacity. It’s earnings that support debt repayment, not the number of cows or acres.

Measuring farm debt is pretty straightforward; not so with measuring profitability. A good way to look at earnings is earnings before interest, taxes, depreciation and amortization (EBITDA).

The key to evaluating debt carrying capacity is the relationship between the two measures: debt-to-EBITDA. A good recommendation for any farm is to stay below 4-1 debt-to-EBITDA to cash flow expenses and meet scheduled debt payments.

Conclusion

We are in a different economic situation in terms of milk price, net earnings and debt service capacity than we were just a couple of years ago. A prolonged period of reduced milk prices may not be sustainable with the current cost structure on many farms.

Focusing on maximizing earnings and lowering net cost of production needs to be a high priority to be able to service as much current debt as possible and achieve long-term viability. For those farms out of balance in terms of profitability and debt level, getting things righted is going to require making some tough decisions and adjusting capital spending plans accordingly. ![]()

Mark Mapstone is a CAC farm business consultant with the Farm Credit East. Email Mark Mapstone.

Key take-home points

- A business must be profitable enough to service the debt required to replace or reinvest in assets that wear out over time. A farm that can’t service its debt is essentially living off depreciation and will be out of business eventually.

- The current economic situation may require many farmers to rethink their current debt level target and future investment strategy.

- Every farm is different in terms of profitability, and therefore also in terms of debt repayment capacity and debt per cow. All producers should understand their operation’s break-even milk price, scheduled debt principal retirement and blended debt term.

- The best predictor of how much debt your farm can retire for the current year is your farm’s cash flow projection and capital spending plans. These should be monitored regularly by your management team.

- If you can’t service the debt you currently carry, work on operational profitability before you ask your lender to extend debt terms or go with interest–only payments. Get help from industry consultants to determine where there are management opportunities to improve your operation’s profitability.

- EBITDA-to-debt ratios are a good way to determine how much debt your farm can handle. Ask your loan officer or consultant to help you calculate EBITDA and earnings ratios.