Ever since the increasing popularity of non-dairy alternatives, dairy farmers have suffered from depressed prices and marginal profitability, causing considerable stress throughout the industry.

The situation became even worse earlier this year when the price of milk suddenly dipped to historically low levels due to supply chain disruptions caused by COVID-19 – only to rally in the past few months to new highs not seen since 2014, the industry’s last banner year.

Shelter-in-place orders across the country resulted in hundreds of thousands of closed restaurants, resulting in a massive milk oversupply which, in turn, led farmers to dump millions of gallons of fresh milk. And while milk prices seem to have (for now) recovered, there are concerns that when government subsidy programs end, the oversupply issue could re-emerge and again threaten the long-term sustainability of this essential industry.

Moreover, not all businesses in the dairy industry have been lucky enough to benefit from the recent rally in milk prices. The dip in dairy profits has had a particularly acute effect on farmers and distributors whose milk is intended for the restaurant industry. Even when restaurants reopened and the price for milk rebounded, the weakened supply chain made it difficult for customers to actually procure milk. Meanwhile, operations distributing through grocery stores and to cheese producers have been mostly insulated from these misfortunes.

The upshot of this discrepancy is: In a market as unstable as milk currently is, there is no telling what can happen. The recent volatility coursing through the dairy industry underscores the need for shrewd financial planning to ensure the continuing operability and profitability of one’s business. To that end, our advisory group has compiled its top three steps for businesses whose cash flows have been negatively affected by the turbulence in milk prices. We urge these businesses to take action immediately to preserve their financial health.

Get a real-time budget

Most businesses are accustomed to creating budgets on a yearly or quarterly basis – and usually that is enough. But when a business’s revenue is so heavily tied to the fluctuating price of a commodity, like milk, traditional budget planning may not be accurate enough to keep the business in good financial standing. For instance, if a dairy farmer’s budget planned expenditures under the assumption that milk would be fetching $18 per hundredweight (cwt), but the prevailing price is only $14 per cwt, that very well could lead to a dairy spending quite a bit more on feed, labor and other direct costs than it is bringing in.

Real-time budgeting aims to minimize the obstacles that result when a business’s costs or income deviate from what traditional budgeting assumed. And it is not only helpful for making sure you have enough cash to pay your bills; it can also allow businesses to take advantage of opportunities. Real-time budgeting can, for instance, identify situations where there is unexpected room in the budget to increase spending on, say, capital investments or some other strategic improvement.

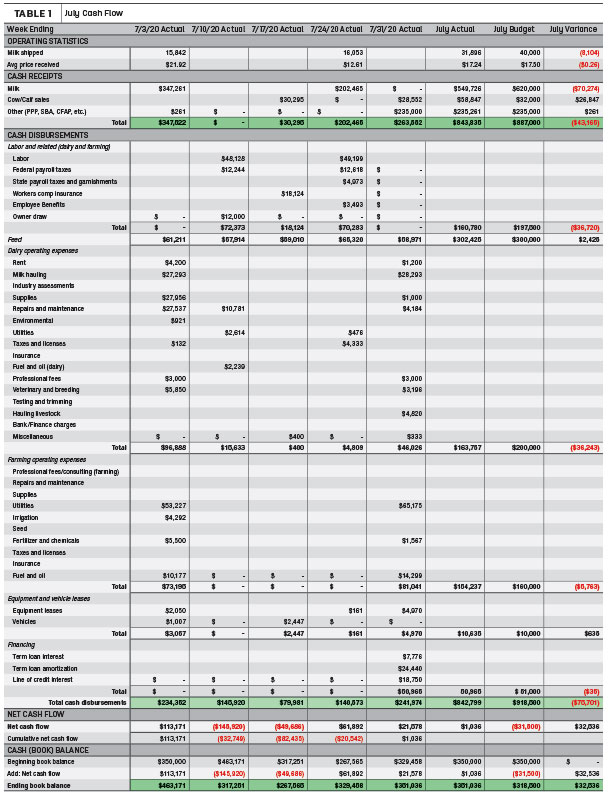

The basic unit of real-time budgeting is the 13-week cash flow outlook. This outlook can be represented relatively easily in an Excel (or other) spreadsheet. The precise fields will vary depending on the industry and the structure of the organization, but a typical cash flow forecast will include – at the very least – fields for cash receipts, cash disbursements, net cash flow and the cash, or “book,” value in the company’s bank account at the end of each week.

Typical sources of cash receipts for a dairy would be milk and cow sales. Cash disbursements, by comparison, are your dairy’s expenses. That includes everything from labor, and its associated federal and state taxes, to all kinds of operating expenses such as feed, irrigation, utilities, fuel, equipment repair and milk hauling. Interest on loans also falls under the category of cash disbursements.

It should be easy to populate these fields in your spreadsheet, as they correspond directly to all the revenue and expenses you are (hopefully) tracking in Quickbooks or in your other accounting software. On the basis of that historical data, you then extrapolate to create a “calendar” of how much – and equally important, when – cash will come in and go out over the next 13 weeks.

To be clear, cash flow forecasting is not synonymous with budgeting. Budgeting is the process of determining where to spend your money in order to accomplish some goal, whereas cash flow forecasting is concerned purely with determining how much money is coming in and going out. However, proper budgeting ultimately depends on the business’s cash flow. That’s why the two most important fields in any 13-week cash flow outlook are “net cash flow,” which tells you if your business is gaining or losing money, and the bank book value, which corresponds to how much money you have in the bank to pay your bills right now. If you find either of those numbers to be unfavorable, then you know you need to adjust your budget. In this way, a dairy’s budget should always follow from its cash flow forecast.

In order to be useful from a real-time budgeting perspective, the 13-week cash flow outlook must be updated on a rolling basis. That means monitoring your business’s performance and comparing it to your budget on a weekly basis. (See example of this for a dairy business in Table 1.)

Click here or on the image above to view it at full size in a new window.

Any variances should be identified and accounted for. As you create new cash flow forecasts, you will find that they start to overlap. Indeed, this is part of what makes them so useful as a planning tool: The variances between your current forecast and a forecast from, say, six weeks ago can tell you not only in which areas you need to improve your forecasting methodology but also which parts of the business need to improve their performance.

In this way, a continually refreshed cash flow forecast arms business owners with a reliable indication of how much cash they will have to work with at a given time, which is the most critical point of data for determining how you will budget your expenses. To be sure, real-time budgeting is not a replacement for quarterly budgeting. You still need a long-term plan for where you would like your business to be one year or one quarter from now, and a budget is essential to that planning. And while certain kinds of software can definitely speed up the process, real-time budgeting definitely requires extra work. But that extra work can pay off massively in the form of not finding your business overextended, avoiding putting your business in a bad place with creditors or vendors and being able to take advantage of the opportunities available to your business.

Sell assets, if necessary

When there is a gap between how much the farmer is bringing in and how much they are spending, the difference has to come from somewhere. Dairy farmers (and other businesses along the dairy supply chain) negatively affected by today’s milk market have a lot of decisions to make. They can try to cut costs. For instance, farmers could adjust the feed they give to their cows. Of course, lower-quality feed means less milk production – which means less money coming in. Indeed, many cost-cutting measures can have these kinds of downstream effects.

The other option is finding a way to bring in more money – and in a tough milk market, that may very well entail selling assets. Unfortunately, business owners typically tend to be averse to selling assets, and dairy farmers are no different. Psychologically, no one wants to see the size of business shrink. But there can be tremendous power in selling off assets. A business is a dynamic entity; most will grow and shrink many times throughout their life cycle, whether the business owner likes it or not. A savvy business owner knows it can be advantageous to scale down, especially if the only other option is bleeding cash, and then scale back up again when conditions are better.

It is understandable to not want to lose all that work you put into growing your business. But ultimately, it may be your best bet. Plus, if you truly commit to real-time budgeting, you can be sure you will have the chance to take up all the future opportunities to grow your business that come your way.

Communicate with lenders and vendors

There is a tendency among business owners to try to hide their business’s distressed condition and just hope it will all work itself out. This is the exact opposite approach business owners who are seeing budget shortfalls should take. The sooner you communicate your status to banks and vendors to whom you owe money, the better chance you will have to work out a payment plan acceptable to all parties. Cluing in these parties early and with transparency establishes a stronger sense of trust and may even encourage them to take a more flexible approach to your situation.

Communicating with banks in particular is essential if your business hopes to negotiate new credit lines in the future. Typically, banks will want to see proof that your distressed business is still capable of servicing its debt. To do that, they often require distressed businesses to bring in a trusted, third-party expert to ensure forecast accuracy and credibility. In most cases, these corporate finance experts will help you put together a feasible plan that preserves your business while appeasing the bank’s desire to see its money and interest.