I have been listening to all the discussions about the need for dairy producers to “market for a margin.” This approach to risk management was born out of the pain of 2009 and the desire to find some way to lock in a reasonable margin in the midst of volatile commodity markets. While I understand the approach and why it has become a rallying cry, I believe that it sells producers short in the opportunity department. I believe our dairy producers are better than that. Or at least they deserve to hear the argument for how they could be better than that. I’m here to suggest that, in order to achieve continuing success under today’s financial pressures, a necessary mindset shift is in order: stop thinking about “marketing for a margin” and start thinking about “maximizing opportunity.”

What’s the appeal?

I understand the appeal of the “marketing for a margin” approach:

• The idea is simple. You watch milk prices. You watch feed prices. When the spread between is an attractive enough margin, you buy your feed and sell your milk. You have established a margin and it’s done. You can move on to other management challenges.

• It’s predictable. You and your lender understand your financial position for the foreseeable future and can make other plans using your predicted margin in the calculations.

• It provides emotional security. After the experiences of 2009, who would not want some sort of guarantee that your operation will make a targeted margin?

My experience, and indeed the charts from the last couple of years, paint a very different picture. Let’s look at four figures that depict the impact of marketing for a margin.

In all of these figures, the corn price has been used as a benchmark for all feed prices so as to not clutter the charts with too much information. The assumption is that if the price of corn is going up sharply, so too are the prices of all other feeds and vice versa.

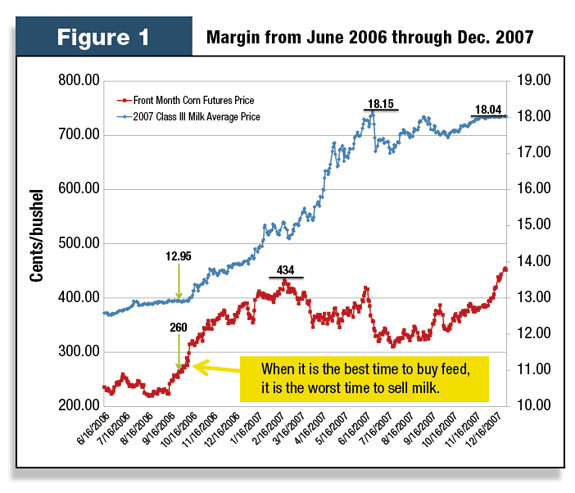

Figure 1 shows the front month corn futures price and the 2007 average Class III Milk futures price from June 2006 through the end of 2007.

Now suppose that in August per September of 2006, a dairy producer was monitoring his margin, and, with corn at $2.60 and milk at $12.95, the market was offering him a good margin. (These target prices are denoted by green arrows on Figure 1.)

So he bought all of his 2007 corn feed needs at $2.60 and sold all of his 2007 milk at $12.95. In the end, the feed purchase looked good as corn went to $4.50 per bushel, but the milk was sold $5 per hundredweight (cwt) below the market high.

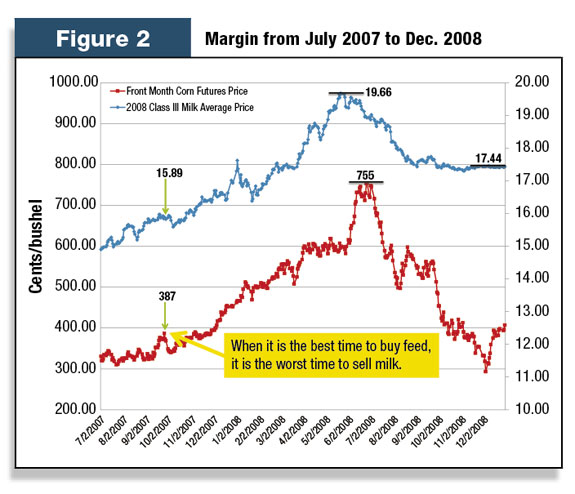

Figure 2 from 2007-2008 shows that locking in an average 2008 milk price of $15.89 at the same time as locking in a favorable corn feed price of $3.87 would have put you almost $4 per cwt under the bull market rally.

Furthermore, if you had believed milk prices would rally and had waited to lock in your milk per feed margin, you would have paid for expensive corn while reaping the higher milk price.

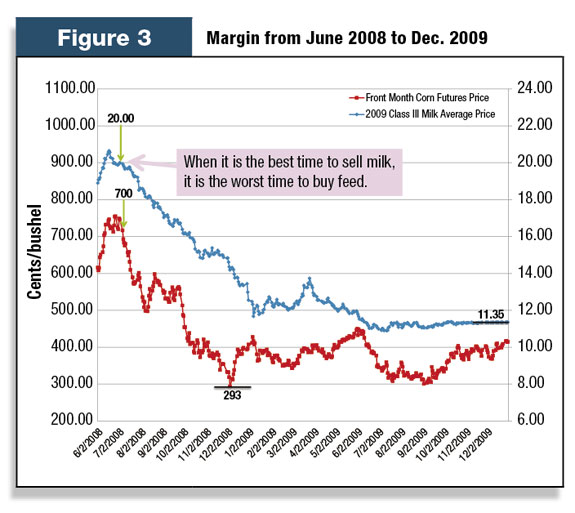

Another example is Figure 3 , a bear market from 2008-2009. Suppose in June ’08 a dairy producer was monitoring his margin and, with corn at $7 per bushel and milk at $20 per cwt, there was a good margin.

So he bought all of his 2009 corn feed needs at $7 per bushel and sold all of his 2009 milk at $20 per cwt.

By July 2009, the sold milk looked good, with the market only offering $10.90 per cwt, but corn at $3.50 per bushel was trading at half of its prior value.

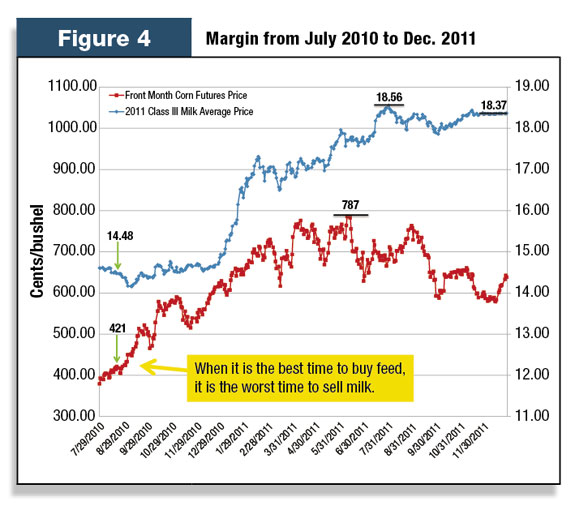

A final example is Figure 4 , which displays the price action of the 2011 Class III average milk futures price and the front month corn futures price from July 2010 through December 2011.

Any margin locked in by buying corn at $4.21 per bushel and selling milk at $14.48 per cwt resulted in the same outcome as in 2007 and 2008. The corn bought was immune from a $3.50 per bushel price increase, but the milk sold ended up $4 per cwt below the market high.

So, as you can see from the figures, when a margin is locked in, even if it is perceived as a good one, further opportunity is never discovered. The marketer has attempted to protect a margin, however, the figures demonstrate how the best time to sell milk is not always the most opportune time to buy feed.

So what is the alternative? Decisions do need to be made about both milk and feed; however, the key to maximizing opportunity is to understand the correlation and then treat decision-making about milk and feed independent of one another.

We let each of the markets tell us when to buy and sell. We can use the milk-feed correlation to our advantage and use the marketing tools at our disposal to maximize a margin.

For example, when feed prices signal they are on the way up, the amount of milk we sell should be minimal, because we expect milk prices to rally too. And when feed prices signal they are on the way down, the amount of milk we sell should be at a maximum, for a longer period out, because we expect milk prices will also sell off.

This incremental decision-making takes vigilance, consistency and, yes, work. Unfortunately, there are no quick and easy solutions when it comes to managing complex markets.

Is it worth the work?

The business truth of all this is that marketing on a margin is “risk management” while setting aside the “opportunity management.” In the long run, some very good producers who do not maximize opportunity will fall to the lower ranks on the profitability scale. That’s because as the Opportunity Managers maximize and reinvest, the Margin Managers will be “getting by.”

Then, when something big like a weather event or a herd health issue or an economic crisis strikes, the Opportunity Managers will be in the position to weather the storm, while the Margin Managers will have no reserves.

This is what the world’s top-managed businesses see when they engage in risk and opportunity management. They see their work in this area as a competitive advantage because not only are they safeguarding against risks – they are also deliberately making the incremental decisions that maximize opportunity.

If the CEOs of the world’s Fortune 500 businesses think this way (including those who buy dairy products), dairy producers can as well. Why should dairy producers be among the last businesses to maximize market opportunity?

If you want to learn more about what I mean by this, look up the “2011 Global Risk Management Study: A Source of Competitive Advantage and High Performance” by the highly regarded consulting firm Accenture.

I hope I’ve given you something to think about and that the figures in this article help tell the story. I welcome your feedback. As always, I’m thinking about ways to help dairy producers go from “good to great,” and I firmly believe that a “maximizing” strategy is a way good dairy operations can become great. PD

Scott Stewart is president and CEO of Stewart-Peterson Inc. Futures trading involves the risk of loss and should be carefully considered before investing. Past performance may not be indicative of future results.

Scott Stewart

CEO/President

Stewart-Peterson Group Inc.

scotts@stewart-peterson.com