hey say hindsight is 20/20, but the year 2020 contained anything but hindsight. Blindsided by what we now know as COVID-19, governments were forced to intervene in the form of financial and medical assistance.

Government programs had a large impact on the financials of dairy farms across the Midwest. The industry saw large swings in prices created by the pandemic’s impact on demand for dairy products and the shutdown of the U.S. economy.

The USDA, in its efforts to offset the financial impact of COVID-19, provided dairy producers with $1.8 billion in first-round Coronavirus Food Assistance Program payments (CFAP1) and $1.2 billion in second-round payments (CFAP2). As a percentage of the $23.5 billion in CFAP1 and CFAP2 payments distributed during 2020, dairy farmers received nearly 13% of the total. In addition, the Small Business Administration (SBA) rolled out the Paycheck Protection Program (PPP) loan program to assist all businesses, including agricultural businesses, with forgivable loans to keep employees on the payroll during these unprecedented times.

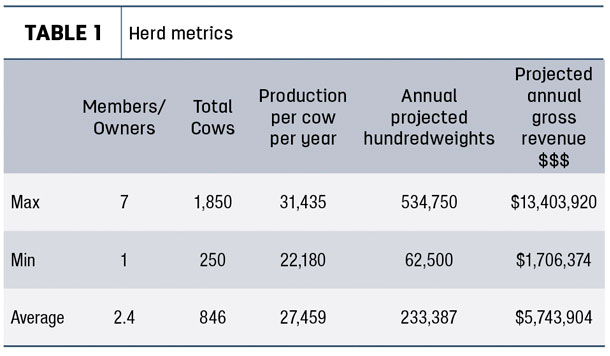

In this article, we will review the impact of government programs, including CFAP1, CFAP2 and PPP, on the financials of a subset of our Midwest dairy clients (Table 1), the vast majority of whom reside in Federal Milk Marketing Order (FMMO) 30.

The tables will report the data as averages, maximums and minimums to illustrate the economic impact and sustainability these programs had on our industry in 2020.

Key to maximizing payments in the 2020 USDA programs were the number of owners per business entity, as the programs capped at $250,000 per owner and a total of $750,000 per business entity. This was a big departure from previous USDA ag subsidy rules. This new rule caused many producers to rethink their business structures. Herd sizes ranged from 250 to 1,850 cows, with an average of 846.

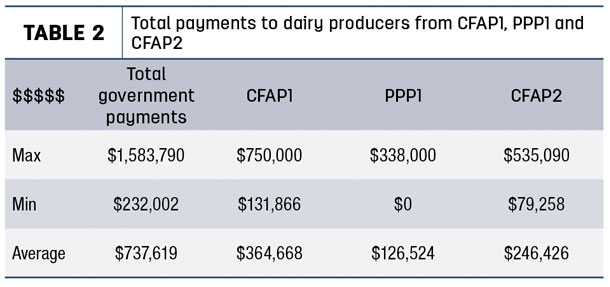

Some dairies in our client base did cap at $750,000 in the CFAP1 distribution portion, but not in other forms of government payments. On average, our clients received $737,619 per operation, with a range of $232,002 to $1,583,790 from COVID-19-related government payments (Table 2).

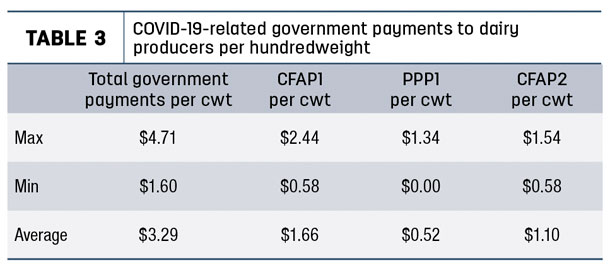

On average, dairies received $3.29 per hundredweight (cwt) in total government payments in 2020 (Table 3).

Most of these payments came via CFAP due to milk price deterioration, with the remaining balance coming from crop and beef price erosion payments in CFAP. The PPP added an average of 52 cents per hundredweight.

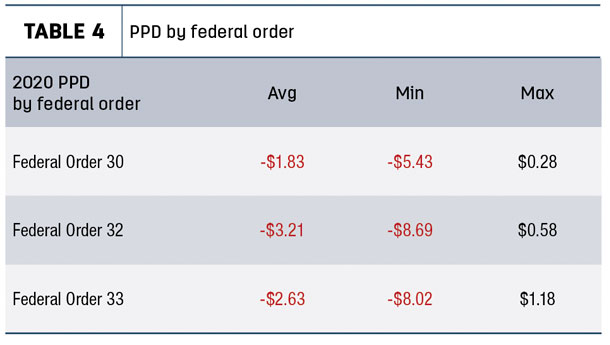

However, we did not see budgeted breakeven prices drop by the equivalent amount of government payment gain of $3.29 per cwt. This was due to the large negative PPDs experienced from supply chain disruptions and the disparate recovery in the Class III price as compared to Class IV. In 2020, monthly Federal Order 30 PPDs ranged from +$0.28 to -$5.43 per cwt. Other Midwest orders (32 and 33 in our database) experienced even larger swings (greater than $9 per cwt) as shown in Table 4.

In 2020, Federal Order 30 lost approximately $1.80 per cwt in PPD revenues compared to 2019. It is estimated that negative PPDs accounted for FMMO shortfalls of more than $2 billion in 2020.

We also saw huge variation across milk procurers as to how order PPDs were passed onto producers, even while many plants chose to depool milk, avoiding these huge negative assessments to their bottom lines. Needless to say, after 2020, many dairy producers have become frustrated with market order pricing inconsistencies both across and within orders.

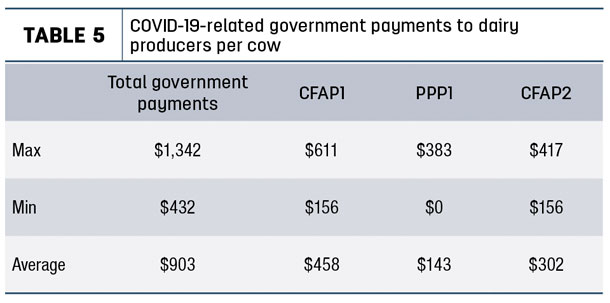

Per cow, dairies received revenues of $903 on average, with a range of $432 to $1,342 per cow (Table 5).

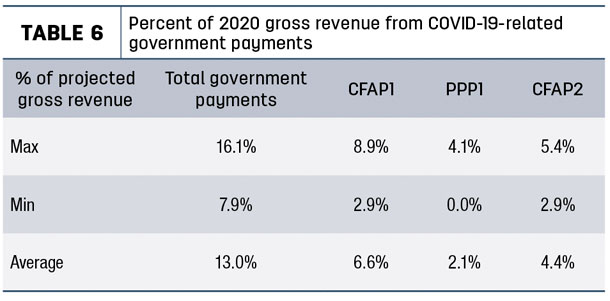

On average, 13% of 2020 gross revenues came from COVID-19-related government payments, with CFAP1 contributing the largest portion of the payments (Table 6).

Beyond direct payments, government food purchase/distribution programs helped support prices in the Class III markets but also created disparity with other classes of dairy products, which led to the negative PPDs. The Class III average price for 2020 closed at $18.16 per cwt, which was an increase of more than $1 per cwt from December 2019 Class III futures.

In addition to these payments, the Dairy Margin Coverage (DMC) program supplemented millions of dollars to dairy producers in 2020, but to a much lesser degree (average of 17 cents per cwt) than the direct payment programs. This was due to its annual limit of 5 million pounds of milk using seven-year-old production bases at the base Tier 1 participation. Part of the proposed CFAP3 program for 2021 includes supplementing DMC to raise a dairy farm’s production history to the maximum of 75% of 2019’s milk production or 5 million pounds of milk. Other government-subsidized market risk management programs like LGM and DRP also impacted bottom lines to varying degrees in 2020.

The bottom line

With the positive impacts of government payments, lower fuel costs, lower current debt and lower interest rates, the net average gain to breakeven price for our clients averaged $3.01 per cwt. That number would have been closer to $4.80 per cwt (for FMMO 30) had PPDs remained unchanged. With a $3-per-cwt gain on breakeven price and a $1-per-cwt Class III price increase, many of our Midwest dairies saw a $4-per-cwt higher profit margin in 2020 as compared to their original budgets. That government-aided margin assistance will be hard to replace as we move into 2021 economic models.

2021 crystal ball

As we write this article, planning is in the works for a CFAP3 program along with a second iteration of PPP. The details are still being worked out and will be impacted by the new administration. In addition to supplementing the DMC program as noted above, the proposed CFAP3 package includes another round of the Farmers to Families Food Box program ($1.5 billion), which will include a wider mix of dairy products than its previous version.

The $4-per-cwt government-aided income in 2020 will be hard to replicate in 2021 with concerns over higher feed costs (+$1 per cwt) along with uncertainty in the supply chain. On the positive side of the ledger, we anticipate lower interest rates, at least short term, lower line of credit balances and lower energy costs, especially for those who took advantage of fuel contracts earlier in 2020. In addition, many dairy producers were able to prepay some expenses at the end of 2020, which will improve 2021 cash flow.

Finally, it goes without saying that, after a year like 2020, risk management will continue to be part of a long-term strategy for our dairies.

Tim Hardyman and Steve Maier also work with Agri-Business Consultants LLC.

-

Rod Wautlet

- Business Consultant

- Agri-Business Consultants LLC

- Email Rod Wautlet