If you watched the men’s or women’s NCAA basketball tournaments, you witnessed extreme strategy at work. Coaches game-planned to attack opposing defenses and put points on the board while shutting down the other team.

Imagine if coaches only planned for how to stop their opponents’ best player. It would be like managing your milk price risk and not paying enough attention to feed and fuel inputs. Unmanaged risks could come back to bite you.

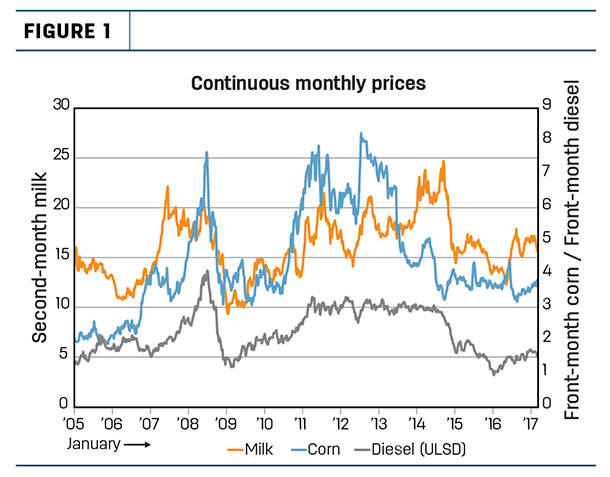

Winning at marketing is about taking a holistic approach to managing risks – income and costs. Strive to flatten out market price extremes and build a strong average price over time (Figure 1).

Importantly, avoid managing to the margin. Instead, manage these commodities independently to maximize opportunities presented by each market.

Basic tenets of great marketing

Start with the right mindset: consistency over time.

One of the primary reasons many dairy producers say active price management doesn’t work is due to marketing inconsistency. When milk prices are trending up, producers may begin to gradually doubt the need for marketing. The more bullish the news, and the more prolonged the bull market, the more second-guessing.

Just about the time they abandon marketing, the market reverses course. With no strategies in place for a declining market, their average price suffers.

Managing your feed

A common myth is to expect lower grain prices – and lower feed costs – the year after a record crop yield. The opposite is often true. After a record year like 2016, history shows corn and soybean prices are likely to rally. It’s a simple matter of supply and demand:

- A record yield is not usually followed by another record yield. That’s been true for 77 percent of the time from 1970 to 2016. If corn prices have rallied and corn yields have decreased, generally speaking, this means supply decreases the year after a record year.

- Lower prices in a record-yield year lead to greater demand in that year and building into the next year, resulting in higher prices off lower supply.

Feed and milk prices generally move in the same direction. If the milk price is rising, chances are the cost of feed is going up as well. For these reasons – and because you never know what the market will do – it’s important to consistently manage the price you pay for feed.

Managing your milk

The milk market follows a typical cycle of overproduction followed by significant underproduction. There’s really no middle ground of balanced production in line with demand. This contributes to price volatility.

Currently, the major fundamental force plaguing dairy markets is U.S. milk production. Adjusted for leap year, January-February 2017 U.S. milk production is up about 2.5 percent compared to the same period last year.

In terms of demand, if growth in domestic consumption continues trending similar to 2016, and the recovery in exports continues, we might see a significant recovery in the milk price later this year.

When prices turn, you will want to capture as much of that price appreciation as possible. Since there are no signs announcing a change in price direction, the best way to capture favorable prices is to have strategies in place now.

Managing your fuel

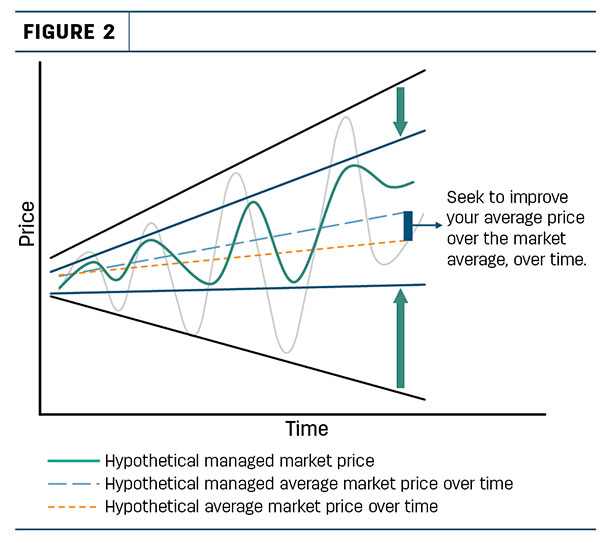

The cost of fuel tends to move in the same direction as milk and feed. If you’re receiving a higher price for your milk, you’re likely paying a higher price for feed and fuel (Figure 2).

How much of a component should fuel hedging be in your overall input strategy? Most dairy farmers use only one-quarter to one-half of a fuel futures contract (42,000 gallons), making it difficult to implement a fuel hedging strategy.

In these cases, we advise locking in prices with your supplier or topping off your fuel storage when prices are attractive.

If your operation’s size and fuel use warrant it, you can also manage price risk by cross-hedging. Unlike milk and feed, there are no exchange-traded futures contracts specifically designed for diesel and propane. Instead, ultra-low sulfur diesel futures can be used (a cross-hedge) to help manage price.

Regardless of how you manage fuel price risk, it’s important to include fuel in your overall planning.

Learn to use marketing tools

Once you commit to consistent and strategic planning for selling and purchasing commodities, options become a powerful marketing tool. Learn these tools and how they work.

A common misconception is that options are a waste of money. It’s important to remember the insurance analogy: A house insured against fire may never burn. This doesn’t make the insurance any less valuable or unnecessary. There’s also the crucial question of how much protection to purchase. As with insurance, you can spend too much – or too little.

Just as you set aside dollars for production costs, consider marketing tools as an important business expense. In this case, the expense is toward the goal of a high average price for all milk sold and a low average price for inputs purchased.

Recognize what it means to be strategic

Knowing that markets usually provide limited opportunities, how do you capture opportunity before it slips away? More than anything else, effective marketing is the result of making choices and developing strategies before the market moves. Using tools to protect prices without giving up opportunity adds to the effectiveness.

A key factor driving strategy is math. Good marketers prepare for price volatility by running numbers to look at potential price outcomes. You can use a combination of current market fundamentals and historical prices to begin creating a picture of future price potential.

For instance, a look at soybean prices dating back to 1970 reveals the average soybean price rally in the year after a record-yielding crop is 60 percent. You can use this kind of information to paint a picture of future price potential to make strategy decisions.

When developing strategies, adopt “what-if” thinking. What if soy meal rallied to $380 or $400 per ton – or declined to $300 or $280 per ton? With possible scenarios in mind, develop strategies with the goal of building the best possible average price over time.

Being strategic not only helps you manage risk, it also can strengthen relationships with lenders and other advisers with whom you work.

Involve your lender and other advisers

Risk management is best done with the operation’s overall financial management in mind. That’s where your lender and other financial advisers can play a role.

Are you able to show your financial advisers how you will be affected if the market goes up or down? Are you able to calculate your average price for milk sold and input purchased? In surveys we’ve conducted, agricultural lenders said their farmer clients with a good grasp of risk management perform better financially and make better management decisions than farmers who lack skills in this area.

If managing risk for milk, feed and fuel sounds like a lot of planning, it is. But like the coach trying to win an NCAA championship, planning for all variables eliminates surprises and improves your chances of success. ![]()

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.

-

Patrick Patton

- President

- Stewart-Peterson

- Email Patrick Patton