The California Department of Food and Agriculture (CDFA) has announced they will be holding a hearing on June 30/July 1 to consider changes to the minimum price formulas for Class 4a (butter/nfdm) and Class 4b (cheese/whey) milk. In this article, we’ll focus on the changes being proposed to the Class 4b formula, with specific attention paid to the way our Class 4b formula accounts for the value of the whey stream generated as part of the cheese-making process.

Background

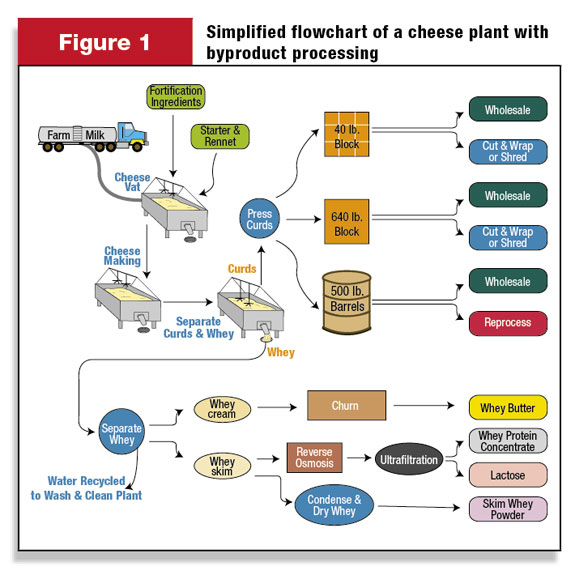

In order to fully comprehend the California minimum price formula for milk sold to cheese plants, we need a basic understanding of how the milk is utilized by these plants. To assist in that, CDFA has created a “Simplified Flowchart of a Cheese Plant with By-Product Processing.”

While each cheese plant is unique, this flowchart captures the basic utilization of raw milk by a plant processing cheese and whey products.

As you can see on the flowchart, during the course of the cheese-making process, the curds and whey are separated, with the curds further processed into the different varieties of cheese. The whey stream is also available to be further processed, with the whey cream able to be skimmed from the whey stream and churned into whey butter.

The flowchart shows that cheese plants can also take the whey skim and further process it into products like whey protein concentrate, lactose or skim whey powder (often referred to as “dry whey”).

In past CDFA hearings, testimony from the state’s cheese-makers pointed out that not every plant has the infrastructure to process their whey stream. In 2008, CDFA released data on this issue, showing that while only 14 of the 61 plants operating in California at that time processed their whey stream, those 14 plants represented almost 90 percent of the volume of milk being purchased by our cheese plants.

So it’s fair to say that while some of the smaller cheese plants in the state (many of whom are likely making a specialty cheese that receives a premium over cheddar cheese in the market) are not processing their whey stream, a vast majority of our milk sold to cheese plants is being processed into various whey products.

So why is this important?

The reason we need to understand how milk is used by processors is because in California (as well as in Federal Order areas), we’ve chosen to set our minimum milk prices using an “end-product pricing system.”

That means in order to determine the minimum prices producers must be paid for their milk, we start with the value of the dairy products being made (butter, nfdm, cheese and dry whey) and work backwards.

A little history

Prior to 2003, the California Class 4b formula did not account for the value of dry whey when calculating the minimum price paid by cheese plants. But starting in April 2003, the Class 4b formula was amended to include a “dry whey factor.”

That original formula to determine the dry whey factor was:

Dry Whey Factor = (Dairy Market News’ “Western” Dry Whey Price MINUS a “Make Allowance” of $0.17 per lb.) TIMES a “Yield” of 5.8 (The “yield” of 5.8 accounts for the fact that CDFA estimated that 5.8 lbs of dry whey could be manufactured from 100 lbs of standardized raw milk.)

From 2003 until 2007, that formula was amended by CDFA twice through their hearing process, with both amendments resulting in a higher make allowance for dry whey (first it was increased to $0.20 per lb in 2005, then again increased to $0.267 per lb in 2006).

In 2007, after dry whey values that spring/summer had shot up above $0.80 per lb (which added more than $3 per hundredweight to the Class 4b minimum price during those months), CDFA held another hearing and decided to remove the formula used to calculate the “Dry Whey Factor,” and instead assigned a constant value of $0.25 per hundredweight (cwt) as the “Dry Whey Factor.”

That’s what has been in place since December 2007.

At the same time, the Federal Orders have maintained a variable “Dry Whey Factor” using a formula similar to the California formula referenced above:

Other Solids Price = (NASS Dry whey price MINUS a “Make Allowance” of $0.1991 per lb) TIMES a moisture adjustment of 1.03 TIMES a “Yield” of 5.9

One of the most notable differences between this Federal Order dry whey factor and the pre-2007 formula used in California is the substantial difference in Make Allowances (the Federal Order make allowance from 2003 – present has ranged from $0.159 to $0.1991 per lb, while the California make allowance ranged from $0.17 to $0.267 per lb).

This is an issue that warrants a larger article by itself, so I won’t go into those points right now.

The main point being focused on now is that for the past 42 months, California’s “dry whey factor” has been a constant $0.25 per cwt, while the Federal Order “dry whey factor” has ranged from ($0.26) to $1.79 per cwt (that’s right … when the price of dry whey is below the make allowance level, the Federal Order formula – as well as the pre-2007 California formula – has a negative dry whey factor).

With dry whey values escalating in recent months above $0.50 per lb, the gap between the California dry whey factor and the Federal Order dry whey factor is at its highest point in recent years – a difference of $1.54 per cwt in May 2011.

This difference between how California dairy families and their counterparts in Federal Order areas are paid for the value of the whey stream creates two major problems. For starters, the state is currently out of compliance with the California Food and Agricultural Code, which specifically states that: “… formulas shall be reasonably calculated to result in prices that are in a reasonable and sound economic relationship with the national value of manufactured milk products.”

It’s difficult to comprehend how California can be in a “reasonable and sound economic relationship” with the national value of manufactured milk products when it has a Class 4b formula that has a dry whey factor ranging from $0.51 higher to $1.54 lower than a comparable pricing formula used throughout most of the country.

Secondly, and of equal importance, is the difficulty this difference creates in participating in risk management strategies. The risk management tools available for milk sold to cheese plants use the Federal Order Class III minimum price to settle on.

But as you can see, the California Class 4b formula doesn’t track well with the Federal Order Class III price, particularly in recent years, largely due to the differences in how the whey stream is valued.

For example, in the 42 months since California went to a flat $0.25 per cwt dry whey factor, the average difference between the Federal Order Class III price and the California Class 4b price has been $0.85 per cwt (that is, the Class III price has been $0.85 higher than the Class 4b price).

If that were the case month-in-month-out, you could adjust your risk management strategy to account for that. But the reality has been that the California 4b price has ranged from $0.80 per cwt higher (February 2009) than the Federal Order Class III price all the way to $2.64 per cwt lower (March 2011).

Milk Producers Council and other producer organizations have proposed alternatives to CDFA aimed at narrowing the gap between the California and Federal Order dry whey factors. While those alternatives have been rejected by CDFA in the past, this upcoming hearing presents another opportunity to make the case to CDFA.

The upcoming CDFA hearing on June 30/July 1

Land O’Lakes has put together a proposal for the upcoming hearing that attempts to address this huge gap between the California and Federal Order dry whey valuations. So stay tuned … PD

References omitted due to space but are available upon request to editor@progressivedairy.com .

—Excerpts from Milk Producers Council Friday Market Update newsletter

-

Rob Vandenheuvel

- Milk Producers Council

- Email Rob Vandenheuvel