Any one of these close or far-flung family members could be an owner of your business: Cousin Earl, 88, who inherited 15 shares from Uncle Don. Your sister, who lives and works in Denver with her insurance salesman husband.

Nephew Tyler, who is in Costa Rica fulfilling his first year of Peace Corps commitment. But none of them manage the dairy you own – the business you live, sleep, eat and breathe.

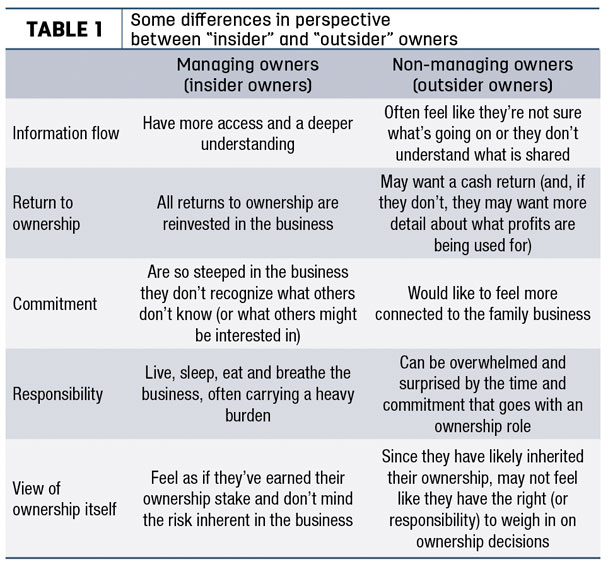

Having non-managing owners (stockholders, shareholders, minority or majority owners) who don’t work in the business creates an additional layer of complexity within your family business. This complexity emerges from a natural difference in perspective between non-managing owners – who often feel like family business “outsiders” – and managing owners, who are really family business “insiders.”

The main advantage of non-managing owners is the friendly capital they provide. Not having to purchase that portion of the business (whether it’s from a retiring parent or a sibling that’s employed elsewhere) provides additional growth capital to a business.

And, if expectations are clearly communicated, non-managing owners can also provide a source of energy and a link to the family and business history. Engaged, satisfied non-managing owners are a tangible way the business is providing some of the glue that allows the family to stick together.

At the same time, challenges presented by the presence of non-managing owners are significant. The natural difference in perspective among insider and outsider owners often sneaks up on family businesses. For instance, you may have had a few very contented non-managing owners – they were happy with whatever information insiders passed along and didn’t ask for any monetary return.

Beware of this situation. There is a high likelihood outsider owners’ view of the world will change. Perhaps their children are asking them about the family business. Maybe they want to retire and wonder if their stock has any monetary value after all. Perhaps they are doing estate planning and are trying to decide what to do with this ownership stake in the family business.

Whatever the prompt, nearly all non-managing owners step back at some point and begin to wonder, “What does my family business ownership mean, anyway?” At which point, they begin asking sometimes difficult and challenging questions.

Here are some fundamental differences in perspective among non-managing and managing owners (see Table 1).

Eventually, these differences in perspective among family business owners will come to light. In the absence of respectful relationships and clear decision-making structures among owners, situations get ugly.

Sometimes, the issues simmer for a while, and you end up with a kind of passive-aggressive friction where the different owners resent each other for different reasons. Insiders are annoyed by the extra work and pressure they feel from outsiders.

Sometimes, the issues simmer for a while, and you end up with a kind of passive-aggressive friction where the different owners resent each other for different reasons. Insiders are annoyed by the extra work and pressure they feel from outsiders.

Meanwhile, outsiders are frustrated because insiders seem to have all the knowledge and power. Plus, it sure looks like they’re getting a lot of perks for working in the business.

So, to summarize, if you have both managing and non-managing owners, some difference in perspective is inevitable. Whether these distinctive perspectives turn into damaging conflict depends on two things: relationships and structure.

Building the relationships (and knowledge base) of family business owners is best started very early – as early as children’s elementary years.

Building the relationships of adult family business owners in the face of conflict takes a lot of energy. Because managing owners have more power and authority (by virtue of their position within the business), they bear a deeper responsibility for opening the lines of communication and allowing less powerful (non-managing owners’) voices to be heard.

I don’t meet a lot of managing owners who recognize their own power within the business. It does exist. Being deliberate about wielding this power for the good of the family is the essence of leadership.

Also note, if non-managing owners have been kept in the dark, historically, then they lack the knowledge necessary to make meaningful contributions as owners. In addition, if the only folks in the room who have that knowledge are the managing owners, then the outsiders are dependent on the insiders for their knowledge growth. This dependency is unhealthy and makes it very difficult to build trust.

When you combine inherent difference in perspectives that have fueled mistrust, a big power imbalance and inexperienced owners, you have a situation that takes a lot of time and energy to work your way through.

So, now to the structure. To get started, make time to meet and begin the needed conversations. The attendees should be the family business owners – all of them. Meetings should follow best practices – include ground rules and have an agenda.

If any of the owners are holding on to bitterness or anger, I strongly recommend using a facilitator to support at least your initial two to three meetings.How to fuel an ‘ownership attitude’

If you choose to hold the meetings yourself, someone should play the role of facilitator. That role is tough. You have to be able to manage the meeting process – ensuring everyone has a chance to speak, monitoring the agenda and watching the time – and, at the same time, as a family owner yourself, you should also contribute your opinions and content to the meeting.

Early on, your meetings should be a combination of relationship building and education. After the family owner group grows trust and learns about their ownership role, you can add decision-making to the agenda. The family owner group should meet one to four times annually, then they can move to “maintenance mode.”

Fueling an “ownership attitude” when your family business includes non-managing owners takes time, patience and energy. It requires managing owners to respect outside owners’ differing perspective. Starting early in owners’ lives makes this job much easier.

This work, while challenging, can help family businesses reap the rewards of a cohesive ownership team: access to family capital and connection with the family legacy. ![]()

Barb Dartt has 16 years of experience supporting folks in business with family.

-

Barb Dartt

- Consultant

- The Family Business Consulting Group

- Email Barb Dartt