The road to better marketing continues for Dave Geiser and Deb Reinhart of Gold Star Farms. After choosing a marketing consultant in November 2009, Dave and Deb began their journey. The destination: Better control of their business through better marketing. Travel log entry: January 2010 “We are in an uncomfortable place right now, so we are procrastinating. We’re hands-on doers, and being unsure makes us not want to act at all. We are in uncharted territory…”

When we last left Deb and Dave , they were just beginning regular conversations with their new marketing adviser, Matt Mattke of Stewart-Peterson . Matt’s initial focus has been helping Deb and Dave become more familiar with typical terms, tools and strategies used in pricing feed and milk. Deb and Dave’s initial focus has been to educate themselves, as well as communicate the farm’s needs and preferences to Matt so that he can customize recommendations.

For Deb, who likes to gather information and thoroughly understand before making decisions, the knowledge mountain has seemed impossible to climb.

“I feel like I don’t have all the tools yet to make good decisions,” Deb said in mid-January.

As a result, much of January was spent poring over information from their adviser, with both sides asking questions. Collectively, they wanted to arrive at a set of marketing strategies that would position the farm for whatever the markets dish out in the coming year.

“We are learning with Matt’s help to understand how to view milk prices on the futures market,” says Deb, the farm’s business manager. “We did a 2010 budget, and we did not plan on a pay price as high as I had hoped. To help the budget, we adjusted feed costs down from 2009 levels, since we could procure less-expensive feed.”

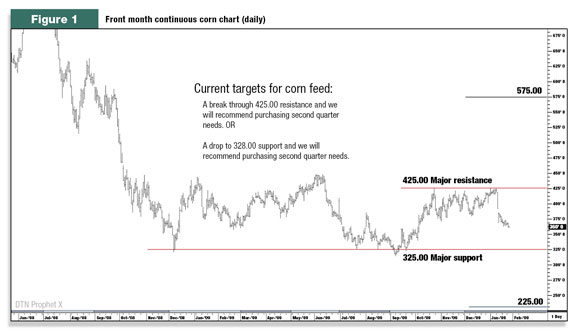

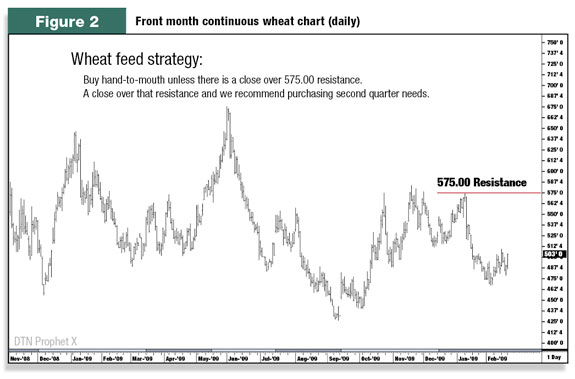

The team quickly went to work on feed-buying strategies. Dave projected first quarter feed needs; Matt presented several target prices that represent good values for purchases of corn, wheat and soybean meal.

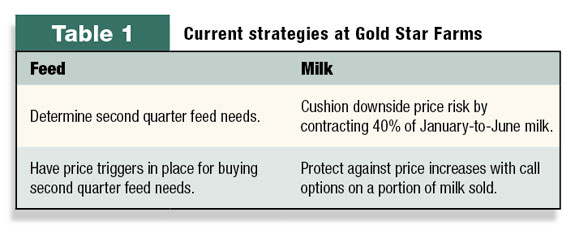

Dave explains, “We put together a scenario with trigger points that will tell us to make a purchase. Matt keeps us informed as prices approach the trigger point. We know exactly what we’re going to do when the trigger hits. So now we wait.” (See Table 1 and Figures 1 and 2 .)

The planning will help Deb and Dave better predict their feed costs and eliminate what Dave calls “that blind side.” Although the feed isn’t purchased yet, Dave thinks having the strategies in place will help them make better decisions.

“We’ve thought about it and now we’re ready to move when it happens,” he says.

Adviser’s turn

Adviser Matt has continued to send information to Deb and Dave that will help them get comfortable with their marketing knowledge level. Matt is encouraging Deb and Dave to:

• Learn about all of the hedging tools available.

• Learn how each tool works.

• Understand the capital requirements to establish and hold a position with these tools.

• Learn under what market condition to use any given tool.

“All the technical and fundamental analysis capabilities in the world are useless if a producer does not understand how hedging tools work and how to implement them,” he says.

And while the team waits for feed purchase triggers to be hit, Matt provided possible milk price scenarios and how various price levels could impact the operation.

“Long-term, we continue to believe that dairy market fundamentals are going to improve further into 2010. Cow numbers and milk production continue to fall,” Matt says. “For that reason, we did not want to sell too much milk too quickly. Having 40 percent sold (at the time of this writing) gives some cushion against possible short-term corrections. We have some call options in place as a hedge should opportunity arise.”

These hedges are important, the adviser says, because many producers, seeing profitable margins, might lock in what seems to be a “good” price without giving themselves enough upside opportunity. Locking in a margin too early is dangerous, he says. Consider these facts from the past decade:

• The range of potential profit margins swung from 56.4 percent positive in May 2004 to 47.1 percent negative in February 2009 (based on our analysis of USDA Economic Research Service’s cost of production computations and the announced Class III milk prices, 2000-2009). That’s a swing of 103 percent.

• USDA’s milk-feed ratio was above the generally accepted breakeven mark of 3.0 in the last decade (120 months) only 37.5 percent of the time.

What does this mean for the milk marketer?

“It is crucial to take as much margin as possible as a cushion against the negative months,” Matt says.

Travel log entry: February 1, 2010

“I am so excited. We had a great phone conference with Matt. We looked at charts and we are understanding the strategies much better. We keep evolving…”

Having come from that “uncomfortable, uncharted territory,” mapping out strategies seems to have had a calming effect on Deb and Dave. While it’s too early in the process to report any economic results of their decision-making, the couple agrees that the coaching is helping them regain confidence and control.

“I’m noticing that we can make better decisions because we are coming from a place of confidence rather than a place of fear,” Deb observes.

Dave adds, “There’s something about seeing that line on the chart. It shows us the trend and tells us when we are approaching a trigger. They know the historical numbers, watch weather patterns, track world markets and follow all the indicators. I’m just watching where Matt’s line is going. It may seem like an easy concept, but someone’s gotta do it. Knowing Matt is doing it, I can enjoy production.” PD

Angie Molkentin is a freelance writer from Oconomowoc, Wis.

Follow Dave and Deb’s next risk management steps in the May 21 issue of Progressive Dairyman .