During times of tight margins and economic uncertainty, investing into your business can seem risky, if not impossible. With lenders and consultants telling you to cut expenditures, it’s tempting to put all capital investments on the back burner.

Before completely closing the checkbook, however, it’s important to remember that there are certain investments that, when analyzed carefully and structured correctly, can actually improve short term cash flow, and provide an immediate benefit to the business.

Let’s look at the following example:

A 620-cow farm is considering putting up grain bins. They’re currently using bays, and between birds and other wildlife, and their windy location, they suspect that they could save significantly on shrink with bins. Unfortunately, the $100,000 price tag for the setup they’re looking at seems like too much to take on right now. Let’s break it down:

Investment costs

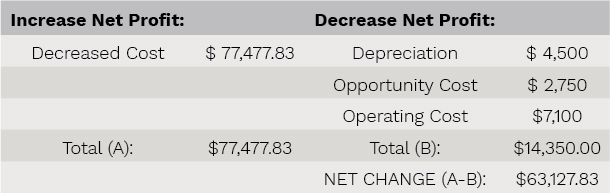

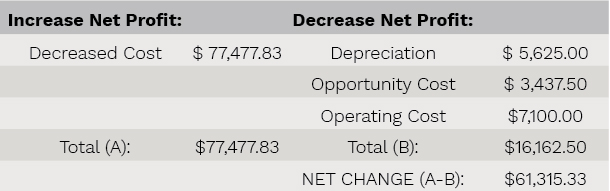

The first step is to determine whether the investment will increase overall profitability. Assuming we’re talking about a purchase that affects only one area of the business, we can do this with a simple partial budget. In this phase, we need to take into account the changes in operating income or expense that will result, as well as the associated depreciation and opportunity cost.

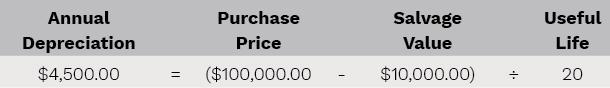

Depreciation. We know that the total cost of the project will be $100,000. The bins have a useful life of 20 years, and will have a 10 percent salvage value. We calculate depreciation for management purposes as purchase price less salvage value, divided by useful life. In this case:

Opportunity cost. Our current opportunity cost, or what rate of return we could make by investing the money somewhere else, is 5 percent. Annual opportunity cost is calculated as total investment plus salvage value divided by 2, times the estimated rate of return available.

Opportunity cost. Our current opportunity cost, or what rate of return we could make by investing the money somewhere else, is 5 percent. Annual opportunity cost is calculated as total investment plus salvage value divided by 2, times the estimated rate of return available.

Operating costs. Operating the bins will incur some additional costs, including supplies, repairs and utilities. The annual estimated cost for the structure they are considering is $7,100.00 or $591.67 per month.

Operating costs. Operating the bins will incur some additional costs, including supplies, repairs and utilities. The annual estimated cost for the structure they are considering is $7,100.00 or $591.67 per month.

Cost savings

Next, we need to determine cost savings. We know that switching to bins will reduce shrink, reduce some feeding labor time, as well as equipment use time, but to analyze the investment, we need to put some numbers to those savings.

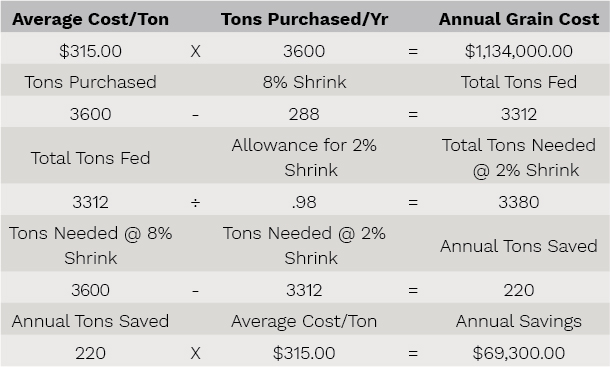

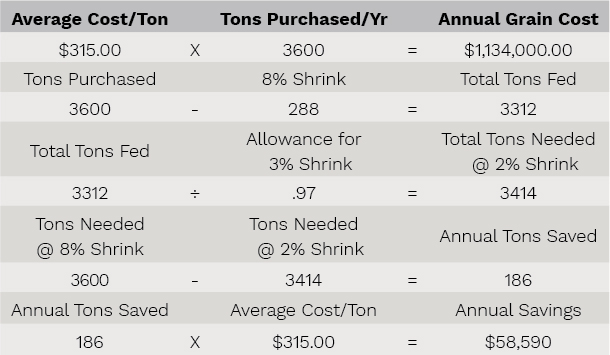

Reduced shrink cost: Let’s say the farm has an annual throughput of grain of 3,600 tons, at an average cost of $315 per ton. Using the bays they currently have, they estimate their shrink is 8 percent. By switching to bins, their shrink will be reduced to 2 percent. Now, they can determine their annual and monthly cost savings as follows:

So, we know that as soon as they’re placed into service, the bins will decrease feed costs by $69,300 annually or $5,775 per month.

Reduced labor cost: Switching to bins will reduce average daily feeding time by 30 minutes. If the average feeder costs a farm $16.50 per hour, including all benefits, annual labor savings would be $3,011.25, or on average $250.94 per month.

Reduced equipment usage: Moving to bins is predicted to cut loader usage time in half. Currently, their loader runs an average of 1.2 hours per day, costing them an average of $28.31 per day in fuel, repairs and maintenance as calculated in a 2016 PRO-DAIRY Feed Center Activity Analysis Project by Jason Karszes, Ashley Howlett and Anna Richards. Cutting this cost in half would lead to an annual savings of $5,166.58, and a monthly savings of $430.55.

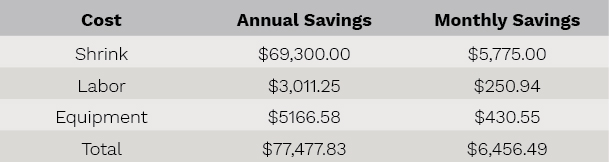

We can summarize our total cost savings as follows:

For this example, we’ll assume that this is a hard number, i.e. that you can predict the change in operating expense with relative certainty. Our annual partial budget would look something like this:

At first glance, this improvement in profitability makes the bins seem like an obvious choice. What this doesn’t take into account, however, is how we’re going to pay for them in the first place. In the current dairy economy, many businesses are not in a position to cash flow a $100,000 investment.

Cash flow with financing

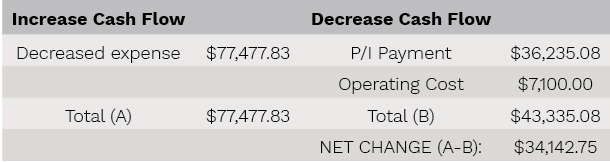

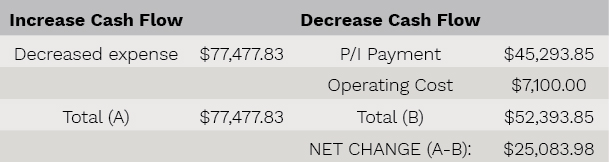

Let’s say that we instead financed the bins for three years at 5.5 percent. Remember that for cash flow purposes, we do not care about depreciation or opportunity cost, and instead add in our principal and interest payment. Our annual cash flow partial budget would look like this:

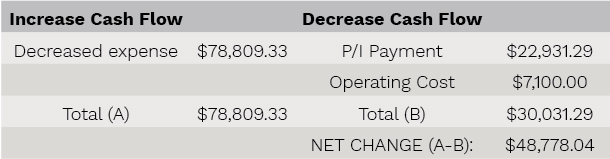

Here we can see that even though we may need to borrow for the initial investment, the immediate cash flow savings will more than cover the payment. Annual cash flow would increase by $35,474.25 for the first three years, and by $78,809.33 per year after that if grain, labor and fuel costs remained the same.

If costs increase over time, the investment looks even better from both a profitability and cash flow standpoint, as the cost savings increase, and our investment and payment remain the same.

Since the cash flow savings is higher than the payment, we could even use the increased cash flow to pay the loan off faster, saving interest cost, if there were not a higher value use of cash within the business at the time.

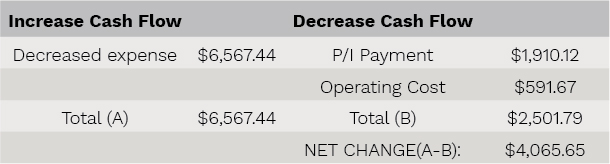

On the other hand, if freeing up more immediate cash flow in the business is the highest priority, we could extend the financing term to five years rather than three, decreasing our monthly payment and changing our cash flow budgets as follows:

Annually (first five years):

Monthly:

Monthly:

A key to this example, however, is that while we increased the loan term beyond the payback period, it is not longer than the asset’s useful life. After five years, when the loan is paid off, our cash flow increases significantly, and there will still be 15 years of useful life left.

Sensitivity analysis

The last piece of the process is to determine how much room for error we have in our assumptions. In other words, what if we’re wrong about how much shrink we would save? We do a sensitivity analysis to determine just how wrong we can be before it’s no longer a good decision.

For example, what if the cost of the project overran by 25 percent, increasing our investment to $125,000 rather than $100,000. In terms of profitability, our partial budget now looks like this:

Our projected cash flow partial budget on a three-year loan term would change as follows:

While the cash flow increase is obviously lower, it’s still positive, and so we’d still most likely go ahead with the investment, all other things being equal.

Let’s say, however, that our shrink savings is lower than we originally estimated. We can go back and adjust our savings numbers as follows:

We would then plug the reduced savings number into our budgets as we did above, to determine that both our profitability and cash flow calculated above would be reduced by $10,710 per year, still leaving us with a positive increase in both budgets, albeit a smaller one.

We can then do the same exercise testing each of the variables we’ve included (labor savings, equipment use, etc.), and in various combinations, to determine what our level of risk is in making the investment. While these steps may seem tedious, using an excel worksheet can allow you to easily adjust variables and test different scenarios without having to start from scratch.

Running a purchase decision through these exercises does not, however, absolve us of considering the other factors in economic decision making. We must still look at whether it fits into the long-term strategic vision for where the business is headed in the future.

We also need to evaluate whether it’s the best use of limited resources. While we have determined that it will increase both profitability and cash flow, credit is not an unlimited resource, and if there are more potential investments to consider that are competing for available credit, we need to run them all through the above exercises and compare the benefits of each. Remember that if you only compare one option, that will always be the most attractive one!

Periods of financial stress do not necessarily mean you should stop investing in your business altogether. They do, however, require you to evaluate investment decisions carefully, from both a profitability and cash flow standpoint, to ensure you’re making the best use of limited resources, and that they fit into your strategic plan and long-term vision for your business. ![]()

Anna Richards is a dairy business management specialist with PRO-DAIRY. Email Anna Richards.

This article appeared in PRO-DAIRY’s The Manager in December 2018. To learn more about Cornell CALS PRO-DAIRY program, visit PRO-DAIRY Cornell CALS.