The clock is ticking, and time is running out. When was the last time you reviewed your living wills and trusts? Has your net worth increased or decreased? Perhaps you recently married or had a baby? Or perhaps you’ve divorced, or lost loved ones since you created your estate plan? All of these factors could have an impact on your existing estate plan.

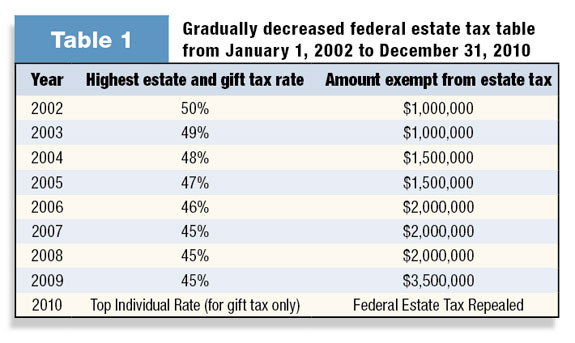

Table 1 is the gradually decreased federal estate tax table from January 1, 2002 to December 31, 2010.

As you probably know, Congress eliminated federal estate tax and generation-skipping transfer tax for estates of decedents dying in 2010. But, do you realize that on January 1, 2011, an estate worth more than $1 million will pay estate tax at the rate of 55%? That’s right, the Economic Growth and Tax Reconciliation act that President George W. Bush signed into law is about to expire. That means all the lower estate tax rates up to year 2010 are about to disappear unless Congress does something before the end of the year.

Do you want your hard-earned money to disappear overnight? If not, it’s time for you to sit down with your loved ones and take inventory of your assets, gather your financial data and plan for your future goals and expectations. Estate planning is very complex. A simple will may adequately serve the estate planning needs of some people, but we recommend you meet with a qualified legal adviser to communicate your wishes. Poor estate planning could create a potential problem or result in a financial burden to your heirs.

No matter your net worth, it is very important to have a basic estate plan in place. A will tells everyone who gets what when you die and you can also name guardians for your children in a will. Keep in mind that even if you have a trust, you still need a will to take care of any assets outside of the trust when you die. A basic estate plan consists of a will, durable power of attorney for asset management, a living will and durable power of attorney for health care. A carefully created estate plan can ensure that your heirs and financial goals are met after you die.

There are many ways to preserve your estate for your heirs, such as giving gifts tax-free. First, you may give up to $13,000 a year (annual exclusion amount for 2010 year) to an individual without the gift becoming taxable (or $26,000 if you are married and elect gift-splitting with your spouse). Second, you may also pay an unlimited amount of expenses for education and medical bills if paid directly to the institutions.

Have you ever considered contributing to your grandchildren’s or beneficiaries’ 529 college savings plan? A 529 college savings plan is designed to help you set aside funds for your beneficiaries’ education costs in the future. You may contribute up to $13,000 a year to each beneficiary. Even better news, you can make contributions up to $65,000 ($13,000 x 5) to a beneficiary (or $130,000 if you are married and elect gift-splitting with your spouse) and elect to treat the contribution as made over a five-calendar-year period for gift tax purposes.

However, keep in mind that only after your taxable gifts made during your lifetime reach $1 million will any gift tax apply. It is a sound method for reducing your estate and passing assets to your heirs in an effort to minimize the tax liability that may exist upon your passing.

The bottom line is that your estate plan requires periodic review due to tax changes and other life-altering events. Again, the clock is ticking. You should plan for your future now. Don’t wait. PD

Tony H. Chiang

CPA/Partner

tony@genskemulder.com