Like any good story, the dairy market complex has done a good job of keeping viewers in suspense. Here’s the most recent storyline: As farm profitability drops to dismal levels, dairymen view positive returns as a remote possibility, something to hope for in future years instead of this one. At that moment, the market finds a way to spring back to life and provide producers with enough return to keep both them and their cows in the game. Since the 2009 cycle low, three such incidents have occurred just in the nick of time.

In 2009, prices spent the spring/summer at levels under $10 per hundredweight (cwt). Paying for elevated feed costs, producers lost money and equity at a pace never before witnessed. The outcry from dairies led to congressional committee hearings and later to USDA action.

In July of 2009, USDA Secretary Tom Vilsack announced an increase in cheese and NFDM subsidy levels that effectively raised the price of milk by more than two dollars. This led the market on a run that peaked in December with Class III milk priced at $14.98 per cwt.

In 2010, prices settled to levels near $13 per cwt after subsidies returned to normal levels. Strong exports tightened supplies of fresh/short-aged cheese. A run on block cheddar prices to $1.77 per lb. led milk to prices just under $17 per cwt in October and November of last year before falling back to levels equal to where they started the year.

Now in 2011, prices have sustained a move that has been unmatched in terms of velocity since the beginning of dairy futures and options. In a period of 12 trading days, milk prices ran up nearly $3 in nearby contracts to levels near $17 per cwt. Many are asking: Why?

The causes are multiple. Strong demand for powder and butter became evident in Fonterra’s first 2011 auction. Hedgers scrambled to find protection in the instruments made available to them, including Class III milk futures. Speculators, who watched them scramble, saw opportunity for a 2004-like spring move and flocked to buy contracts.

Producers who had priced milk with their co-op or through futures and options instruments hit the panic button and worked to exit/neutralize previous positions. Concerns over upside-down returns at the farm were mitigated in a matter of a couple of weeks.

The question now will be: “What happens next?” The market always seeks to find equilibrium. With regard to milk, that process becomes a bit more volatile because we deal with a perishable commodity.

In times of surplus, we do not have the luxury of storage. We cannot simply put it away for a later time. It must either be used … or dumped (not a likely or affordable option).

In times of even minor shortage, processors pay aggressively to procure supplies in order to keep their plants at capacity. This process becomes even more interesting, and prices become even more sensitive to these small fluctuations in production when you add speculative market interest. The moral of the story is: Change often happens quickly and when we least expect it.

So how will the market, producers, consumers and processors respond to the most recent change? That is the million-dollar question. There is plenty of concern already regarding the economic health of our consumers.

Will they pay more for their dairy case favorites? Or will they migrate to lower-quality, lesser-cost substitutes? Consequently, will processors maintain current premium structures? Or will the pressure from higher price inputs and fragile consumer expenditures cause them to prune their farm gate offerings?

One thing that will likely hold true on the producer end, is that production will rise … perhaps significantly. How can we be confident in such a statement? It is a matter of history.

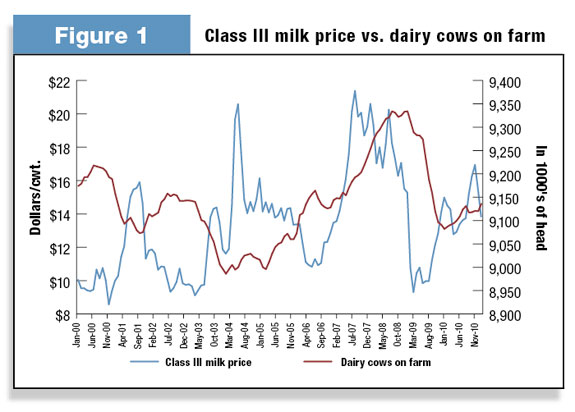

Let us for a moment take a look at Figure 1 , an illustration of the relationship between the Class III milk price and the number of dairy cows on-farm.

You will notice, quite logically, that the price of milk and the number of cows producing it, exist in a very inverse relationship.

As cow numbers rise, milk price falls … and vice versa.

Certainly farm economics will play into the speed by which these actions occur. However, the relationship presses on.

One thing to look at in 2011, however, is our ability in which to grow production.

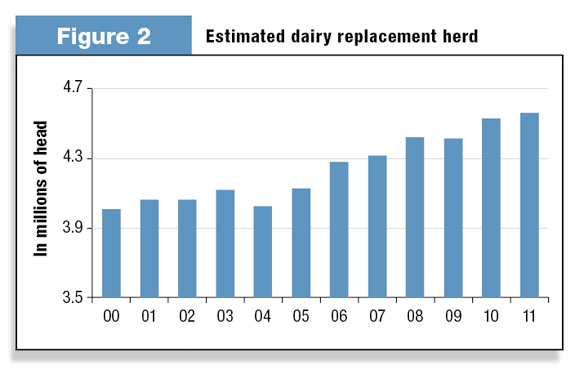

Many producers, despite current feed costs, have continued to grow their heifer populations. (See Figure 2 .)

Estimates of dairy replacement heifers continue to grow.

The recent Cattle Inventory report released by the USDA in January reveals that 4.56 million head of dairy replacement heifers are in supply to backfill culled cows and expand herds.

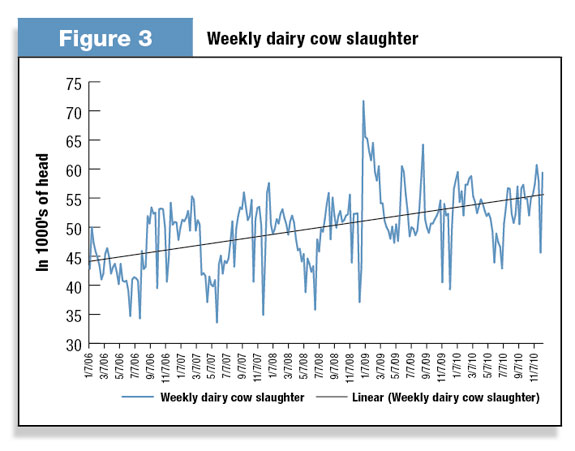

This growing population has allowed us to grow our herds (56,000 head in 2010) in spite of a dairy cow slaughter pace that has grown 25 percent in the past five years. (See Figure 3 ).

The ultimate effect of this trend is a growth in our overall productivity. We have watched for years as management has delivered greater production per cow.

This added heifer supply condition that we face could amplify those efforts in 2011 as springing heifers take the place of less-productive herdmates.

The multiplying effect of growing cow numbers as a function of rising prices and increasing productivity per cow lays the groundwork for a very fast correction in prices as supply overcomes (perceived) demand.

As dairymen, are you prepared for such a shift? How does the recent price run affect your margin? Have you strategically addressed your revenue stream after this recent run in milk prices?

These are all questions I challenge you to answer. Discuss them among your management team. We have talked in previous years about proper actions in markets such as these. Discuss those actions with your risk management adviser.

Capitalize on the opportunities at hand! As quickly as things change lately, your actions may come just in the nick of time. PD

UPDATE: Since the publication of this article, Mike North has left First Capitol Ag and is now the president of Commodity Risk Management Group. Contact him by email .

-

Mike North

- Milk Marketing Specialist

- First Capitol Ag