Dairy farmers have until Dec. 15, 2017, to make decisions on participation in the Margin Protection Program for Dairy (MPP-Dairy) for 2018. One option includes the ability to opt out. By opting out of MPP-Dairy, they are eligible to use a separate risk management tool, Livestock Gross Margin for Dairy (LGM-Dairy).

No forms are required to opt out of MPP-Dairy; you simply do not sign up. If you have questions, check with your local USDA Farm Service Agency (FSA) office.

By opting out in 2018, a dairy’s MPP-Dairy coverage ends on Dec. 31, 2017. Dairy farmers who opt out of MPP-Dairy for 2018 may begin to purchase LGM-Dairy insurance in November, providing coverage beginning in January 2018.

LGM-Dairy policies are normally sold the last business Friday of the month. However, with the Thanksgiving holiday, the November sales period is Friday, Nov. 17, with coverage beginning in January 2018.

That allows farmers to transition from MPP-Dairy to LGM-Dairy without a lapse in coverage, and will ensure MPP-Dairy and LGM-Dairy coverage does not overlap, which is prohibited by law. Upcoming LGM-Dairy sales dates are to be Dec. 29, 2017, and Jan. 26, 2018.

By allowing dairy farmers to opt out of MPP-Dairy in 2018, dairy and government leaders recognized the program’s poor performance. LGM-Dairy is a more flexible product and provides more protection, but you must do your homework.

LGM-Dairy, MPP-Dairy performance compared

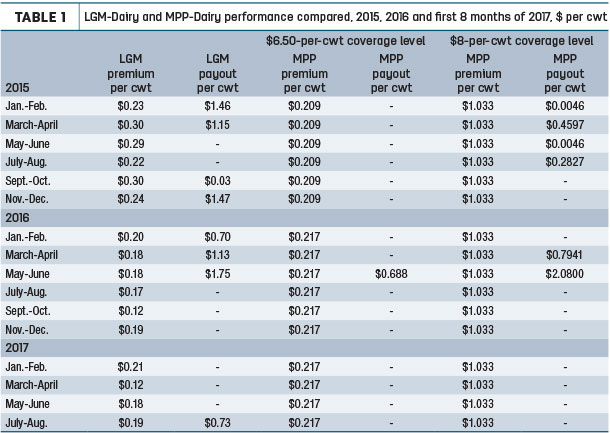

Our agency compared LGM-Dairy to MPP-Dairy premiums and indemnity payments for the period January 2015 to August 2017 (Table 1).

Click here or on the image above to view it at full size in a new window.

We compared premium costs and indemnity payments for a sample farm producing 10,000 hundredweights (1 million pounds) of milk per month.

The LGM-Dairy policy was purchased six months in advance, selecting a $1-per-hundredweight (cwt) deductible policy. The coverage was for 100 percent of a dairy’s milk. We chose the lowest-allowed amount of feed cost because that is the most common choice of our clients.

In 2015, the average margin covered was $15.48 per cwt. In 2016, the average was $13.54 per cwt, and the first eight months of 2017 was $14.72 cwt.

In 2015, the average milk price was $17.24 per cwt. For 2016, the average was $15.30 per cwt, and for the first eight months of 2017, the average was $16.45 per cwt.

We analyzed MPP-Dairy at $6.50- and $8-per-cwt coverage levels. At 1 million pounds of milk production per month, the sample herd was in MPP-Dairy’s “Tier 2” coverage level, with higher premium costs than a herd producing 4 million pounds or less per year (Tier 1).

MPP-Dairy covered 9,000 cwt because the program allows a maximum of 90 percent milk production coverage. Any MPP payouts were reduced by the government sequester of 6.8 to 7.3 percent.

Why not evaluate MPP-Dairy coverage at the $4-per-cwt level? Other than the $100 annual administrative fee, that level of coverage has no cost to a dairyman and has never had a payout.

Data sources: Dairy Market and Policy, University of Wisconsin LGM Analyzer .

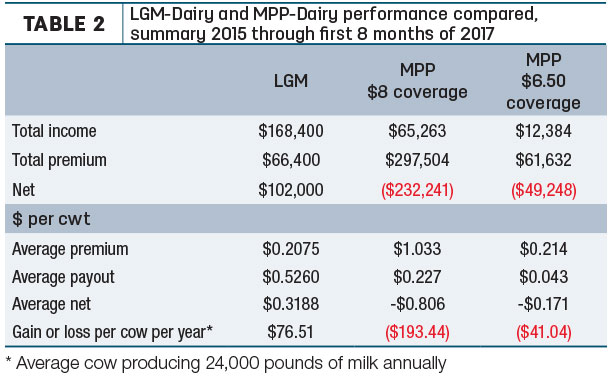

The analysis showed LGM-Dairy had a $75-per-cow gain versus losses in MPP-Dairy (Table 2).

That difference may not happen all the time, but $75 per cow is a lot of money. Given the current environment of tight margins, a little time spent on education makes LGM-Dairy worth investigating and understanding.

One key difference between the products is: LGM-Dairy is not available through your local FSA office. LGM-Dairy is administered through the USDA’s Risk Management Agency, part of LGM policies covering various livestock operations.

LGM-Dairy and other LGM policies are sold through licensed insurance agencies offering federal crop insurance. Additional training is required, and not every crop insurance agent will handle LGM products.

LGM-Dairy provides risk protection you can customize for your operation. But while LGM-Dairy has more choices than MPP-Dairy, it is not necessarily more complicated. We feel it encourages dairy producers to look at the markets at least once a month to evaluate opportunities.

Some decisions can probably be made once with the help of your agent. For example, you can agree on the amount of corn and soybean meal coverage appropriate for your operation. You can also agree on the deductible you are most likely to use.

Final coverage decisions can be made on or before each sales date. You’ll need to determine an amount of milk to cover and the coverage period. You must purchase coverage for at least two months to receive a subsidized premium. Applying for LGM-Dairy is simple, with only one signature required.

Other LGM-Dairy details

LGM-Dairy became available in 2008 and was further refined in 2010. The changes in 2010 added subsidies to reduce premiums and moved premium payments to the end of the coverage period. LGM-Dairy:

- Manages the risk of falling milk prices and rising feed costs

- Guarantees against income loss due to market events

- Is federally back by RMA/USDA which underwrites and manages policies just like other crop insurance policies

- Allows coverage up to 240,000 cwt per crop year

- Has deductibles ranging from $0 to $2 per cwt

- Has subsidy rates ranging from 18 percent to 50 percent

- Uses customizable feed amounts to match your operation. MPP uses a fixed amount of feed

- Uses milk prices based on Chicago Mercantile Exchange Class III milk futures and feed prices based on Chicago Board of Trade corn futures and soybean meal futures (MPP-Dairy also uses national average alfalfa prices in its calculations.)

- Is offered 12 times a year

- Can cover two to 10 months of milk production (The amount of milk covered can vary month to month. Coverage can be purchased on any portion of your milk production.)

- Has an RMA subsidy limit of $20 million for all livestock products.

- Has no transaction or commission costs paid by dairymen.

Ron Mortensen is a co-owner of Dairy Gross Margin LLC, a crop insurance agency specializing in LGM-Dairy. Based in Fort Dodge, Iowa, Dairy Gross Margin LLC has agents licensed in 20 states and has been selling LGM products since they were first offered.