U.S. dairy farmers have been struggling with suppressed milk prices for nearly four years. The first part of 2019 has been better, but improved milk prices have been overshadowed by tariff and trade issues, extremely wet weather in much of the country and the length of time milk prices have been low.

The U.S. all-milk price from January to April 2019 averaged $17.70 per hundredweight (cwt), up about $2 from the same time period in 2018. Current Chicago Mercantile Exchange (CME) milk futures prices are following the same trend. For the second half of 2019, the average Class III milk futures price is trading about $2 per cwt higher than the same period a year earlier, and the average Class IV futures milk price is trading nearly $2.50 per cwt higher. This is excellent news for the nation’s struggling dairy farmers.

Unfortunately, a lot of dairy farmers do not think about risk management when milk prices are climbing. Waiting for prices to start declining before developing a risk management plan can be a costly mistake.

The new Dairy Margin Coverage (DMC) program offers dairy farmers an affordable risk management tool every dairy farm in the U.S. should consider.

Administered through the USDA’s Farm Service Agency (FSA), DMC is a similar but improved version of the Margin Protection Program for Dairy (MPP-Dairy). Herd size is still divided into Tier 1 and Tier 2, but maximum milk production for Tier 1 dairies has increased from 4 million pounds to 5 million pounds of annual production history. Based on national average per-cow milk production, 5 million pounds is roughly equivalent to a 240-cow dairy. Tier 2 dairies are defined as having greater than 5 million pounds of annual production history.

Production history for dairies that participated in MPP-Dairy will transfer to DMC once enrolled. Dairies that did not participate in MPP-Dairy, or are new operations, can still enroll in DMC. Annual production history will be established by 2014 Farm Bill rules.

The margins available for coverage for DMC were expanded. Tier 1 dairies can cover margins between $4 and $9.50 per cwt in 50-cent increments. Tier 2 dairies can cover their first 5 million pounds of production history at Tier 1 margins and premiums but, for any production in excess of 5 million pounds, margin coverage is capped at $8 per cwt, at Tier 2 premiums.

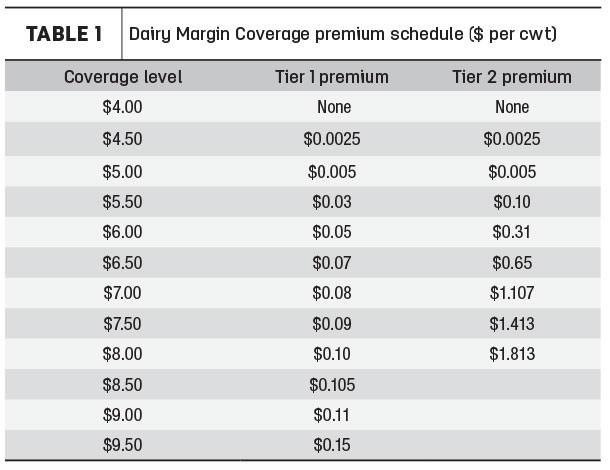

Starting at the $5.50-per-cwt margin, Tier 2 premiums are more expensive than Tier 1 premiums. Table 1 shows the premium schedule for Tier 1 and Tier 2 dairies.

The $4-per-cwt margin is free after paying the required annual $100 administration fee to enroll in the program.

Margins are calculated monthly by subtracting feed cost ($ corn + $ soybean + $ alfalfa hay) from the U.S. all-milk price. In a late change, the USDA replaced the alfalfa hay price in the formula with a blended price for “dairy quality” (Premium and Supreme quality) alfalfa hay. An indemnity is triggered when the margin drops below the elected margin covered. Dairy farmers enrolled in DMC receive payments each month a payment is triggered. Full premiums are due the fall of each program year but may be paid monthly by deducting premiums from indemnity payments.

The volume of production history dairy farmers can elect to cover was also expanded, on both ends. Dairy farmers can cover 5 to 95% of production history. (The coverage allowed under MPP-Dairy was 20 to 90%.)

The 95% coverage level allows Tier 1 dairies to cover nearly all their production history.

The volume coverage was decreased on the lower end to allow larger dairies to cover their first 5 million pounds at Tier 1 margins and premiums. For example, a dairy with 100 million pounds of production history can elect to cover 5% of production history (5 million pounds) and still cover a portion of production in Tier 1. Twenty percent of 100 million would have automatically put that dairy into Tier 2 and higher premiums above the $5 margin. For production history above 5 million pounds, a separate margin must be selected under the Tier 2 premium schedule (Table 1).

Other considerations

The 2018 Farm Bill offers a 25% discount to any dairy willing to enroll in DMC for the full term of the 2018 Farm Bill (2019-23). To receive the discount, the dairy must make a one-time decision and pick a margin and volume to be covered. That decision is locked in for the life of the 2018 Farm Bill and will carry over each year. Re-enrollment is not necessary, but premiums must be paid by the fall of each year regardless of whether any indemnities are paid that year.

If a dairy chooses not to take the discount, then annual enrollment is required, and the full premium must be paid. However, farmers have the option to make changes annually, including just paying the $100 administration fee for the $4 margin coverage.

Premium calculations

At the $9.50 margin, the premium for Tier 1 dairies is $1,425 per 1 million pounds of production history covered. The 25% discount makes the premium $1,068.75 per 1 million pounds per year, a total savings of $1,781.25 per 1 million pounds of production history covered over the life of the program. The savings by taking the discount is roughly equivalent to getting one year of free coverage over the five-year program.

To try to help compensate dairy farmers for the ineffectiveness of MPP-Dairy, the 2018 Farm Bill also included a provision offering two options for a partial refund to eligible farmers. Eligible dairy farms should have already received notification they are due a refund. Dairy farmers can receive a 75% refund of net premiums (premiums paid into MPP-Dairy minus any benefit received) to be used for future DMC premiums over the next five years. A second option offers dairy farmers a one-time cash payment of 50% of net premiums paid. The 50% refund option is also available to dairies that participated in MPP-Dairy but are no longer in business. Refund requests can be made at local FSA offices from now until Sept. 20, 2019.

The enrollment period started on June 17, 2019, and will continue through Sept. 20 for the 2019 program year. Enrollment must be done at local FSA offices. The program will be retroactive to Jan. 1, 2019.

Example herds

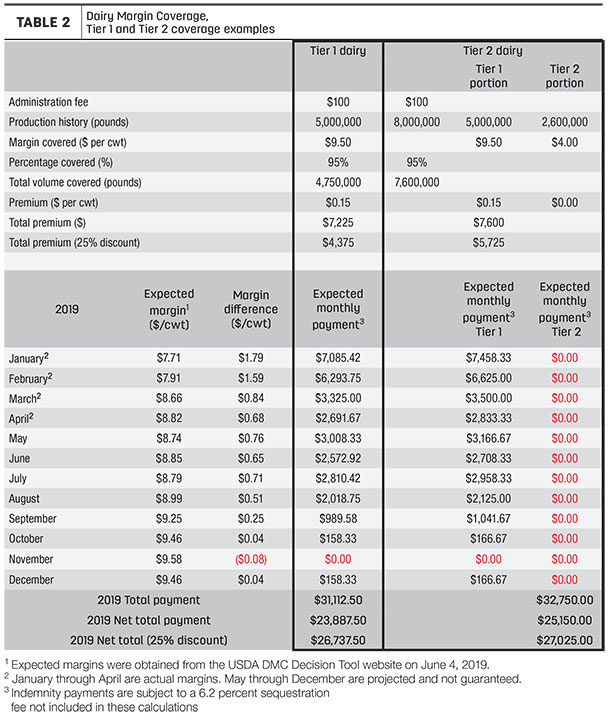

Examples of DMC calculations based on latest projections are included in Table 2. The January-April 2019 margins are already secured at $7.71, $7.91, $8.66 and $8.82 per cwt, respectively.

As of June 13, 2019 margins were projected below the $9.50 coverage level in most months. And January and February indemnities will more than cover the cost of enrolling this year at the top coverage level.

Based on those projections, a dairy operation with 4 million pounds of production history covered at the $9.50-per-cwt/95% level could see 2019 indemnity payments totaling nearly $31,112. Subtracting premium costs, the net would be nearly $23,888. And if the operation enrolls for the entire five-year program and takes the 25% premium discount, the 2019 net payment is about $26,737.

A larger dairy with a production history of 8 million pounds would be able to cover the first 5 million pounds at the Tier 1 level, with the remainder at the Tier 2 level. Selecting the $9.50 margin/95% coverage on the first 5 million pounds would yield a total 2019 indemnity payment of about $32,750. Deducting the premium costs, the net indemnity payments would total more than $25,150; if the dairy enrolled for the full five years and takes the 25% premium discount, the 2019 net indemnity payment would be more than $27,025.

All indemnity payments are subject to a 6.2% sequestration deduction (not included in these calculations).

Conclusion

DMC is an improved program over its predecessor, MPP-Dairy. A payment under MPP-Dairy was rarely triggered from 2014 to 2017. If the current DMC rules were available during the same time frame, indemnities would have been triggered for nearly two-thirds of the months.

— Article submitted by the Center For Dairy Excellence