Even though the PPD has been used since 2000, it is a difficult part of producer payment to understand.

This past November, PPDs in all orders were negative. They ranged from 94 cents per cwt in the Upper Midwest to $3.39 per cwt in the California federal order, with an average in all orders of $2.19 per cwt. When the PPD is a large negative number, more questions are asked. This article discusses factors impacting the PPD and why the PPD may be positive or negative. Hopefully, this helps make PPDs a little more understandable.

The definition of PPD

Let’s begin by defining the PPD. The PPD is the total dollars in a federal order pool available for producer payment minus the total dollars paid to producers for their milk production at the Class III component values for butterfat, protein and other solids. The sum is divided by the total cwt of producer milk. The result is the PPD per cwt.

Consider the Class III component values paid to producers as the base price. Any difference in an order’s revenue, after paying producers at the base price, is the PPD. The difference can be positive or negative. When total Class III dollars paid to producers is greater than total revenue in the order pool, the PPD is negative. If total dollars in the pool are greater than the Class III price paid to producers, the PPD is positive.

Explained another way: Each month, federal orders calculate and publish a statistical uniform price more commonly known as the blend price. The blend price is for a cwt of milk containing 3.5% fat, 2.99% protein and 5.69% other solids. When the Class III price is greater than the order’s blend price, the PPD is negative. When the order’s blend price is greater than Class III, the PPD is positive. The Class III price plus the PPD (positive or negative) always equals the order’s blend price.

The term PPD was introduced, along with multiple component pricing, back in 2000, but the concept is not new. Prior to multiple component pricing, when milk was priced on skim and butterfat, the PPD was incorporated into the order’s blend price. When an order’s blend price was below the Class III price, and it did occur prior to multiple component pricing, it was called a price inversion. This is similar to a negative PPD. This still happens today in the four orders using skim-butterfat pricing.

Factors affecting PPD

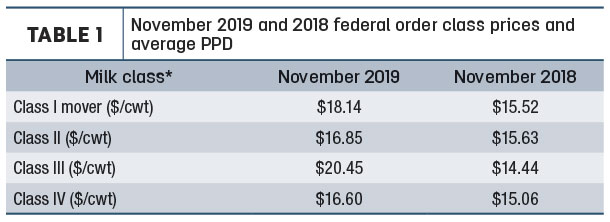

There are three primary factors impacting the PPD. The first is the relationship of the Class III price to the other class prices. In November 2019, the Class III price exceeded, by a large amount, all other class prices (see Table 1).

You will recall, last October and continuing through most of November, cheese prices moved quickly upward. This resulted in the Class III price increasing $1.73 per cwt from October to November with a November Class III price of $20.45 per cwt. The other class prices only increased 20 cents to 30 cents per cwt. After federal order pools settled with producers at the base price, or Class III price, more dollars were paid out than received in the pool. The result: a negative PPD.

Going back to Table 1, we see in November 2018, the reverse was true. The Class III price was lower than the other class prices. After federal orders settled with producers at the base price, there was additional money in the order pool. Thus, a positive PPD. When the Class III price is low, relative to the other class prices, the order pool has more money than paid to producers at the Class III price, and there is a positive PPD.

A point to remember is to expect a negative PPD when the Class III price is increasing, especially increasing more than other class prices. Even though the PPD is negative, and no dairy farmer likes to see a negative number on the milk check, dairy farmers benefit from an increasing Class III price.

Class III milk volume’s impact on PPD

The second factor impacting the PPD is the volume of Class III milk pooled. When the Class III price is higher than the blend price, there is little economic incentive for Class III milk buyers to pool their milk. Most Class III milk buyers are not required to pool their milk receipts in a federal order. It is a voluntary decision for these milk buyers, mainly cheese plants, to pool or not pool.

Let me explain using the Central Order as an example. Last November, a cheese plant (Class III milk buyer) located in this order’s base zone was required to pay into the order pool, if the plant pooled. The payment was $3 per cwt on all of its Class III milk pooled. Why was a payment into the pool required? In simple terms, the Class III price was higher than the order’s blend price. The payment goes into the order pool, allowing milk users whose milk price is below the blend to pay their producers the blend price.

Because of being required to make payments, many cheese plants chose not to pool their milk in November. Why pool if it costs the plant money? Let me interject: There are order regulations making it more difficult to not pool milk one month and then pool the following month. However, the decision is still voluntary for most Class III milk buyers.

Now let’s look back at November 2018. The Class III price was lower than the Central Order blend price. The cheese plant had an economic incentive to pool. The cheese plant received a payment from the order pool of 78 cents per cwt on Class III milk pooled. This payment allowed the plant to pay its producers the order’s blend price, which was higher than Class III.

This decision of pooling or not pooling impacts the PPD. A significant volume of Class III milk, in all orders with MCP, was not pooled last November compared to normal. For example, in the Central Order, Class III utilization was only 13.54% compared to 50.71% in November 2018. Other orders saw similar changes, such as California. California Order Class III utilization declined from 63.7% in November 2018 to only 1.9% in November 2019. The economic incentive to pool Class III milk was diminished. When less Class III milk is pooled, in a month like November 2019, there is a lower or negative PPD.

Class I’s decline lowers PPDs

A third factor impacting the PPD is Class I milk. Generally, the Class I price is higher than the Class III price, thus adding revenue to the order pool above the Class III price. More revenue beyond the Class III price, the larger the PPD. However, the method of calculating the Class I price and volume of Class I impacts this.

Advanced pricing is used to calculate the Class I price. For example, November 2019 Class I prices were announced on Oct. 23, using commodity prices from the previous two weeks. The November Class III price was announced on Dec. 4, using commodity prices from the month of November. The November Class III price had the benefit of higher cheese prices in November compared to October. This led to a Class III price higher than normal in relation to Class I, which negatively impacts the PPD. When cheese prices decline, the reverse happens. The impact of lower cheese prices is seen in the Class III price before the Class I mover. The result is a higher PPD.

The volume of Class I milk impacts the PPD as well. Generally, the higher an order’s Class I usage and Class I price, the higher the PPD. In simple terms, the Class I differential, as well as the Class II differential, are reflected in the PPD. Unfortunately, due to declining fluid milk sales, there continues to be fewer dollars from Class I differentials in federal order pools.

In summary, the PPD is the difference between a federal order’s revenue available for producer payment less payment to producers at the Class III price based on components. Factors impacting the size of the PPD, positive or negative, are Class III price relative to the other class prices, volume of Class III milk pooled and an order’s Class I price and usage. ![]()

Calvin Covington is a retired dairy cooperative CEO and now does some farming, consulting, writing, and public speaking.

-

Calvin Covington

- Retired Dairy Co-op Executive

- Email Calvin Covington