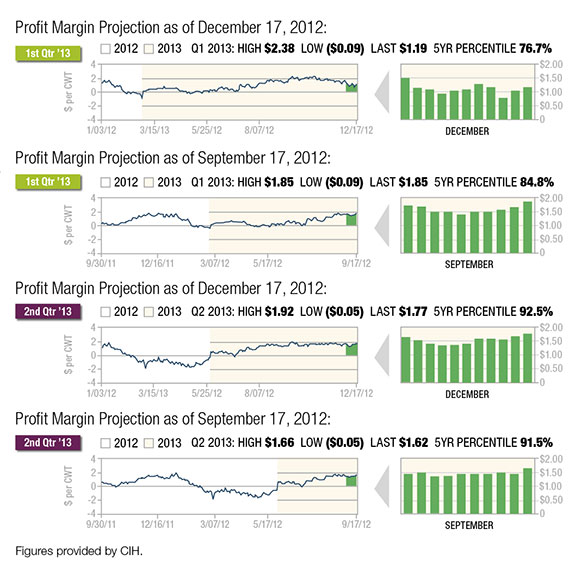

As we begin the new year in 2013, dairy producers have a lot to be hopeful for as forward margins through next several quarters are projecting profits at relatively high historical percentiles.

With the exception of spot Q1, all deferred periods in 2013 are projecting margins at or near the 90th percentile of the past five years, with those margins improving since the last time we took this snapshot in the fall.

Price volatility has been relatively muted for the individual components of the profit margin over the past few months, although there generally has been a weakening trend across both milk prices and feed costs.

Weakness in milk has been more pronounced in nearby expirations, as the market has come down from some of the loftier price expectations being projected back in the fall.

Deferred milk prices have held steady, as those contracts never carried that premium to begin with.

Both corn and soybean meal prices, meanwhile, have been drifting lower as the market adjusts to the reality of the lower crop size in response to this year’s drought. The figures reflect both the current outlook for dairy margins through the fourth quarter of 2013, as well as comparison figures to these same forward profit margin projections back in September.

Milk prices have succumbed to recent pressure, as there are signs production has begun trending higher. The latest monthly production report for November from the USDA showed milk production at 15.973 billion pounds, up 1.5 percent from October and 1 percent above last year.

The report also reflected the November milking herd at 9.193 million head, up 7,000 from October. This is contrary to the existing trend that has been in place, as the U.S. dairy herd has generally been contracting since May while dairy cow slaughter has been running strong.

Year-to-date, dairy cow slaughter is up 6.2 percent from 2011. Obviously, feed costs and poor margins have been the main catalysts behind increased culling, particularly in Western regions where those costs have hit producers disproportionately relative to their counterparts in Midwestern states.

Forage prices reached record levels in the West earlier this year, due in part to years of drought in the Plains. According to USDA’s Agricultural Prices report, alfalfa prices in the Southwest averaged more than $120 per ton higher than in the northern Midwest in January, although that spread has narrowed to about $35 per ton since then.

The Midwest has not exactly been immune to increasing feed costs either, though. According to the University of Wisconsin , Midwest hay prices have risen 42 percent since early July – and along with that, dairy cow slaughter in the Midwest has run about 2.3 percent above last year.

Meanwhile, dairy product exports are beginning to feel the weight from higher milk output in Oceania.

New Zealand milk production is on track to exceed last year by 4 to 5 percent, and the record-high production means Oceania exporters have been active marketing product.

October nonfat dry milk (NDM) exports were down 4.6 percent from last year following a 13.4 percent year-over-year drop in September, the first back-to-back monthly decline in NDM exports since August and September 2009.

Asian nations represent four of the top five destinations for U.S. NDM/SMP exports after Mexico, and it is obvious that increased exports out of Oceania into the Asian market have been responsible for the lower U.S. exports here.

Cheese exports remain strong with monthly totals posting year-over-year gains for 13 consecutive months, and the year-to-date total up 20 percent over 2011. Here too, however, the pace of cheese exports has slowed significantly from earlier this summer.

On a positive note, the forward futures curve is flat throughout 2013, so there is neither a premium that the cash market needs to work up toward nor a discount discouraging future production.

While alfalfa hay prices remain quite high, both corn and soybean meal prices have been moderating without any new bullish catalysts to drive either market higher.

Recent rainfall in South America has been seen as largely beneficial for crop prospects, with private forecasters making slight increases to their soybean production estimates in Brazil. Another recent development has been soybean export cancellations by China, which are starting to be reported by the USDA.

It seems as though China may have overbooked their late winter needs with the U.S. out of fear that adequate supply would not be available in time from South American exporters, and now they are canceling those commitments which were made to help ensure against a potential problem developing with the South American crop.

While soybean meal prices remain quite high from a historical perspective, as well as above their recent low in mid-November, the market has generally been moving lower since peaking earlier in mid-September.

Corn likewise has been displaying recent price weakness, with an ongoing sluggish export pace and no indication that there are serious issues with South America’s corn crop.

The market will be keen to gauge first-quarter demand with the quarterly stocks figure for December 1 due out with the normal monthly WASDE and final production figures in January.

While some market participants are still thinking the crop size has been overstated, with smaller harvested acreage to be reported that will tighten ending stocks, the cash market does not appear to signal a shortage of corn, even though basis levels remain historically high and have been firming recently on the break in futures prices.

Corn has largely been following soybeans, which have been leading the grains and oilseeds complex, so the recent Chinese export cancellations and more favorable weather turn in South America have put pressure on corn.

In general, both crops seem to be following a classic “short crops have long tails” pattern, where prices tend to put in an early peak in response to supply fears and then gradually retreat as the marketplace adjusts to the reality of the actual supply.

Unlike milk, where the forward futures curve is basically flat through 2013, both corn and soybean meal are inverted with deferred futures trading at a discount to nearby expirations. Clearly there is an expectation that a large South American crop, followed by a recovery in U.S. production later this year, will allow both corn and soybean meal prices to gradually fall further as we work our way through the new year.

While this may or may not come to fruition, the market is offering an opportunity right now, based on the matrix of projected input costs to milk revenue, for a dairy producer to secure attractive profit margins throughout 2013.

While there are a variety of ways this may be accomplished through contracting alternatives in the cash market or through the use of exchange-traded derivatives, it is important to at least understand that forward margins are presenting an opportunity that is attractive and worth looking at. It is good to know that the outlook for 2013 is hopeful as we start the new year. PD

Whalen is a vice-president of education and research for Commodity & Ingredient Hedging based in Chicago, Illinois. Click here to email him.

Chip Whalen

Senior Risk Manager and Director of Education

CIH – Commodity & Ingredient Hedging LLC