It is times such as these when statements such as “I should have …” or “If I only would have known that the market …” or “Next time I will make sure that I …” become prevalent in conversations surrounding the market or prices. They are statements of regret and lost opportunity.

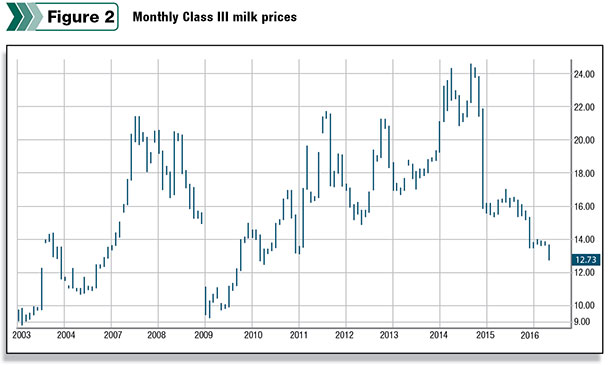

They are similar to the statements made in 2014 as Class III prices rallied to $24 per hundredweight, and those that had sold milk made statements like “I will never …” or “I wish I wouldn’t have …” or “If only I would have known that …”

The common theme in these discussions is: The author of such a statement has been hijacked by the expectation of perfect foresight, perfect timing and perfect results. The reality is: Each day, we operate in the absence of perfect foresight. We are blind to the many variables that have yet to become reality.

Things can happen without an immediate explanation. Absolutes about why or to what extent things take place can often be lacking. Emotion can trump logic. Perfect timing can only be fully defined as such after the moment has passed. Results are no different. We never know absolutely what to expect in life or in the markets. We can never perfectly predict what will happen or what our actions will lead us to. Bottom line: Perfection is an illusion.

However, does that dismiss us from prudent management of risk and opportunity? “No” is the quick and easy answer. Marketing and risk management are essential elements in any business.

You will have a difficult time finding any long-term thriving business that doesn’t tend to both the opportunities and risks in their business. In an era where information moves quickly and responses move faster, risk can be devastating and opportunity can be fleeting.

Look inside your own business. How do you manage liability? What protocols do you employ in maintaining herd health? How do you address safety? What types of insurance do you carry on your assets, health, life, etc? All of these are risk points. To what degree have any of these issues become a reality? Have they ever become a reality? Have the low odds of incidence caused you to ignore the risk?

How do you address opportunity? Thriving businesses can also identify the quality of different offerings as they relate to price of materials/ingredients/inputs and the corresponding impact they have on profitability. They can identify the degree of profitability that comes with the sale of product at different price points.

While agriculture, as a whole, is subject differently to external impacts such as weather, disease, foreign competition, global economies, etc., we have a general idea what to expect under normal circumstances. How do you filter opportunities as they arrive? What mechanisms have you put in place to manage them?

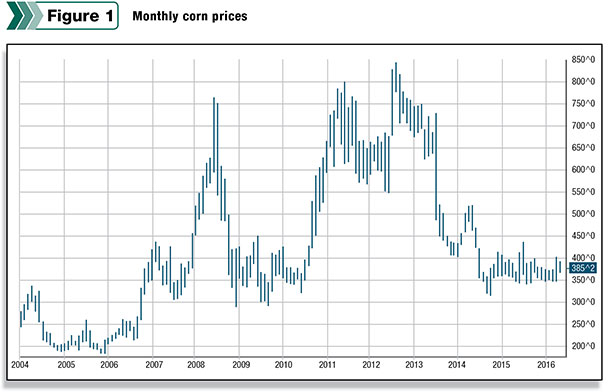

Upon analyzing your farm profitability in the last 10 years, which elements/forces have presented the greatest opportunities and which have caused the greatest harm? I would submit to you that the answer to both questions can be summed up in one word: prices. Price volatility in the last decade has been profoundly noticeable.

See Figures 1 and 2 for historical milk prices and corn prices. It has been the avenue by which great profitability has been derived. It has also been the source of great pain and financial loss.

You have attended to nearly every risk on your farm with insurance or procedures to mitigate them. Meanwhile, prices have presented the most consistent risk to your operation. How have you managed them?

Often, many dairies approach marketing and risk management with either a casual curiosity or general disinterest. The subject is not as attractive as other, more appealing topics. They recognize the risk. They recognize the opportunity. However, they are often hindered in taking action on such things by the illusion of perfection, the fear of missing out or the lack of understanding about what can be done.

Often, many dairies approach marketing and risk management with either a casual curiosity or general disinterest. The subject is not as attractive as other, more appealing topics. They recognize the risk. They recognize the opportunity. However, they are often hindered in taking action on such things by the illusion of perfection, the fear of missing out or the lack of understanding about what can be done.

I hope we have put to rest this idea of perfection. It is unattainable. While you might find yourself in such a place from time to time, it cannot be duplicated in a consistent and ongoing manner. Welcome to life as a human. So let’s tackle the other two.

It has become quite common in recent years to meet someone that makes a comment such as, “Boy, am I glad I didn’t do anything with milk price ahead of the 2014 market.” For them, it is a badge of honor that their lack of attention to the market allowed them to realize the opportunity of that year. It is their justification for why they do not take action in any year.

To their point, there is no question that any milk marketing or risk management efforts ahead of 2014 led to some degree of loss. Markets exploded. Prices were amazing. Those who had done nothing were rewarded. Those who did act missed out on several dollars per hundredweight.

Fast-forward to today. Prices have fallen, and current markets are several dollars below previous offerings. Cash flows have turned negative, and the hard-earned equity of years past will now be used to save the outcome of this one. How much equity that was previously built will now be suddenly washed away by the choice to do nothing?

Unfortunately, there will be scores of stories about those who experienced the record prices of 2014 only to find themselves out of business in 2016. If “taking the highs and the lows” now leaves them out of the business, future highs are no longer attainable. What is the cost to that?

As a side note to this point, much has happened by way of expansion in recent years. Almost always, those expansions take place following strong profitability. When the cash is available, the investment is often made in growth. When a multitude of your peers wish to expand, all at the same time, how much more expensive are those projects compared to a time such as now, when few people have the cash to do them?

How many more opportunities pass by during periods of low dairy profitability that could have otherwise been considered?

None of these questions are meant to be an attack on one’s performance, ability or person. These are simply points of evaluation that must be considered when taking the stance of “riding out the highs and the lows.” While those who decided to take action in 2014 may have missed out on some of the rise in prices then, they took actions to ensure profitability.

In the years that have followed, they have employed the same decision-making. Profitability wasn’t just a season; it was a practice.

Marketing and risk management are actions taken to create predictability amid unpredictable markets. They are not random or whimsical but rather consistent and methodical approaches to profitability and long-term viability. They empower dairymen to be more dynamic in their decision-making.

As a management practice, marketing and risk management make you more attractive to potential partners, financiers, vendors and others who maintain a financial stake in your business. Amid the ongoing volatility, such practices create a road map for your business’s future success.

None of this is to say that the process is easy. It requires time. It requires study. It requires understanding. That can also be a hindrance for those entertaining the concepts of marketing and risk management. However, should that be a valid excuse for those in the dairy business today?

American dairymen are the best in the world. They employ the best management practices, latest technology and highest standards in guiding and growing their operations. In doing so, they have attended to many opportunities that are presented in production growth and efficiency.

That same focus is required to attend to the risks and opportunities in the marketplace. How much time do you spend understanding what is influencing prices? How much time do you invest in understanding and developing strategies for managing those risks and opportunities?

Proper understanding leads to a correct view of what marketing and risk management are as well as creating more consistent results in the effort. Like learning how to run a computer, we have moved beyond the era of dismissing our interest in learning the art of marketing and risk management. It is a part of our world.

Tough times in the market always present an opportunity for evaluation that often doesn’t come when times are good. Now is a great time to evaluate your management of price risks and opportunities and to begin asking yourself the hard questions. This article is meant to prompt such an evaluation. PD

DISCLAIMER: The information contained herein is the opinion of the writer or was obtained from sources cited herein. It should be noted that the impact on market prices due to seasonal or market cycles and current news events may be reflected in market prices. Trading in futures products entails risks of loss, which must be understood prior to trading and may not be appropriate for all investors.

-

Mike North

- President

- Commodity Risk Management Group

- Email Mike North