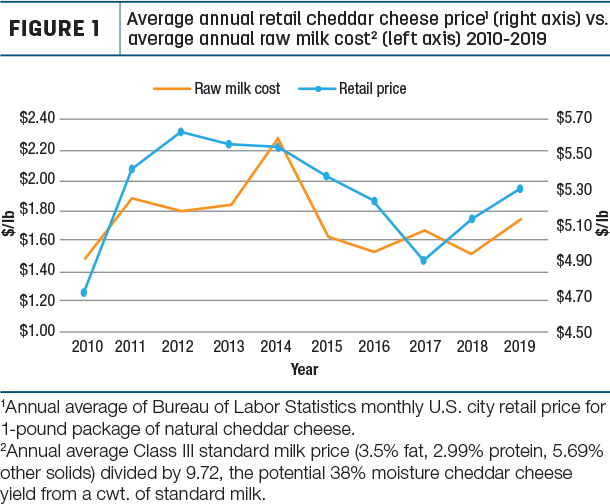

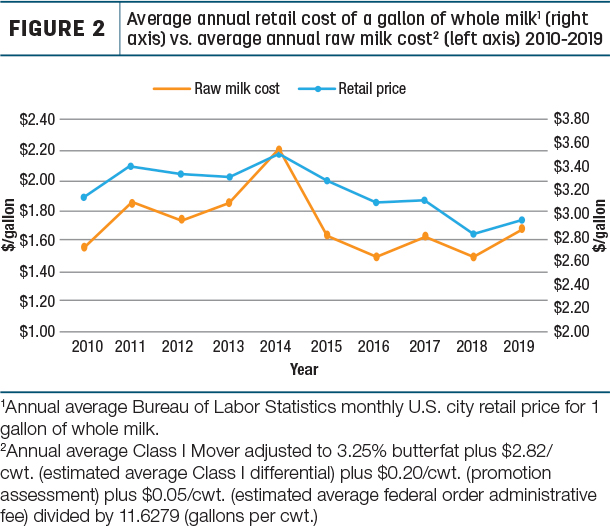

Average annual retail prices from 2010 to 2019 for a pound of natural cheddar cheese and a gallon of whole milk are shown graphically in Figure 1 (cheese) and Figure 2 (whole milk). The retail prices used are those published by the Bureau of Labor Statistics.

In addition, each figure shows the average cost of raw milk needed to manufacture a pound of cheddar cheese and process a gallon of whole milk for each year. For cheese, the federal order Class III price is used to calculate raw milk cost. An estimated national average federal order Class I price is used for whole milk raw cost.

Statistical analysis shows a positive correlation between cheddar’s retail price and raw milk cost. However, the correlation is not perfect, as depicted in Figure 1. From 2012 to 2013, the retail price decreased, slightly, but the raw milk price increased. While from 2017 to 2018, the opposite occurred. The retail price went up while the raw milk cost went down.

As Figure 1 shows, the natural cheddar cheese retail price has increased for the past three consecutive years. Based on average prices for the first four months of this year, it appears 2020 will be the fourth consecutive year for higher retail cheddar cheese prices. Even with higher retail prices, cheese demand continues to increase. Over the past 10 years, domestic disappearance of American cheese (cheddar is the primary American cheese) has increased over 23%. Granted, it is probably easier to increase retail price on a product with demand increasing. However, let’s hope retail cheese prices do not increase to a price point which slows the growth in cheese demand.

Moving to whole milk, there is a stronger correlation between the retail price and cost of the raw milk in a gallon of whole milk. For the 10-year period, there is only one time, from 2012 to 2013, when retail price and raw milk cost went in opposite directions. The retail price decreased while raw milk price increased. For all other years, if the raw milk price increased or decreased, the retail price followed the same direction. Granted, the change in direction may not be of the same magnitude, but the two prices moved in the same direction.

Based on my experience, the main reason for whole milk’s strong correlation between retail and raw price is raw milk represents about 80% of the wholesale cost of a gallon of processed milk, at the processor’s dock. The majority of milk gallons sold at retail are private or store labels, not a brand. Most private-label, packaged fluid milk is sold to the retailer based on the processor’s monthly raw milk cost, plus packaging, ingredients, processing and transportation costs. Any change up or down in raw milk cost noticeably changes the price charged to the retailer due to it being 80% of the wholesale cost.

The nature of the cheese industry helps to understand the lower correlation between natural cheddar cheese and its raw milk cost. Cheddar is manufactured into 40- or 640-pound blocks. Bulk cheese is cut and wrapped into consumer packages, often by another entity. Based on the maturity desired, cheese may be stored for a period of time before cutting and wrapping. Cutting, wrapping, storage, plus at least another stage in the supply chain besides manufacturing, adds cost to cheese, beyond the raw milk cost. Thus, the raw milk cost is a smaller percent of the wholesale price of a packaged cheese product, compared to processed fluid milk. Further, a significant portion of cheese found in a grocer’s dairy case is national brands, not private label, unlike fluid milk. Generally, branded products are less sensitive to changes in raw product costs.

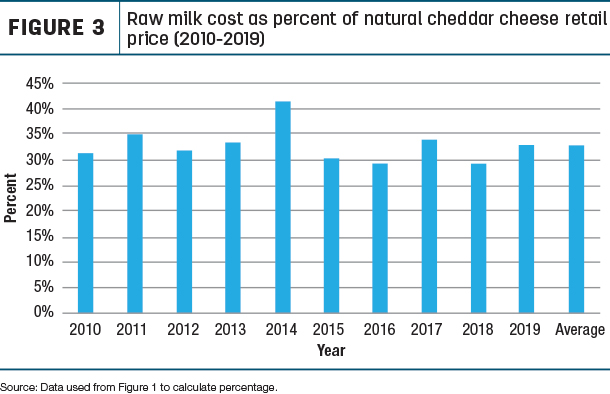

Figure 3 shows raw milk cost as a percent of the retail cheddar price.

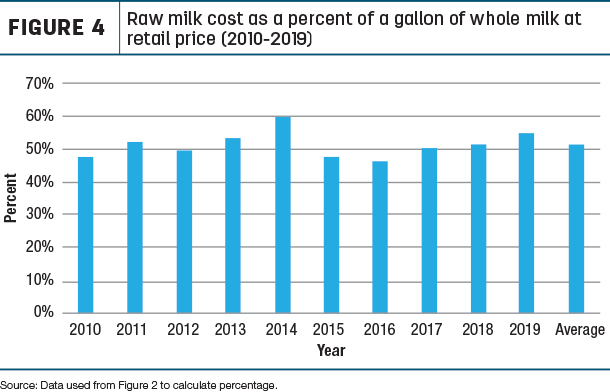

From 2010 to 2019 it averaged 33%. The highest raw milk cost as a percent of the retail price was 41% in 2014, the year of record-high milk prices. The lowest was in 2016 and 2018 at 29%. Moving to Figure 4 and fluid milk, we see raw milk is a higher percent of the retail price.

This is expected based on the previous explanation. For the past 10 years, the cost of raw milk averaged 51% of the whole milk retail price. The highest, again, was in 2014 at 60%. The lowest, in 2016, was at 46%.

Some other observations about whole milk: Since 2015, the difference between retail price and raw milk cost, or gross margin, declined every year. In 2015, it was $1.80 per gallon but dropped to $1.37 per gallon in 2019. Lower gross margins may help partially explain recent bankruptcies by two dairy companies. Unlike cheese, fluid milk sales declined about 16% over the past 10 years. It is difficult to maintain, much less increase margins, when marketing a product with a declining demand. Plus, in some markets, retailers discount the price of private label milk gallons as a means to increase store traffic. Retail milk price data for individual markets show this has become more common in recent years. This practice would also explain lower margins.

In closing, let me emphasize this article uses national averages for retail cheddar price and raw milk price. Retail prices and raw milk prices vary across the country, so the results for individual markets may be different than the national average. Based on national averages, there is a positive correlation between retail prices for cheddar cheese and a gallon of whole milk and the cost of raw milk needed to produce these products. For the past 10 years, the cost of raw milk needed to produce a pound of natural cheddar cheese was 33% of the retail price. For a gallon of whole milk, it was 51% of the retail price. ![]()

Calvin Covington is a retired dairy cooperative CEO and now does some farming, consulting, writing, and public speaking.

PHOTO: Getty Images.

-

Calvin Covington

- Retired Dairy Co-op Executive

- Email Calvin Covington