Never in my wildest dreams did I picture myself living and working in Chicago as a licensed commodity futures and options broker. The son of a third-generation dairy farmer, I grew up on a farm in Tulare County, California. My background on the farm gives me a very unique perspective on the work I do now. I have seen first-hand the challenges and frustrations producers have when the markets do not move in their favor.

After several years of financial woes, 2014 was the year for U.S. dairy producers. Export demand was stronger than ever, which caused milk prices to reach all-time highs. Record production in both corn and soybeans made feed prices more tolerable.

Those who survived the decline in 2009 were smiling all the way to the bank. The stars had aligned and the future was bright. However, many producers were “blinded by the light” and are now unprepared for a year that will likely bring some financial instability.

The U.S. dairy markets held a premium to international markets for most of 2014, but a massive corrective selloff ensued during the fourth quarter. The euro has fallen to a more- than-11-year-low versus the U.S. dollar, reducing the competitiveness of our products in the export market.

China and Russia, the largest dairy-importing countries, have cut back substantially on their purchases. The global milk supply continues to see persistent growth. The population of milk cows in the U.S. has risen back to January 2009 levels. 2015 has all the ingredients for another challenging year for U.S. dairy producers.

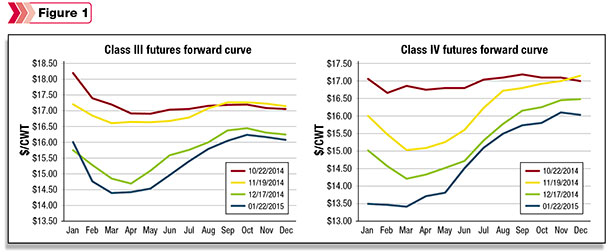

Class III and Class IV forward curves graphs (Figure 1) give a clear example of how significant the deterioration of those contracts has been over the last few months.

Managing risk in 2015’s volatile market

Due to the nature of milk and its production, it is susceptible to severe price fluctuations. Milk is a perishable good with a mismatched seasonal production and demand cycle. Cows do not have a shut-off valve, which makes the supply of milk very inelastic.

Many policies have tried to combat this price volatility, but they have proven to be relatively ineffective. There are many tools available to dairy producers to manage the risk that comes with this volatility. It is important for producers to develop a strategy to mitigate this risk. Here is a simple checklist to follow when developing a strategy:

1.Be more than a ‘price-taker’

The first step in developing a strategy to mitigate price risk is deciding you are going to be more than just a “price-taker.” To many dairy producers, taking this step can be difficult. Most dairies are multi-generational family operations, and the fear that there may be potential profits left on the table causes many to shy away.

While making this decision, some folks may benefit from building a trustworthy team of people around them that can assist in your risk management decisions. Whether it is your nutritionist, loan officer or a commodities broker in Chicago, it is important to have support from those who follow the markets on a daily basis and have your best interest in mind.

2.Know where your risks are at

There are risks at every level of a dairy operation. When developing a strategy to manage some of these risks, it is important to categorize them in order to properly hedge against them. The milk you sell has different utilization based on the marketing order you live in and therefore has different exposures to risk. Although it is difficult in some cases, it is vital to your strategy to know where those exposures are based on your components and utilization.

The same principles apply to managing feed risk. Whether you are growing feed, buying feed or even selling feed changes how you go about managing your risk. Different regions have varying basis risk due to transportation, storage and other logistical factors. Understanding where these risks are and how to deal with them is imperative to your strategy.

3.Know your tools

-

Margin Protection Program (MPP): The MPP is a government program written into the farm bill that provides a safety net for dairy producers if margins fall below the level of protection purchased by producers ($4 per cwt to $8 per cwt).

The program uses the national monthly average prices for all-milk, corn, soybean meal and alfalfa to calculate a margin level. The program offers some low-cost disaster insurance with the lower levels of protection, but because the margin levels are calculated by using national average prices, the program does not correlate well to most dairy farms.

-

Livestock Gross Margin (LGM-Dairy): LGM insurance is also a government program that allows producers to insure their margins based on the average settlements of Class III milk, corn and soybean meal futures for the last three days of each month.

LGM insurance, as well as the MPP, is advantageous for producers from a cash-flow standpoint because it provides a reasonable amount of protection without forcing producers to put much money up initially. The limited signup windows for LGM limits the flexibility and effectiveness of the insurance it provides for producers.

-

Forward contracting: Forward contracting programs through cooperatives are also another attractive option for producers because they offer excellent opportunities to lock in a milk price. Because the cooperative can credit or debit the hedge from producers’ milk checks, it makes the process simple for producers.

The risk transferred through the cooperative must either be dealt with by a processor or be backed with futures. This tends to make forward contracts slightly more expensive than the use of futures and options.

-

Futures exchanges: Futures exchanges such as the Chicago Mercantile Exchange and the Chicago Board of Trade provide dairy producers with the most versatile ways to mitigate their risk. Class III and Class IV futures contracts trade up to 24 months in advance, 23 hours a day, five days a week. This allows you to create customized hedges based on the specific risk factors of your operation.

Futures trading does require participants to put forward capital in a margin account as a performance bond so that the clearing firms can guarantee the positions that are held. This deters many hedgers because they feel that any losses in capital are realized losses. If hedges are set up correctly, any loss in a margin account will be made up for by your cash position.

4.Develop a proactive strategy

When developing a risk management strategy for your operation, it is important to remember that the strategy must be proactive. The future value of a commodity such as milk reduces in volatility as the delivery date approaches. Hedging your operation’s risks far in advance will always provide you with the greatest coverage. By the time you see a major decline in your mailbox, it will be too late.

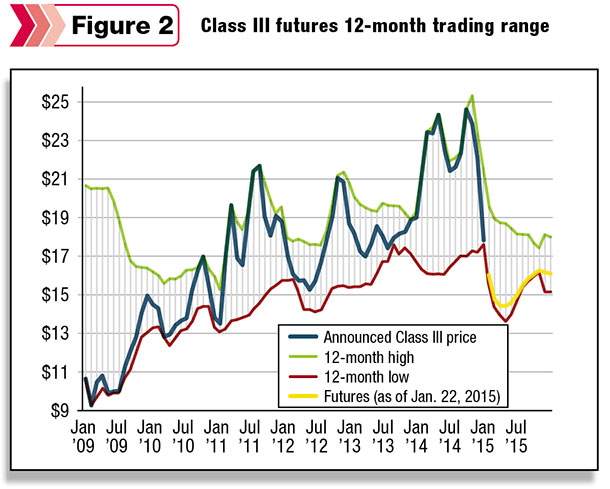

If you look at the trading range of Class III milk futures 12 months prior to the expiration of each contract, you can see why being proactive is important. In the last 12 months of trading, the January 2009 Class III futures contract made some enormous moves.

Between February 2008 and June 2008, the contract increased in value by more than $4 per cwt. After putting in its high in June, the contract tumbled more than $9 per cwt to a settlement price of $10.78 per cwt.

On the contrary, the January 2014 contract traded more than $1.50 per cwt lower in the first half of 2013, but in the last six months of trading, the contract rose by more than $4 per cwt. The January 2015 contract climbed more than $2 per cwt in the first half of 2014, but has since fallen by more than $3 per cwt. Figure 2 illustrates these moves.

As you can see, it is important to proactively watch how the markets price out the commodities that are your livelihood. When the market provides an opportunity for a healthy profit margin, that opportunity must be seized. We have all seen hard-working farmers fall victim to the financial volatility in the dairy business. Do not let yourself be next. Develop a prudent risk management strategy for your operation. PD

Disclaimer: The risk of loss in trading futures and options can be substantial. Past performance is not indicative of future results.

Curtis Bosma

Account Manager– Dairy Division

High Ground Trading