As 2012 winds down, many will be doing the traditional year-end paperwork … taxes and tax planning, operating loans, financial reporting, etc. While we work to close out the year, it is imperative that we give proper time to planning the year ahead. We have talked in previous issues about the opportunities and risks that lie ahead as well as a few things that you can do to manage those situations.

As I get into different groups of producers around the country, I find that price volatility and feed availability has kept many of them on the sidelines. Risk management was challenging enough when you just had to navigate pricing decisions.

It is intensified when those decisions must be coupled with what feed you will use and from where you will get it. Needless to say, managing the risk and opportunities of 2013 will be a multi-front battle. It will require a plan that is flexible and accommodates your individual access to feed. To that end, how are you doing? Do you have a plan in place? Are you prepared for what 2013 can or will throw at you?

Since everyone’s situation will be a little different, your approach will likely differ from your neighbor’s. That doesn’t make their approach wrong. Nor does it make their approach right for you. The strategies you choose must take this into consideration as you seek profitable margins or defend against negative ones. By managing price risk with margin in mind, we establish what our opportunities can be and what our risk will not be. Additionally, the margin we are offered will determine how aggressive or how passive we should be.

To help you find your place in that spectrum, here are a few questions you may want to ask yourself:

1. What efforts must I make to source feed? For some, especially in the more northern part of the country, forages and grain are easy to come by. Favorable weather allowed for an abundance of local supply. For those outside that region, finding access to these needed inputs was a logistical juggling act that rivaled the best of any traveling circus performances.

As a result, your ration has likely changed. If you are still mapping out available feedstuffs and what additional components you will require, be sure to take into consideration seasonal price patterns, transportation cost, quality levels, etc. All of these things will play into your cost structure going forward. Most important, however, will be availability.

It is tough to get milk from a cow without feed. Even the best price risk management strategy cannot feed your cows. Make sure you have available supply. This message rings true even for those who were blessed with rainfall and good local feed supplies.

Proteins could pose a threat as we work into the new year. Even though soybean yields were not nearly as disappointing as corn, soybean balance sheets are now as tight as ever. Presently, the USDA is building their balance sheets around the expectation for a record-large South American crop.

What if they don’t get one? We have previously discussed the strong seasonal tendency for protein to be bought best in fall. With soybean meal treading water at $470 per ton in the spot market and averaging $430 into fall 2013, few are excited about booking much protein. I understand. However, when considering the fact that soybean meal spent most of the 2012 summer at levels north of $520 per ton, it is easy to make a case for much higher protein prices if there are any hiccups in South American production or, for that matter, our own.

Having physical supplies booked will go a long way to ensuring you aren’t stuck searching for protein this coming spring and summer. You can defend these purchases with put options if you fear booking at too high a level.

Presently puts can be purchased throughout the year at levels $30 per ton lower than current levels for an average cost of $10 per ton. If you are concerned of a major decline in price after your purchases, you can protect those decisions with such a put option. If you don’t think the market can fall that much, why are you waiting to make your purchases?

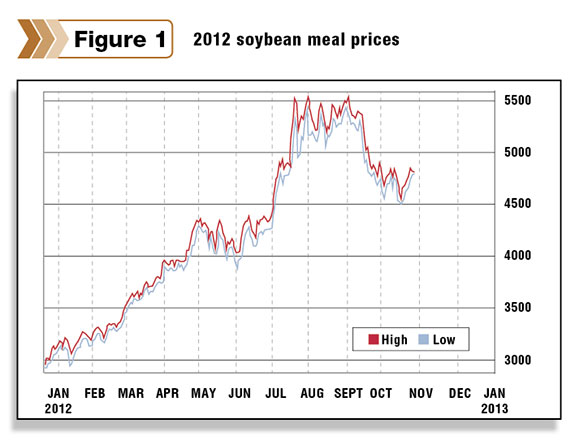

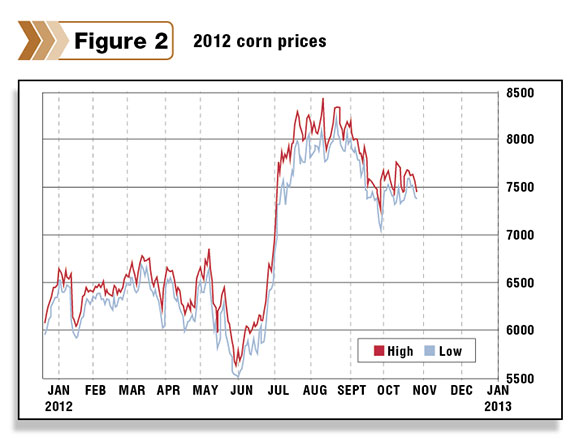

2. What risk exists for feed prices to rise? A quick review of the charts displays the market’s potential to rebound to higher levels. It goes without saying that a market can at the very least repeat what it has already done. ( See Figures 1 & 2 ). With that in mind, corn can return to prices just shy of $8.50 per bu ($303 per ton) and soybean meal can return to levels north of $550 per ton. While analysts use different technical indicators to suggest where prices will go, the fact remains that they are clueless as to whether they will go there. As you

assess your own risk, recognize that prices can increase at least 15 percent (a measure of the move back to the highs of both corn and soybean meal).

Both of these markets have a seasonal tendency to go up from the harvest period into the spring and summer. Given the tightness of the balance sheet, there is a great deal of fundamental influences that will support seasonal behavior.

3. What risk do I face in milk price? Over the years, many new offerings have been made at the plant level, a few producers have dabbled with the LGM product, while many others have increased their portfolio of futures and options strategies. Why? More and more producers recognize that the extreme volatility common to the milk market has expanded in recent cycles. Additionally, there has been greater recognition that a cycle exists.

The aggressive culling which began with lower profitability in the spring of 2012 was complemented by extensive culling due to the drought. Over the next couple of years, this fact alone will go a long way to supporting or moving milk prices higher. However, in the short term, risk still exists.

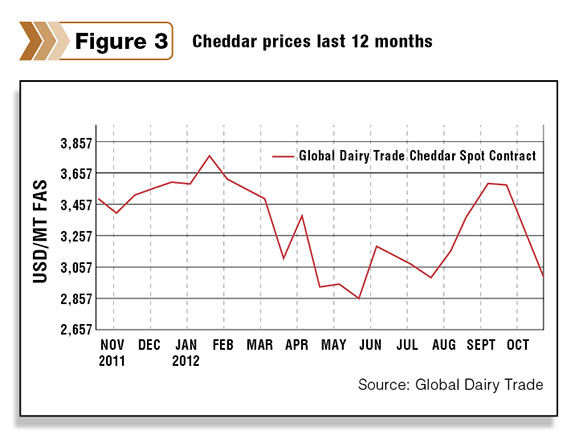

While many have focused on the potential impact of drought, processors continue to produce product available for domestic and world buyers. The holiday buying that persisted through the fall was able to rally U.S. prices to strong levels (cheese north of $2 per lb), while world markets sagged to levels not seen since summer and late spring. ( See Figure 3. )

Once the holiday buying is over, what will happen? Will the world buyer step up and become willing to pay more for product or will product prices (and then consequently milk prices) retract to meet the world buyer? What if both happen? Last winter, markets retracted from a fall high of $2 per lb to settle into a range that spanned from $1.45 to $1.65 per lb for a period of seven months.

The market cleared a lot of product. Exports established new records of volume. If we were to settle into a similar price zone while other products manage to show similar price performance, we could expect to see Class III prices somewhere between $15 and $16 per cwt. This is the risk we face in the milk price arena. Are you prepared? What strategy will you use to defend yourself from this scenario?

4. What can I do to manage milk price? There are obviously many ways by which you can address this. As you have worked through these questions, hopefully your answers have both revealed what kind of margins you are dealing with and whether you should become aggressive in your risk management pursuits or maintain a more passive approach.

For those seeking to be more aggressive, selling milk is an approach you may choose to take. For example, you could sell milk with the plant (you may substitute such a sale with a sale of futures to maintain a bit more flexibility … but should prepare for the coinciding margin responsibilities) for the first half of 2013 and purchase $20 calls for $0.60 per cwt.

The more passive individual may choose to purchase a simple put option for the period. For example, an $18 put will cost approximately $0.50 per cwt for the same period. While there are many approaches to managing the risk, you must find a strategy that fits your business model, emotional comfort, cash flow, etc. Then, more importantly, you must develop a plan that you will execute.

I was once told that a failure to plan is a plan to fail. Don’t let the chaos of the moment or the volatility of the market scare you from doing what is necessary to make your business succeed. Work through the questions, find solutions, and take action.

If you have questions of your own regarding any of the items we have discussed, talk with the professionals you have at your disposal. If I can be of assistance, feel free to call or email. Have a blessed 2013! PD

UPDATE: Since the publication of this article, Mike North has left First Capitol Ag and is now the president of Commodity Risk Management Group. Contact him by email .

Mike North

Senior Risk Management Adviser

First Capitol Ag