Although it is easier to strategize about protecting profitability when times are good, a sound risk management plan applies to all margin environments and is especially important when the outlook is bad. When margins are low and opportunities are hard to find, producers may not consider it worthwhile to initiate margin coverage, preferring to stay open to the market.

While understandable, that tactic leaves operations vulnerable to further margin deterioration. Many dairies may now be in the situation where they don’t have adequate coverage for the current margin outlook because profitability projections over the past several marketing periods never presented a catalyst to trigger a risk management decision.

As an example, in 2017, a dairy may have set targets to trigger risk management decisions for 2018 margins at levels above the 80th percentile of the previous decade. Assuming the dairy was tracking forward margins a year in advance, they may have already established some forward protection on milk production through the first half of this year, since margin projections had reached those trigger levels.

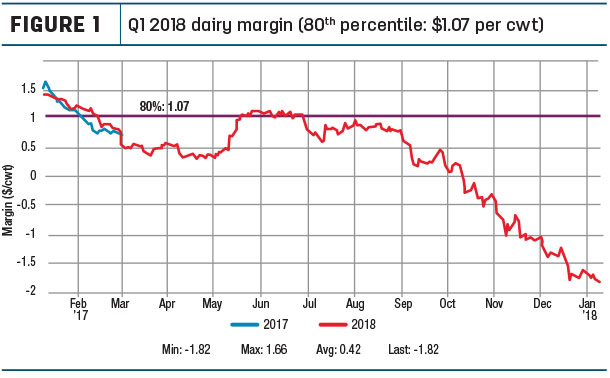

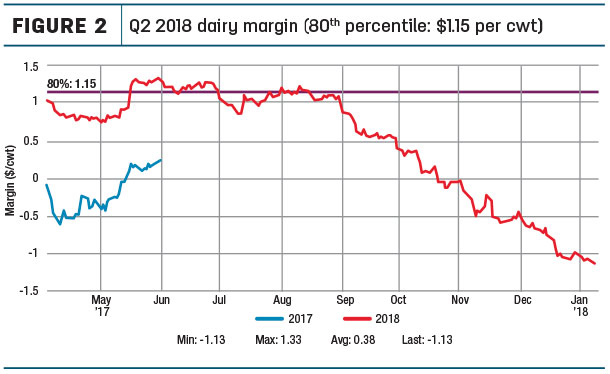

Figures 1 and 2 illustrate the margin projections for the first and second quarters of 2018, respectively, along with the 80th percentile of margins for those calendar quarters over the past 10 years.

In each case, it was possible to establish protection at this margin threshold in advance, mitigating some of the impact of current negative margins.

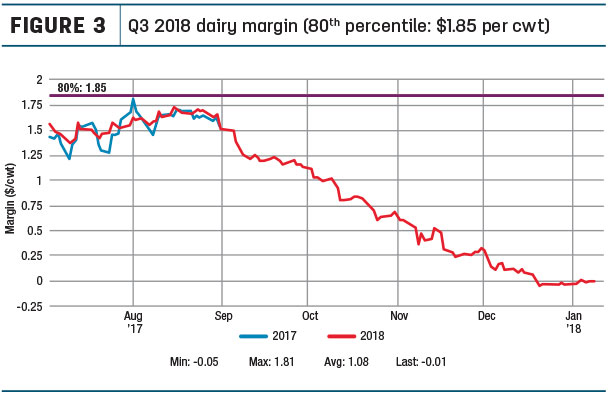

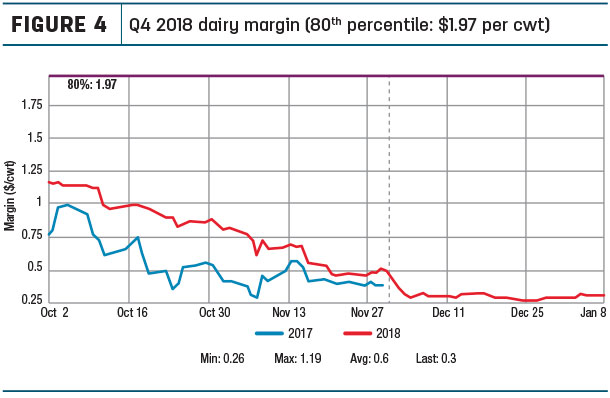

Figure 3 and Figure 4 show the margins for the third and fourth quarters of 2018 against the 80th percentile for those same calendar quarters over the previous decade.

While there were certainly opportunities to protect margins for these forward periods at much better levels than what exists today, they never actually reached the 80th percentile.

That means a dairy operation setting that threshold as a trigger for a risk management decision might not have carried out their intended marketing plan.

Contingency planning

The dairy’s marketing “Plan A” is not atypical. In a best-case scenario, the market will cooperate and allow the producer to scale into selling targets at incrementally higher levels, thus establishing favorable margins over time if all of their planned targets are triggered.

A dairy producer typically would select thresholds of historical profitability to initiate strategies to protect forward margins, though this plan is dependent on the market cooperating and delivering those opportunities to establish margin coverage.

While Plan A is a good starting point for a sound margin management policy, all risk managers also need a Plan B. This plan addresses the possibility the preferred course of action can’t be executed due to unfavorable market dynamics. While contingency planning is not exactly fun – and no one wants to think about what they will do when things go wrong – a thoughtfully crafted backup plan can provide many benefits.

A good starting point for a backup plan might be addressing catastrophic risk. As an example, a producer could look at their margin history and determine some threshold level where they would absolutely want to have protection against a worst-case scenario. In the current environment, where many producers are either at or slightly below breakeven levels, they might start by considering their cash flow situation.

They could work with their lender to determine at what point they would no longer be able to afford a loss exceeding “x” amount of money for “y” period of time before things became problematic financially with their loan covenants. This could help to define that line in the sand.

As an example, following a $2- per-hundredweight drop in the price of milk futures from earlier this summer, a dairy producer might opt to purchase out-of-the-money put options in deferred months to protect their revenue from any further declines. This strategy would help mitigate catastrophic losses in the case of a market that moved sharply lower.

One important component of this type of planning, though, is determining when to pull the trigger. Ideally, it would be best to wait for the market to provide opportunities to execute Plan A. While a producer is waiting, however, it is necessary to consider whether that plan may need to be adjusted. This is when Plan B comes into play.

The producer may determine ahead of time, based on some sort of secondary trigger, when they will proceed with implementing their backup plan if their primary one can’t be executed. One example might be the dairy producer deciding they won’t let their projected margins drop below a loss of 50 cents per hundredweight before deciding to act and purchase the defensive put options against their forward milk revenue.

Another example might be the crop producer choosing a point in time during the growing season, such as early to mid-summer, as a seasonal threshold to establish protection. The benefit in both cases is: The producer will know ahead of time they will have some protection in place, regardless of how the market unfolds. This will also help to ensure a catastrophic event with extremely negative margins is avoided before it becomes a problem that needs to be managed under duress.

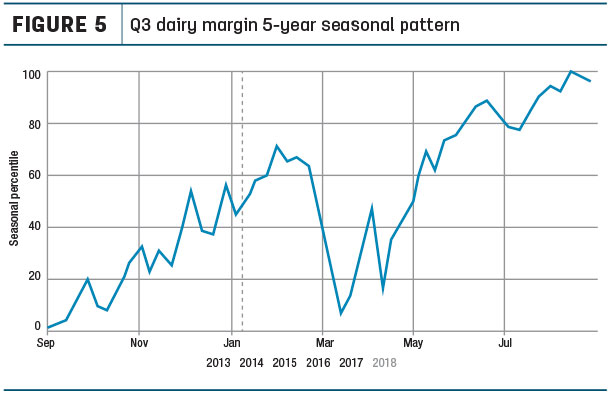

Figure 5 shows the seasonal pattern for third-quarter dairy margins over the past five years. There has been a historical tendency for third-quarter margins to deteriorate from late January into mid-March.

Accordingly, a dairy producer might conclude it would make sense to establish some type of forward margin protection by late January if their primary plan could not be executed due to unfavorable market dynamics.

Accordingly, a dairy producer might conclude it would make sense to establish some type of forward margin protection by late January if their primary plan could not be executed due to unfavorable market dynamics.

Be ready to adjust

A contingency plan is meant to address a worst-case scenario but, ideally, the margin profile improves over time. If a dairy is implementing Plan B, there should also be a corresponding strategy to adjust their position and protection to capture better margins.

In the previous example, the dairy producer may purchase out-of-the money puts on milk to protect the catastrophic risk of prices declining further; however, they should also incorporate a strategy for capturing any improvement in forward margins in a recovering market.

For instance, if the dairy is purchasing Class III milk put options at the $15.50 strike price, they might set up an alert to be notified if milk prices rise above a certain target price, such as $16.50 per hundredweight. In this scenario, they could opt to roll their put options up to a higher strike price and possibly pay for this increased cost by selling call options.

Alternatively, they may simply decide to execute fixed sales if they are projecting a profit margin they consider acceptable for the operation.

While the worst-case scenario in this example would equate to a loss on that portion of their production in a falling market, it would nonetheless be a defined loss and mitigated to some degree by the portion of the production protected at stronger margins.

This may also have helped the dairy in year-end discussions with their lender feel better about cash flow projections, particularly given that most operations are currently faced with negative spot margins in the first quarter of 2018.

Another benefit of having a contingency plan in place is to limit fear and emotion from impacting the risk management decision. Without a plan, a producer might be more likely to act impulsively to put some type of position on without careful consideration of all the potential ramifications.

This would be particularly true if the position was initiated under duress or outside pressure. By having a backup plan built into a marketing strategy ahead of time, unfavorable and unintended outcomes may be avoided. ![]()

Disclaimer: There is a risk of loss in futures trading. The information contained in this article is taken from sources believed to be reliable but is not guaranteed by Commodity & Ingredient Hedging LLC, CIH Trading LLC nor any other affiliates, subsidiary, or employee, collectively referred to as CIH, as to accuracy or completeness, and is intended for purposes of information and education only. Nothing therein should be considered as a trading recommendation by CIH.

The rules and regulations of the individual exchanges should be consulted as the authoritative source on all contract specifications and regulations. Past performance is not indicative of future results.

-

Chip Whalen

- Commodity & Ingredient Hedging

- Email Chip Whalen