Sweat equity is sometimes used to compensate a successor for years of labor and management that helped build the owner generation’s wealth. It can be used to justify gifting personal, titled property or giving a discounted price when the property is eventually sold to the successor. When considering labor compensation in forms other than money, the goal of both the employer and employee/successor should be analyzed to ensure it is an appropriate compensation package.

Sweat equity used for commodity wages

Suppose the employee’s goal is to learn more about the farm business and gain management and/or marketing skills. In this case, you could provide a way to allow them to make management decisions on a smaller scale using sweat equity payments. Payment of grain would allow the employee to decide when and where to market the grain. Market livestock can provide additional skill development as the employee makes management decisions to raise the livestock to market weight. From the employer’s perspective, skill development can translate into a better employee who is more responsible. In addition to skill development, the employer may not have the cash flow to compensate the employee completely but can provide the commodity as part of the wage package.

If the employee’s goal is to manage their own herd eventually, then payments in breeding livestock may be a viable option. It is essential to consider where the animals will be housed with this option. If the animal stays in the original herd at freshening but is owned by the employee, how will feed and other ownership costs be paid and milk income distributed? The employer must consider the long-term implications of the employee’s animals remaining in the herd and taking facility space from the owner’s herd. The employer should determine if they can manage the loss of the income. Or does the owner need to calculate overhead costs and charge this expense to the employee?

Sweat equity is as valuable as cash equity and should have a one-to-one conversion rate. Therefore, it is vital to correctly value the items being given as sweat equity. Some commodities have a worldwide market, and their value can be more easily determined by this market value. Other commodities produced on-farm, such as cattle, may be undervalued if the animal can command a premium above what they could be harvested for.

For these animals, an appraiser may be called in to determine their value. This is most commonly done for insurance purposes and can help determine a herd’s baseline value. To assess the animal’s worth, the appraiser will evaluate the quality of the animal, which may include a comparison of your animals to animals of similar quality that have recently been sold.

Sweat equity used for succession

When the goal is to slowly transfer business assets to the next generation, sweat equity can be used to transfer assets to the successor. For example, breeding stock can be transferred to the successor over time, allowing them to own a significant portion of the herd. This mode of equity transfer can be facilitated by forming a business entity that owns farm assets as shares or interest. These shares or interests can then be transferred to the successor. When clearly outlined in a farm succession plan, this option can provide the successor generation a guarantee that the assets will be transferred and remove the speculation that surrounds a verbal promise.

One thing to consider with this option is: How many of the assets can and should be transferred in this way? Is the owner generation dependent on these assets for retirement? If the answer to this question is yes, how many of the assets can be provided in trade for labor, and how many need to be retained by the owner or be sold to the next generation for cash to fund retirement needs?

Reporting non-cash wages

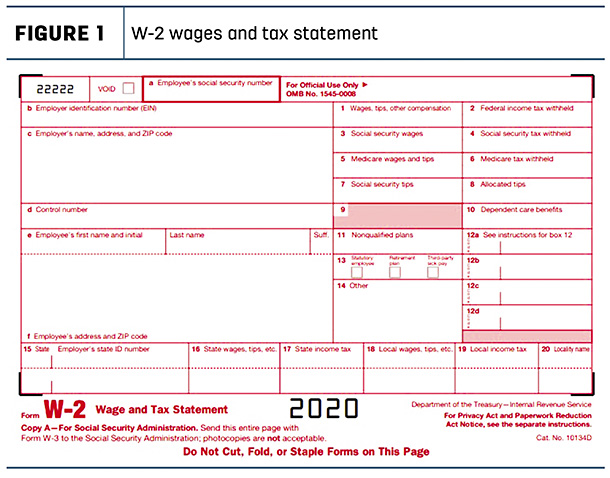

In 1994, the IRS issued guidelines for dealing with non-cash payments in exchange for farm labor. Employers need to note that wages paid to an employee in the form of a commodity (grain, milk, livestock, etc.) are considered taxable income under I.R.C. § 3121(a)(8)(A). Therefore, they must be reported on the employee’s W-2 form (Figure 1) in Box 1 (Wages, tips, other compensation).

However, they are not subject to Social Security and Medicare taxes (FICA taxes) for either the employer or the employee. In addition, they do not have to be reported in Box 3 or 5 (Social Security, Medicare wages and tips). Taxpayers can choose not to follow these guidelines, but they are more likely to be challenged in an audit by the IRS when they do not.

The employee has a basis in the commodity equal to the value noted on the W-2 in Box 1. Basis is the difference between the local cash price of a commodity and the price of a specific futures contract of the same commodity at any given point in time. A subsequent sale of the commodity by the employee will trigger a taxable gain or loss depending on whether the sale price exceeds or is less than the basis of the commodity. If the employee is not a dealer in the commodity and does not sell the commodity in the course of the farm business, the sale should be reported on Schedule D (Form 1040). If the employee is a dealer or farmer, the sale should be reported on Schedule C (Form 1040) or Schedule F (Form 1040), respectively.

The employer can claim a deduction for the value of the commodity paid to the employee but should report income as if the commodity had been sold for its fair market value.

The use of sweat equity to compensate employees allows their compensation to match their contribution without financially burdening the farm. For those looking to succeed the owner generation, sweat equity allows them to build equity and confidence before the succession occurs. It is essential to consider if the compensation is equitable for the work done and the tax implications of using sweat equity. ![]()

This article is provided for information purposes only. Readers should consult their own professional advisers for specific advice tailored to their needs. Information contained in this article may be subject to change without notice. Resources and research citations are available upon request.

-

Heather Schlesser

- Dairy Agent

- University of Wisconsin – Madison Division of Extension

- Email Heather Schlesser