In November of 2017, the milk price finally broke out of the prolonged sideways market that began way back in July 2016. Unfortunately, that break fell on the downside, and farmers were faced with lower trending prices for the next month-and-a-half.

Since mid-January, prices have been in a slow and steady recovery – and to this point, opportunity has been somewhat limited. This type of price action has made it difficult for many to operate profitably. If that’s not bad enough, it’s also created a less obvious risk that could inflict more financial pain, even when milk prices show meaningful improvement.

That risk is disengagement. An extended period without significant upward trends leads farmers to believe in their gut prices will never get better. With this mindset, it appears prudent to only manage to downside risk rather than to prepare for opportunity. This is especially the case as farmers hear about market oversupply.

If you’ve become accustomed to a lack of upward price momentum, I encourage you to take a closer look at your marketing. There’s a case to be made a change in positive trend is possible (which is touched on later), and it’s always the case to be prepared for wherever the trends take us.

How sideways markets mess with your mind

In any market, a good marketer focuses on strategic cash sales and supports them with strategic hedging to protect against market price risk.

Sometimes, however, when money is paid to protect against risk and the risk doesn’t materialize, there’s a tendency to believe the money was wasted. This is especially true in a market without a clear upward or downward trend, when reluctance to protect against risk is greater.

Some marketers place hedges in markets without clear direction because that’s what they were advised to do, yet deep down they believe prices won’t move enough to trigger protection. If their doubts prove true, frustration takes over, and appetite for managing risk fades or disappears.

One answer to this mental conundrum is to remember the purpose of protection. Hedging is like insurance. It’s not a means to make money. When an appropriate amount of protection is added, hedging is just as smart as protecting your car and house against damage and loss.

Another reason farmers disengage during a flat market has to do with procrastination. Psychologists believe procrastinators are usually perfectionists. This could explain why a farmer waiting to place the perfect hedge often refrains from placing one at all.

Let’s not forget, our brains are wired to think both rationally and emotionally. The emotional side seeks instant gratification, which a hedge can’t always provide. If you’re marketing with too much emotion, you may have a hard time getting comfortable with hedging.

If procrastination is a problem for you, the first two steps to overcoming this mental roadblock are to recognize you’re procrastinating and then to try and identify why. If your “why” is you don’t fully understand or believe in hedging, talk through it with a professional you trust. Or look for a different educational resource to gain a better understanding.

Reasons for price optimism

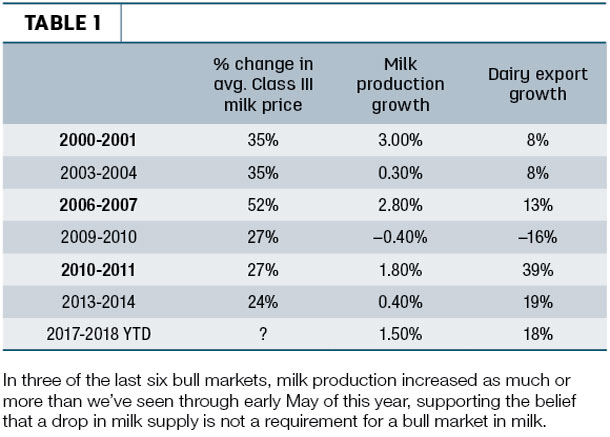

It’s true. Milk prices can jump without a supply crisis. In three of the last six bull markets, prices took a nice ride on the shoulders of demand (Figure 1).

In fact, milk production growth can be quite a bit higher than what we’ve experienced in the last couple of years and still not stop a bull market from materializing, as long as strong demand accompanies the growth.

So far this year, U.S. dairy exports have been strong. The 18 percent growth from January to March is good news, and we need to sustain that rate.

In March, we set the all-time record for exports, with strong growth across various dairy products. It’s not all that surprising. Our dairy products are competitively priced with the rest of the world (as of this writing, the CME spot cheese price is holding a 30-cent discount to Fonterra Global Dairy Trade cheddar), and the value of the U.S. dollar compared with foreign currencies has been relatively low in the first quarter.

The increase has come despite the current U.S. policy on trade dating back to November 2016 and recent trade war rhetoric. In 2017, we set a record for dairy exports to China and the same for Mexico in 2017.

Exports to China were strong through the first quarter of this year. Over the previous year, January was up 5 percent; February, up 19 percent; and March, up 19 percent. Overall for the first quarter, exports grew by nearly 15 percent to China and 12 percent to Mexico.

Remember: Negative news is more popular than positive news

The good news about exports is finally starting to get out. For a long time, repeated stories about strong milk supplies fed market speculation milk prices couldn’t move higher.

But remember: Supply is only half the equation influencing prices. While supply has been strong, demand has been steadily on the rise since 2017. And never forget: The human brain is more sensitive to bad news than to good news.

We’re attracted to negative news. Psychologists call this phenomenon negativity bias. Research has shown the human brain reacts more strongly to a negative stimulus than to a neutral or positive one.

So be careful not to let the many past months of negative news influence your thinking going forward. Good price opportunities may be on the way, and you want to be sure you’re prepared to make the most of any additional rally we may see. ![]()

Futures trading is not for everyone. The risk of loss in trading is substantial. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.

-

Christian Walters

- President

- Stewart-Peterson