If you are interested in learning how to create lasting change – either on your dairy, in an organization or even at the most personal level for yourself, you may enjoy reading The Power of Habit: Why We Do What We Do in Life and Business.

This 2012 best-seller by Charles Duhigg has topped many business book lists. Duhigg doesn’t tell you which habits are good ones and which ones are bad. (Too many business books try to tell us what we should be doing.) Rather, it explains the brain science behind our habits and how to be successful at changing our habits if we want to.

Dairy producers may find several of the stories in the book applicable to your businesses and to the dairy industry as a whole. For example:

- How the CEO of Alcoa CEO focused on safety habits, and in the process, increased productivity and profitability.

- How sophisticated companies market to consumers by understanding their habits. (Got Milk, anyone?)

- How habits can eliminate hesitation and help you reach your goals faster and more effectively. (This point is particularly helpful for those who use the markets to price commodities.)

So let’s dig in to what Duhigg says about the science of habits.

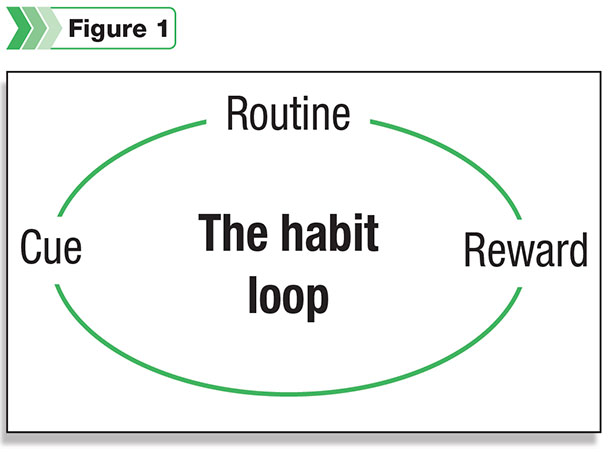

The ‘habit loop’

According to Duhigg, a habit is a looping sequence embedded into our brains that allows us to conserve energy for more high-level thinking. The loop starts with a cue (it’s noon), followed by a routine (I always have lunch at noon), followed by a reward (satisfied).

When a habit loop happens over and over again, “grooves” are worn into the pathways of our brain. In the case of good habits, these pathways keep us on track. With bad habits, the pathways are more like ruts.

Once the pathways of a habit are created in the brain, they will always be there; however, they can be overwritten. In response to a cue, we can consciously change the routine in a way that earns us the reward we want. A new pathway is created.

Some of these pathways are re-drawn more easily than others. In some cases, the cue and reward become so intertwined that a powerful craving emerges, and those are the toughest habits to overwrite. Belief that it can – and must – be done comes into play here.

“Once you understand that habits can change,” Duhigg writes, “you have the freedom – and responsibility – to re-make them. Once you understand that habits can be rebuilt, the power becomes easier to grasp, and the only option left is to get to work.”

Picking the right habits

In 1987, the new CEO of Aluminum Company of America (Alcoa), Paul O’Neill, had many challenges ahead of him and could have picked any number of areas in which to focus. He picked safety as his number one focus. This surprised many people who expected him to focus on product innovation, cost-cutting, improved sales – the things most new CEOs talk about.

It turns out that O’Neill had a knack for picking the right habits on which to focus. He knew he couldn’t change everything overnight. So he chose the one thing that galvanized everyone: employees (who didn’t want to get injured), management (who had to deal with the injuries) and investors (who paid for injury claims and downtime).

The process of transforming safety habits encouraged communication up and down and across the company, and this in turn improved many processes within the company. Productivity and profits went up.

A person or an organization can’t change all its habits at once, Duhigg says. Picking the right one to focus on has spillover effect into other areas.

This was the case with the Tampa Bay Buccaneers. Duhigg tells the story of NFL coach Tony Dungy, who took the Buccaneer helm in 1996. Dungy had a radically simple plan to take the team from the NFL dungeons to the Super Bowl.

“Dungy’s strategy was to shift the team’s behaviors until their performances were automatic. He didn’t believe the Buccaneers needed the thickest playbook … They just needed to learn a few key moves and get them right every time.”

During one coaching session, Dungy asked a linebacker what visual cues he was looking for to help him prepare for the next play. The linebacker said he scans the line and looks for things like the QB’s leg and hip position, gaps in the line and the position of the running back’s foot, indicating a running or a passing play. There were many visual cues to sift through before the play began.

Dungy wanted to free the linebacker from so much thinking. So he put the cues in sequence and told the player what to do (routine) for each cue. Then they practiced over and over again until the sequence became habit.

Despite the uncertainty of what was about to unfold, the linebacker could now move faster because everything was a reaction – and with repetition, a habit – rather than a choice.

This story stuck a chord with me because, for the last 30 years, I have worked with people who want to do a better job managing price risk. There are many books and experts who will talk your ears off about successful market strategies. I prefer a simple approach, and it has to do with habits. (Although before reading this book, I didn’t have the science or the diagram for it.)

The right habits for markets

At the beginning of a new client relationship, we discuss the fact that success depends on overthrowing certain habits and creating new ones. Like Dungy’s football players, a dairy producer who is trying to manage price risk might spend valuable time scanning the news for cues to act.

By the time this scan is done, the market has moved and the dairy producer is already behind. That is a tough habit loop to break because there is so much market news and information around us.

The better habit is to create a cue (such as a certain price target), decide what your routine will be when you see that cue (such as sell 10 percent of your milk production at that price), then enjoy the reward (a percent of your production sold at a good price).

Then repeat, over and over again.

This may be a simplified example, and yet it really works. Fascinated by this concept, I surveyed our advisers about the habits they see in satisfied clients versus the habits of those who are struggling to achieve the reward they want for themselves. It turns out that those who have set up disciplined habit loops are noticeably more satisfied.

The rub of reward

For those trying to manage commodity price risk, habit loops could break when it comes to the reward. Winning the Super Bowl is a clear-cut reward. You hold a trophy in your hand and wear a ring on your finger. Pricing milk at $21 might seem like a satisfying reward one day, and on the day milk goes to $21.25, it feels like a failure.

In my experience, those in the commodity business never allow themselves the reward of feeling like winners unless they happen to sell their product on the day the market hits its high – which almost never happens.

As a result, commodity price management habits become difficult to create – all because of perceptions about the reward.

Duhigg emphasizes the importance of the reward in a story about Procter & Gamble’s failed attempt to launch Febreze fabric freshener in the mid-1990s. Febreze failed at first because P&G was marketing it as a product that took away bad smells.

It turns out that “scentlessness” was not a strong enough reward. P&G execs figured out that Febreze needed to provide a fresh scent that would be the reward at the end of the cleaning process. Within two months of bringing that reward into focus, sales doubled.

In the case of commodity price management, we have to fight the habit of replacing the true reward with an elusive, non-existent reward: perfection. The true reward is whatever you and your adviser have agreed upon as success. For example:

- A weighted-average price for the year that contributes to a 15 percent increase in net worth

- Stability that pleases a lender so you can expand or transition your business

- A weighted-average price that is within 3 percent of the market high for milk

These are examples of rewards for a good price risk management routine. It’s your adviser’s job to keep reminding you of that reward. Doing so helps keep the good habit loop functioning, overriding the old habits.

I believe it is possible for dairy producers to create good habits for dealing with uncertain markets. The nice thing about having good habits is: When they are fully functioning, they free your mind for other thinking. What do you need to do better? Create some new habits for yourself or for those around you, and you should see lasting change. PD

The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson.

Scott Stewart

CEO

Stewart-Peterson Inc.